By Jack Barnett

European inflation is running at record levels, piling pressure on the European Central Bank (ECB) to keep hiking interest rates aggressively this year.

The rate of core price increases bumped to a record 5.6 per cent last month, up from 5.3 per cent and up to the highest level since records began in 1999, according to the bloc’s stats office Eurostat.

Overall annual inflation edged lower to 8.5 per cent from 8.6 per cent. Both numbers topped market expectations.

The data indicated the initial burst in inflation that was primarily driven by Russia’s invasion of Ukraine roiling international energy markets is curbing. Energy price inflation fell to 13.7 per cent from nearly 19 per cent.

Price rises for items that tend to be driven by domestic inflation dynamics are gathering pace, suggesting businesses are passing on higher costs to consumers.

Services inflation climbed to near five per cent, while food prices jumped 15 per cent.

Signs that European price increases are beginning to be fuelled by domestic factors raises the risk of ECB president Christine Lagarde and the rest of the governing council delivering more steep rate hikes this year.

The “ECB hawks will use today’s data to call for the Bank to extend its string of 50 basis point rate hikes into” the second quarter, Melanie Debono, senior Europe economist at consultancy Pantheon Macroeconomics, said.

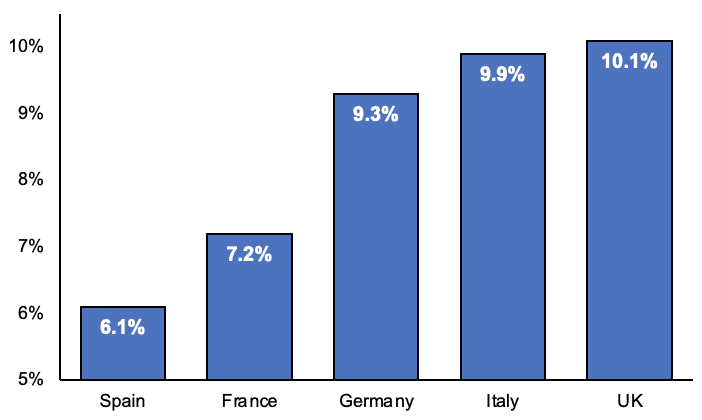

UK inflation is outpacing European peers

“We are bumping up our forecast for May’s rate hike to 50 basis points, from 25 basis points previously. Leaving our forecast for June’s increase unchanged, this implies an ECB terminal deposit rate of 3.75 per cent,” she added.

Lagarde will deliver the next rate decision on 16 March.

Minutes documenting talks that led to the ECB raising rates 50 basis points at its last meeting out today revealed there was “broad support” among council members for a steep rise.

That account “does not change our view that there is a very high probability of a 50 basis point hike on 16 March – with a hawkish 75 basis point surprise more likely than 25 basis point – and significant tightening beyond that,” Andrew Kenningham, chief Europe economist at Capital Economics, said.

The post Inflation in Europe rises to record high, raising spectre of steep ECB interest rate hikes appeared first on CityAM.