By Darren Parkin

It’s gone quiet in the last few days, especially compared to the price action that pushed Bitcoin and a few other cryptocurrencies into double-digit growth in the past weeks.

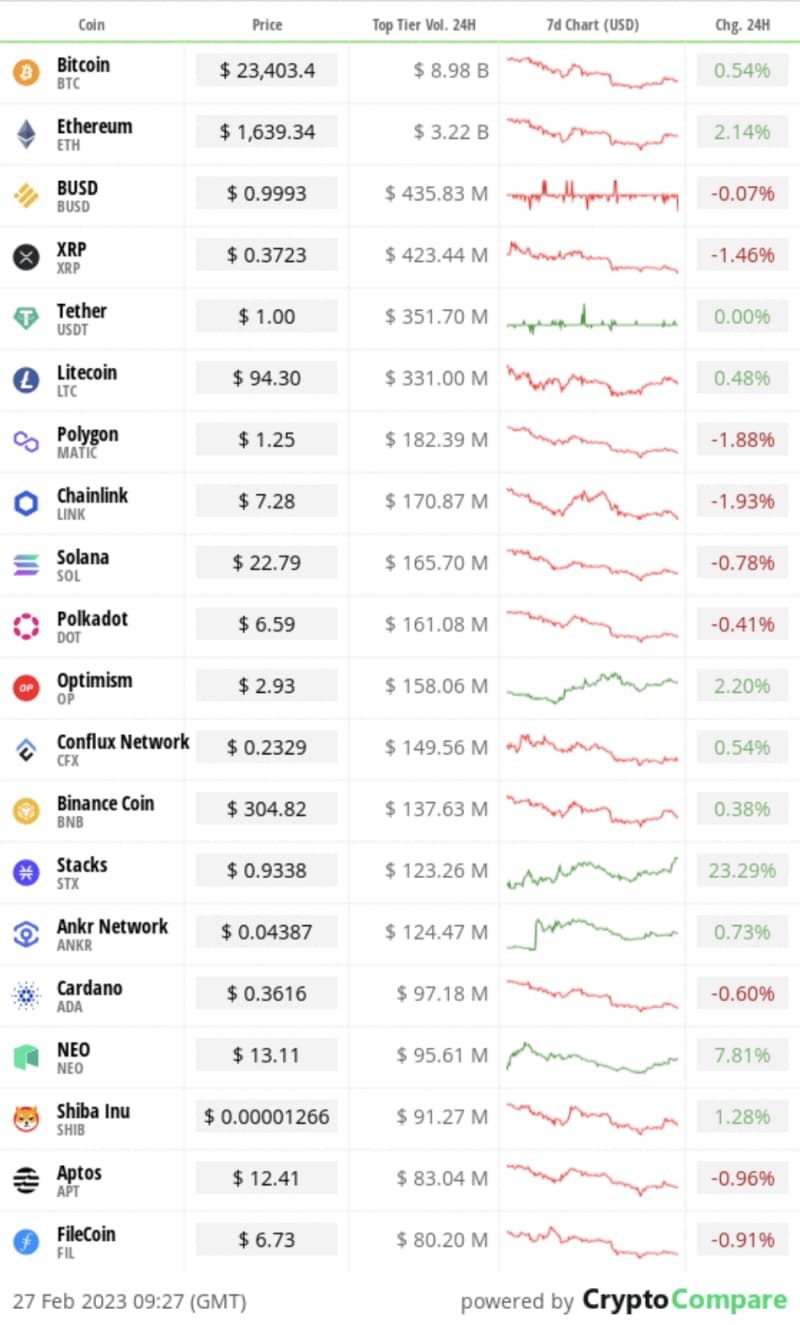

Bitcoin is trading for $23,380 this morning, a gradual decline of 6% over seven days, but up on the day by a little over half a percent. Ethereum is holding strong above the $1,630 level, trading in the green by around 2% since yesterday.

Other large cap cryptocurrencies are trading in a similar range, the majority of these coins either marginally in the red, or in the green over 24 hours, but sliding over a longer timeframe.

It is set to be another period dictated by US inflation data with the latest numbers in the Consumer Price Index (CPI), along with jobless claims to be released mid-March. Expect markets to react, say the analysts.

