By Darren Parkin

Data from CryptoCompare shows the price of Bitcoin steadily dropped from around $25,000 to a $23,000 low, from which it has only recently recovered over the last seven days.

The flagship cryptocurrency is now changing hands at $23,760.

Ethereum’s Ether, the second-largest cryptocurrency by market cap, moved similarly to BTC, starting the week at around $1,700 and dropping steadily to a low of around $1,575 before it started recovering. It’s now at $1,650.

This past week started with the aftermath of stablecoin issuer Paxos Trust being told by the US Securities and Exchange Commission (SEC) the regulator is planning to sue it for violating investor protection laws in a letter known as a Wells notice, which it uses to inform entities of possible enforcement action.

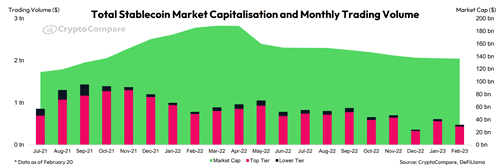

The notice alleged Binance USD (BUSD) is an unregistered security. BUSD is a Binance-branded stablecoin issued by Paxos and listed on several exchanges, including Paxos’ itBit platform. As a result of the notice and as cryptocurrency prices rise, data shows that the market capitalization of all stablecoins dropped for the eleventh consecutive month.

According to CryptoCompare’s latest stablecoins & CBDCs report, stablecoins experienced a 0.68% decrease in their total market capitalization in February, dropping to $136 billion. This marks the lowest market cap for stablecoins since September 2021.

IMF calls for ‘coordinated response’ to crypto

This decline was reported during the same week in which the International Monetary Fund (IMF) has taken a seemingly tough stance toward growing cryptocurrency adoption, with a set of recommendations and a call for a “coordinated response”.

In a statement, the IMF warned about the risks associated with the widespread adoption of cryptocurrencies, stating that it could undermine monetary policy, circumvent capital flow management measures, and exacerbate fiscal risks.

The IMF argued against granting crypto official currency or legal tender status and expressed concerns regarding financial stability, legal risks, financial integrity, consumer protection, and market integrity. The organization recommended a set of nine elements for member countries to create a thorough and unified policy response, including implementing clear tax treatment policies for crypto assets, and said that outright bans should not be ruled out.

Over the week, the Canadian Securities Administrators (CSA), an organisation made up of securities regulators from each of the ten provinces and three territories in the country, has published a long list of new requirements for crypto firms looking to stay legally compliant.

The list included orders for domestic cryptocurrency trading platforms to obtain prior written approval before enabling customers to purchase or deposit stablecoins or any other type of “Value Referenced Crypto Assets” (VRCAs). To obtain consent, these platforms must meet numerous due diligence requirements set by the administrators, which include ensuring that the stablecoin is fiat-backed.

On a more positive regulatory approach, Hong Kong has outlined a plan to allow retail investors to trade larger digital assets like Bitcoin and Ether, in a major step towards its goal of becoming a cryptocurrency hub. The move is part of a policy shift that contrasts with the ongoing crackdown in the US.

Coinbase launches Layer-2 network base

Nasdaq-listed cryptocurrency exchange Coinbase has announced the testnet launch of Base, a layer-2 network built using Optimism’s OP Stack, which offers “a secure, low-cost, developer-friendly way for anyone, anywhere, to build decentralized apps or dApps on-chain”.

According to Coinbase, its goal with Base is to make on-chain the “next online and onboard 1B+ users into the crypto-economy”. The network is set to serve as Coinbase’s on-chain home while being an open ecosystem.

The cryptocurrency exchange reported a Q4 net revenue of $605 million, beating analyst estimates of $588 million, and rising 5% from $590 million in the third quarter. The company reported an adjusted loss of $2.46 per share for the quarter, beating estimates of a loss of $2.52 per share. Its transaction volume has fallen 12% quarter-over-quarter to $322 million.

Over the week, Google Cloud also announced it was set to become a validator on the Tezos (XTZ) network, allowing its corporate customers to be able to deploy Tezos nodes in order to build Web3 applications on the network.

On top of that, Ethereum’s core developers have scheduled the launch of the Shanghai-Capella upgrade on the Sepolia testnet for February 28, at epoch 56832. Shanghai-Capella, also known as Shapella, is an upgrade that aims to enable staked ether withdrawals for network validators.

Finally, a developer has launched the Ordinals protocol on the Litecoin network, after forking the GitHub repository for Bitcoin Ordinals. Ordinals is a protocol that assigns a unique and non-fungible number to each satoshi, the smallest denomination of a Bitcoin, allowing users to attach data such as images, smart contracts, and more to Bitcoin transactions.

Litecoin was chosen as Ordinals can also work on it, due to its inclusion of technology found on Bitcoin, including the SegWit and Taproot soft forks.

Francisco Memoria is a content creator at CryptoCompare who’s in love with technology and focuses on helping people see the value digital currencies have. His work has been published in numerous reputable industry publications. Francisco holds various cryptocurrencies.

Featured image via Unsplash.

The post Stablecoin market cap falls for eleventh consecutive month, and IMF calls for ‘coordinated action’ on crypto appeared first on CityAM.