By Darren Parkin

We continue from Part 1 with other key forms of decentralisation.

Decentralised autonomous organisations (DAOs)

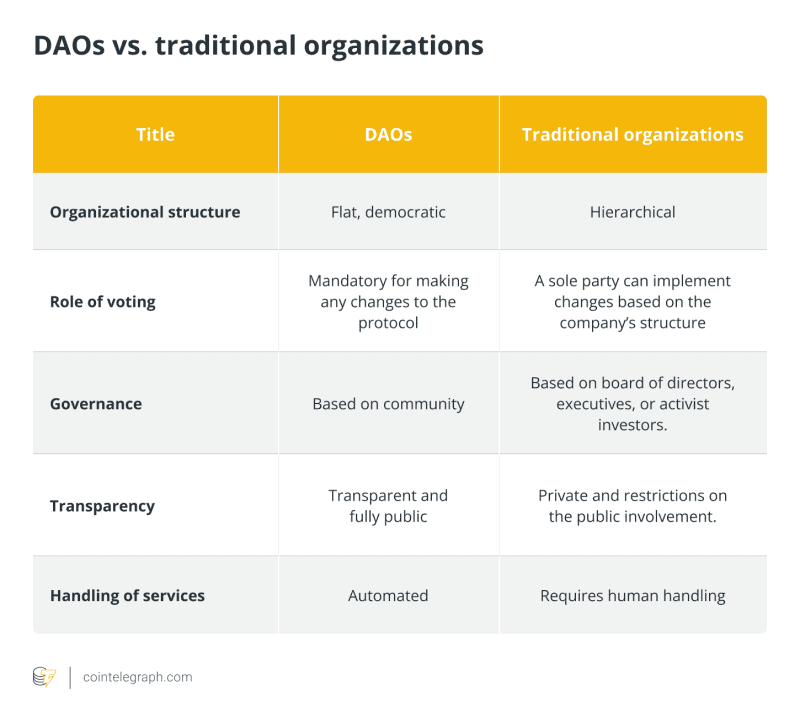

A DAO doesn’t have a central authority and operates based on proposals from its members. Such must be approved by a majority of members to become valid. They then implement these proposals using smart contracts which give the organisation rules on which to execute the agreed-upon actions of its members. Decision-making power is distributed and automated, thus eliminating the need for day-to-day administration. The benefits of a DAO include increased transparency and decentralisation of power. This also enables the autonomous corporation to function independently and without third-party influence. The removal of third-parties reduces cost and downtime.

Traditional organisations require trust in the people at the top whereas in a DAO, it’s the community that runs the show in bottom up fashion. Trust is placed in the code. Codes are far more concrete than trying to understand human motivations. DAOs are also completely transparent and verifiable where every transaction is available on the blockchain.

In consequence, a DAO is more efficient thus can scale faster. Since decentralised organisations have no hierarchical structure, they allow any stakeholder to put forward an innovative idea to improve a project.

Another feature of a DAO is that it distributes decision-making power to all participants. This is crucial to avoid human error. Human beings tend to misbehave in organisations. They are often given power and act in their own interest, whether they are motivated by greed, prejudice, or a desire for fame. Those flaws can make an organisation vulnerable.

DAOs allow Web3 communities to scale and grow without the risk of collapsing into an oligarchy or bureaucracy. This bottom up structure ensures ongoing democracy unlike the pseudo types seen across the globe. Gaining membership in a DAO can be as simple as buying an NFT or DAO token. Smart contracts enforce the DAOs rules in a trustless, objective manner.

The development of the DAO is done by way of vote by each member in the community who holds NFTs or tokens. Members can gain voting rights by purchasing a governance token. Voting is done through a process called “proof of stake.” In order to vote, a member must first deposit a cryptocurrency into a DAO smart contract. This deposit is called a “stake.”

The size of the stake determines the weight of the member’s vote. While some may complain this means the big dogs will monopolise the power, skin in the game has proven to be economic. The more invested the individual, whether in terms of capital or time, the more likely that person will act in the best interest of the organisation.