Friday’s Crypto AM Daily in association with Luno

In the markets

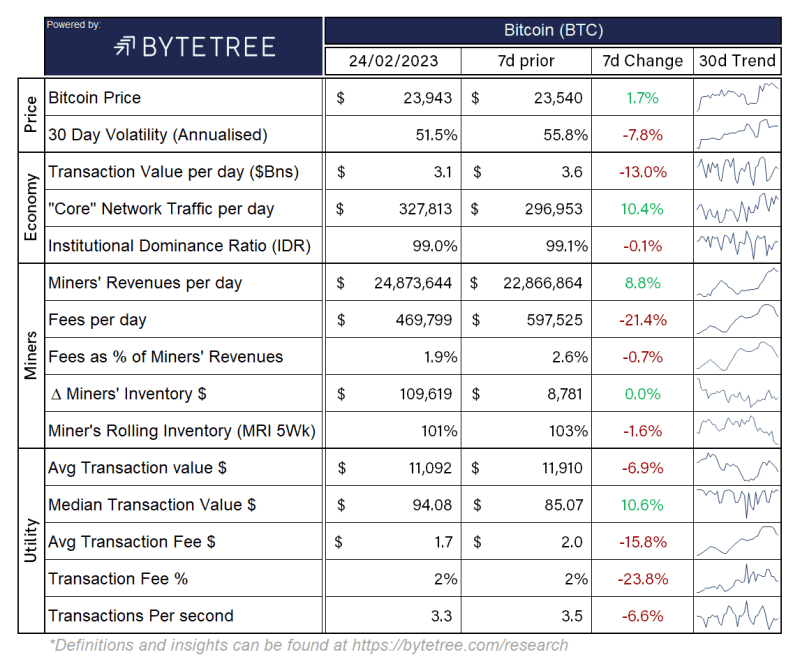

The Bitcoin economy

*Data can be found at https://terminal.bytetree.com/

Total crypto market cap

The total capitalisation of the entire cryptocurrency market this morning was $1.070 billion.

What Bitcoin did yesterday

We closed yesterday, February 26, at a price of $23,561. The daily high yesterday was $23,654.37, and the daily low was $23,084.22

Bitcoin market capitalisation

Bitcoin’s market capitalisation this morning was$451,893 billion. To put it into context, the market cap of gold is $12.007 trillion and Tesla is $622.94 billion.

Bitcoin volume

The total spot trading volume reported by all exchanges over the last 24 hours was $17,894 billion. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of Bitcoin over the last 30 days is 39.32%.

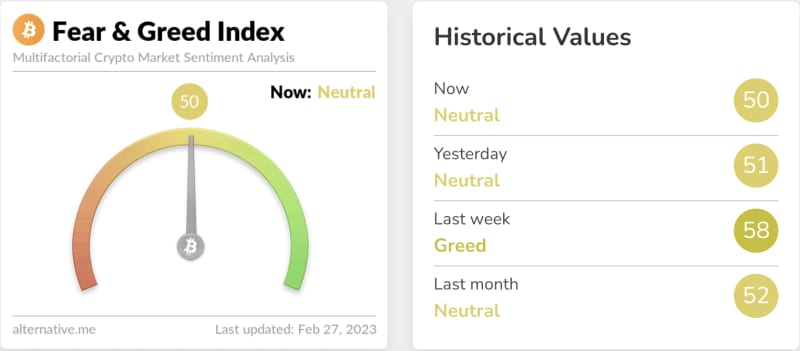

Fear and Greed Index

Market sentiment today is 50, in Neutral.

Bitcoin’s market dominance

Bitcoin’s market dominance today is 43.91. Its lowest ever recorded dominance was 37.09 on January 1 2018.

Relative Strength Index (RSI)

The daily RSI is currently 54.13.Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Convince your fam: Soundbite of the day

“There are about $160 billion in stablecoins currently residing in various wallets and pools and projects across the crypto space. Much of it is unused, belonging to owners biding their time until opportunity knocks.”

Steven Boykey Sidley, author of Beyond Bitcoin: Decentralised finance and the end of banks

What they said yesterday

The next step for Ethereum and staking…

A victory for privacy, in Wyoming, at least…

“Not there yet, but could get there soon.”

Would you like to help spread the adoption and education of Bitcoin in the UK and even stack some Sats while you’re doing it? Well, now you can!

The Bitcoin Pioneers community, backed by Barry Silbert’s Digital Currency Group, was created to introduce Bitcoin to a mainstream audience in a meaningful way and now has members right across the UK.

We share tips, stories and ideas on how to encourage others to try Bitcoin for the first time. And, thanks to support from Luno, each Pioneer gets £500 of Bitcoin a month to share with beginners, helping them get started.

So, if you’re passionate about Bitcoin, why not join today? Click here to find out more!

All feedback on Crypto AM Daily in association with Luno is welcome via email to James.Bowater@cityam.com 🙏🏻

Crypto AM: Editor’s picks

Sam Bankman-Fried: A tissue of lies soaked with fake tears?

Three-in-four wealth managers are gearing up for more cryptocurrency exposure

Crypto.com granted FCA licence to operate in UK

Q&A with Duncan Coutts, Principal Technical Architect at IO Global

Jamie Bartlett – on the trail of the missing ‘Cryptoqueen’

MPs are falling silent over potential of cryptocurrency

Erica’s ‘Crypto Wars’ handed honours in Business Book Awards

‘Let people invest’: Matt Hancock makes case for liberal crypto rules

Explained: Why the Treasury is so sold on stablecoins

Fears crypto is used to avoid sanctions ‘misplaced,’ says Matt Hancock

The cryptocurrency fundraisers behind Ukraine’s military effort

Crypto AM: Features

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM: Contributors

Crypto AM: In Conversation with James Bowater

Crypto AM: Tomorrow’s Money with Gavin S Brown

Crypto AM: Mixing in the Metaverse with Dr Chris Kacher

Crypto AM: Visions of the Future, Past & Present with Alex Lightman

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Taking a Byte out of Digital Assets with Jonny Fry

Crypto on the catwalk

Crypto AM: Events

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

The post Bitcoin trading flat as inflation keeps investor emotions in check appeared first on CityAM.