Discusses highlights on the results and impacts on investor yield

After market close on Tuesday, Fintel covered nitrogen fertilizer producer CVR Partners (NYSE:UAN) reported fourth quarter and full year results to the market, including a special cash distribution of $10.50 per share. The result? Shares trading 8.2% higher in after hours extended trading.

For the final quarter of 2022, CVR Partners generated $212.33 in sales, rising around 12% from the final quarter of 2021. For the full year, CVR grew sales from $532.58 million to $835.58 million.

Q4 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

EBITDA rose more than 30% over the year to $122.27 million and resulted in a full year figure of $403.16 million. At the bottom line, net income strengthened to $286.80 million for the year, from $78.16 million in the prior year.

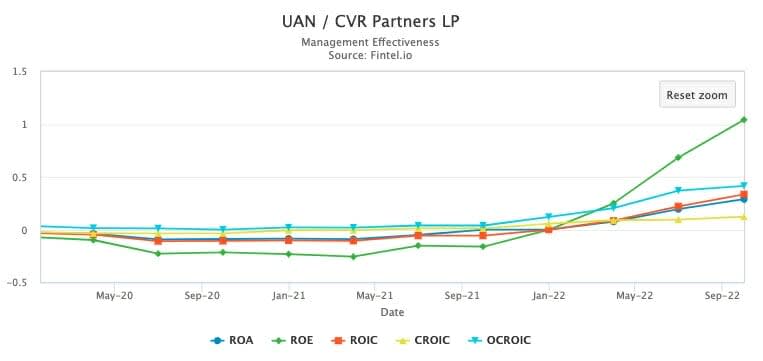

The strength of UAN’s operating conditions are displayed on the management effectiveness chart to the right from Fintel’s financial metrics and ratios page for the stock.

The groups CEO Mark Pytosh commented on the result, stating“CVR Partners reported strong results for the full-year 2022 despite planned turnarounds at both nitrogen fertilizer production facilities”

Pytosh also told investors that since the turnarounds have been completed, the partnership has now achieved record monthly production rates at both facilities.

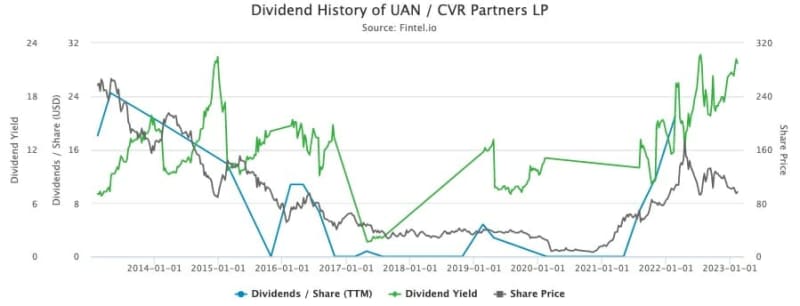

As a result of the strong business performance, CVR Partners declared a fourth quarter distribution of $10.50 per unit. This brings the total value of distributions for the full year to $24.58 per share, equating to a 25.33% dividend yield based on Tuesday’s closing price of $97.05.

In 2023, the company expects grain prices (which are near 10 year highs) to increase by a further 3-5% for the spring planting season that will continue to drive strong demand for nitrogen fertilizer.

UAN management plans on focusing on maintaining financial flexibility to generate strong free cash flows. This could likely result in continued strong distributions over 2023.

Fintel journalists first highlighted the stock as an attractive earner and dividend payer back in May 2022.

The stock was highlighted for having a high Fintel quant dividend score with an attractive global ranking on the leaderboard.

Fintel’s 98.82 dividend score for UAN is still bullish on the company and ranks the stock in second place globally. The high dividend score consists of a high attractive dividend yield, a cash from operations payout ratio of 0.59% and a 3 year dividend growth rate of 6.49%.

The chart below shows the stocks dividend yield vs the share price over time and the recent widening disparity over the last year.

Other stocks with high dividend scores on the worldwide leaderboard:

- AU:SDG / Sunland Group Ltd \- Score 99.20

- SG:AP4 / RIVERSTONE HOLDINGS \- Score 98.45

- GNK / Genco Shipping & Trading \- Score 97.85

- GOGL / Golden Ocean Group Ltd \- 97.73

- PXD / Pioneer Natural Resources Co \- 97.36

Article by Ben Ward, Fintel