While misjudgements and mistakes will be made, this process is far more democratic and robust than traditional top down hierarchies. Further, the largest capital holders in DAOs are likely to be far more distributed than just a board of directors in traditional corporations or elected officials in governments.

Decentralised governments (eGov-DAO)

Dictators with too much power often enact crippling laws that carry consequences for future generations sometimes leading to genocides. Dictatorships are notoriously centralised around one ruler that carries dire consequences for the masses. In China, dogmatic dictator Mao enacted the one-child policy because he feared the young generation would eat the rest of the population alive. He also sent 17 million educated, privileged youth into exile. Without young people, the Chinese labour cost has increased by a factor of 14 since the year 2000. Mexican labour is now one-third the cost and twice as skilled as Chinese labour.

In Russia, 2022 was the last year that Russia had enough people in their 20s to even attempt an invasion of Ukraine. The demographic structure in Russia is diseased, aged, and in terminal decline. In consequence, the logistical supply chains that fuel Russian troops may erode to the point where Ukraine can push the Russians out of Crimea in the east and put an end to this war.

The partial decentralisation of power structures through blockchain and AI is key. One solution is to use an eGov-DAO blockchain to decentralise decision-making and increase transparency. This could potentially revolutionise the way governments operate, making them more efficient and accountable within various agencies while being less susceptible to corruption and more immune to attacks than traditional governments.

eGov-DAOs would remove the security risks of a highly centralised IT infrastructure. Private businesses could then engage with the government for contracted services with increased transparency and trust, reduced costs, and a more efficient process.

Such a system would be fully decentralised making it immune to systemwide malicious attacks. This approach has the potential to regulate and manage all relationships between decision-makers, management, agency staff, other agencies, clients, contractors, stakeholders and citizens using smart contracts.

Some of these contracts would enforce law, while others could guide agreements and internal processes. Every government transaction such as the use and transfer of money, property, data, access/use rights would be recorded on a public blockchain to maintain transparency and accountability. Smart contracts could allow for varying degrees of access.

The DAO would be controlled by pre-defined rules enacted via a smart contract, so it would eliminate errors and paperwork associated with traditional human processes.

A wide range of government procedures could also be automated using the blockchain. Something called a blockchain-based smart permit, for example, might handle many routine government activities. A smart permit, like a blockchain smart contract, is a kind of legal agreement that establishes obligations for various parties. The government and the permitted entity would have separate responsibilities as pertains to the issuance of licences. A non-governmental organisation may engage in a regulated function under the authority of a permit.

Both government and commercial services have been hacked in the past through ransomware and denial-of-service attacks. The e-Gov DAO would prevent this while lowering IT infrastructure costs.

eGov-DAOs will save governments money, increase efficiency, and reduce risk by establishing a transparent and secure e-government system with minimum cost. Estonia was billed as the world’s leading digital e-nation in 2017 well after it launched its e-residency program as well as a nation-wide digital signature platform.

With the launch of Estonian Web3 Chamber, it is well on its way to reclaiming its pole position as it aims to help regulators understand the vast potential of this tech such that the onerous, overbearing regulation in the crypto space will be transformed into a mature, evolved set of rules that enable massive utility.

At a time when public trust in government is at a major low, Web3 blockchain governance is the way forward.

Decentralised money

Bitcoin. What more needs to be said? Bitcoin’s hash rate towers over all other cryptocurrencies. It has never been hacked. Its original code never had to fork. It remains the most secure, peer-to-peer value transfer technology in the history of humanity.

Bitcoin IS the magna carta of code. There are no constitutional rights without the freedom to transact.

This explains why $1 invested in Bitcoin at its average cost of $0.007 in 2010 is today worth $22k/0.007 = $3.1 million. With all the central banks debasing their currencies, the value of a single Bitcoin should well exceed $1 million in the years ahead. Just as with peer-to-peer illegal file sharing, governments could never even come close to eliminating it because it’s decentralised. Instead, it survived then thrived.

Decentralised finance (DeFi)

Centralised systems failed because they were hacked, overleveraged, engaged in uncollateralized lending, or outright broke the law. FTX, Celcius, Three Arrows Capital, and LUNA among others all failed because they engaged in uncollateralized lending to risky counterparties. This is how the extremely high rates of interest could be achieved. But there is no free lunch. Offering such rates of interest took on levels of risk that came crashing down as the bear market took hold.

On-chain, smart contract, protocol-based cryptographic technology overcomes these problems by eliminating the middle men which require us to trust them. Trusted third parties are security holes. Indeed, at the same time centralised entities were imploding, DeFi protocols which lent to largely unknown counterparties, were fine.

At the base level, we have companies such as Aave, Compound, and Maker that force people to post collateral while enforcing aggressive risk controls. Smart contracts can be used to automate payments and transfer value which greatly reduces the cost and time it takes to make a payment, especially for cross-border transactions.

DeFi lending/borrowing:DeFi offers the best platform for lending or borrowing both crypto and real-world assets which opens new revenue streams while increasing access to capital for individuals and businesses. Real-world assets will be tokenized on-chain. One can also leverage with perpetual contracts that never expire. Interest is paid to the side with less demand, thus longs pay shorts when markets are trending higher and vice-versa. This system will exist in parallel with TradFi (traditional finance) systems.

DeFi growth: DeFi at present has a valuation that is minuscule compared to TradFi. The room for growth is massive. For this growth to continue along its S-curve, liquidity, UI (user interface), and transaction fees must be optimised.

a) DeFi growth- liquidity: Liquidity can be increased by using multiple chains, layer 2’s, and liquidity pools. One will submit a trade through a platform that sources liquidity to get the best price with least slippage. Cross-chain bridges will become hack-proof by using zero-knowledge (ZK) protocols. Ethereum will be undergoing upgrades that include ZK protocols later this year. This will greatly increase liquidity.

b) DeFi growth- UI: UI must also become so seamless, the user does not even know they are utilising DeFi, much as AOL and Netscape made the internet easily navigable to tens of millions back in the mid-1990s. Metamask is used by millions but its UI can still be much improved as non-crypto users often find it intimidating; this prevents mass adoption. Further, there are security risks.

A logical solution might be an MPC-based wallet with superior UI as data can be shared in a distributed manner without any third parties and is end-to-end encrypted so no private information is ever revealed. Private keys are not stored in one place which removes single points of failure. Zero-knowledge proofs provide a secure and privacy-preserving way to confirm the validity of transactions without revealing any sensitive information about the parties involved or the details of the transaction. This is facilitated by cryptographic algorithms which make blockchain-based payments more secure and private, as it eliminates the need to trust intermediaries.

c) DeFi growth- fees: Fees currently are paid in ETH. Users should be able to pay fees in stablecoins such as USDC and USDT. A user can easily send stablecoins to their wallet to pay fees which removes the need to buy ETH at all to pay fees.

d) DeFi growth- fiat on-ramps: Fiat-to-crypto on-ramps need to be included in DApps (decentralised apps). Right now, there are no on-ramps where users can easily buy crypto at low fees. Governments may try to block this through regulation. I think that at worst, if centralised exchanges ended up preventing the transfer of assets to non-KYC decentralised wallets such as Metamask, many would KYC their metamask wallets. In countries where regulations kill DeFi due to unrealistic KYC requirements, DeFi will just populate those countries that don’t carry such requirements.

If all governments banned DeFi, DeFi could still exist without KYC within the crypto space. In such a scenario, over time, crypto may fork away from fiat such that we have a black market of sorts where people transact purely in crypto away from plunging fiat as govts struggle to get control. Such a separate market could become a large part of the digital world once a substantial number of people join.

Here’s a good take by the creator of Cardano on why decentralising identities for AML/KYC is key. Here’s another solution where a self-sovereign decentralised ID can solve the AML/KYC issue for decentralised wallets with their website: https://www.nestprotocol.org/. The valuation of NEST rose in 2022, bucking the bear market.

The technologies that solve the above problems will enable mass adoption of DeFi as it is far more trustless, efficient, open, and global than TradFi.

Decentralised identity (DID)

Identity theft and breaches are becoming more common. Verizon’s email hacking statistics show that phishing attempts are responsible for 80% of malware infections and almost 95% of all espionage attacks. Facebook has also had many data breaches since it was launched; hackers use its platform for phishing scams.

A decentralised digital wallet on the blockchain can be used on a mobile to securely store your digital identity and credentials with encryption. This approach conceals data which greatly reduces the risk of credential tracking, hacks, and gaining unauthorised access to steal or monetize people’s data.

With a decentralised identity, passwords don’t exist. Instead, cryptographic keys are used to authenticate users. Individuals own their own digital identity.

Fake diplomas are a billion-dollar industry. With DID, organisations can issue and verify fraud-proof credentials and documents instantly. Even back in the 1980s, there were approximately 5,000 fake doctors in the US. These numbers continue to rise.

With DID, applicants earn a digital certificate from the respective institution or university. Applicants looking for a job share their verifiable certificate stored on their digital wallets with the company. The company receives a QR code and simply scans it to instantly confirm that her certificate is authentic.

By contrast, the traditional, manual verification process would normally take weeks.

Decentralised Science (DeSci)

I first discussed it HERE. David Friedberg discussed its possibilities in his recent podcast HERE.

Decentralised planet

One can see how peer-to-peer decentralised systems can propel humanity by orders of magnitude. Over the next generation, we may look back on centralised systems of governance whether it be nation-states or corporations as relics of the past.

Of course, centralised systems will not let go of their power base willingly so expect the next significant ongoing war to be between centralised and decentralised systems. As digital valuations rise above traditional physical valuations, expect cyberwarfare to also be another major and ongoing war.

But due to the exponential growth of peer-to-peer decentralised networks which are outside of government control, expect these networks which are more efficient and economic to overtake centralised systems within the next decade or so. Stay tuned for my upcoming piece on network states which, in time, will co-exist or even replace traditional forms of government.

(͡:B ͜ʖ ͡:B)

Dr Chris Kacher, PhD nuclear physics UC Berkeley/record breaking KPMG audited accts in stocks & crypto/bestselling author/top 40 charted musician/blockchain fintech specialist. Co-founder of Virtue of Selfish Investing, TriQuantum Technologies, and Hanse Digital Access*\. Dr Kacher bought his first Bitcoin at just over $10 in January\-2013 and contributed to early Ethereum dev meetings in London hosted by Vitalik Buterin\. His metrics have called every major top & bottom in Bitcoin since 2011 to within a few weeks\. He was up in 2018 vs the avg performing crypto hedge fund \(\-54%\) \[PwC\] and is up well ahead of Bitcoin & alt coins over the cycles as capital is force fed into the top performing alt coins while weaker ones are sold\. *

Website 1 of 4: Virtue of Selfish Investing Crypto Reports

LinkedIn: https://www.linkedin.com/in/chriskacher/

Bio: https://drive.google.com/file/d/1GBlOzJdp3XaDJaeuE6gp8xg2iBMwqRuO/view

Company 1 of 3: TriQuantum Technologies: Hanse Digital Access

Twitter1: https://twitter.com/VSInvesting/

Twitter2: https://twitter.com/triquantumtech

Encyclopedia1: https://de.wikipedia.org/wiki/Chris_Kacher

Encyclopedia2: https://everipedia.org/wiki/lang_en/Chris_Kacher

Author: https://www.amazon.com/author/chriskacher

Composer: https://music.apple.com/us/album/teardrop-rain/334012790

Youtube: https://www.youtube.com/user/teardropofficial Interviews & Articles: https://www.virtueofselfishinvesting.com/news

The post A decentralised world brings economic efficiency, economic proficiency, stability, and peace of mind – Part 2 appeared first on CityAM.