By Nicholas Earl

Gas prices have dropped in this afternoon’s trading as warmer weather and economic turmoil eased expectations of demand.

At one point, prices were down 7.5 per cent but the UK benchmark has since slightly recovered to report a 5.9 per downturn on the spot market after lunch.

The cold winter snap has tailed off with temperatures expected to rise to 15C degrees, lowering domestic gas demand.

Futures contracts for April through June were also down 5.5 to 6.5 per cent, reflecting expectations of use declining in the spring months, which should lower the pressure on households and businesses facing ultra-high gas bills.

Like all commodities, gas has also been hit by instability in the US financial sector which has seen three banks collapse, and the hastily arranged takeover of Credit Suisse by rival Swiss lender UBS.

This has triggered economic uncertainty, spooking investors amid the raised prospect of a recession and falling consumption of gas and oil.

There are currently fears First Republic could be the next US lender to face its demise, with the US scrambling to secure the sector and prevent the crisis spreading across Wall Street.

Ole Hansen, head of commodity strategy at Saxo Bank, told City A.M.: “Most commodities are currently driven by fears of what may happen next given the upheaval in the banking sector. Gas is, in addition to that fear, also trading lower as we are running out of winter to support demand.”

Commodities have been highly influenced by the latest instability with gold and silver shooting up as investors scramble for safe assets, while oil prices have tumbled heavily.

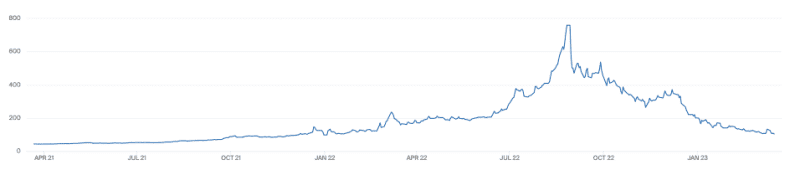

Gas prices climbed to nearly £8 per therm last summer in a record spike following a Russian supply squeeze on European gas flows.

Since then, Europe’s successful topping up of supplies alongside warmer than expected winter weather has seen prices drop sharply, with the continent relying on US and Qatari liquefied natural gas and rationing to ease off supply shortages.

In the UK, blackouts were also avoided although National Grid did have to utilise a coal plant earlier this month to maintain margins while energy saving sessions were also conducted in January.

Prices are now set at around £1.04 per therm, which is significantly below last year’s heights but still over double pre-crisis trading levels when gas traded at 42-45p per therm on average.

This is soon expected to be reflected in British gas bills with Cornwall Insight expecting them to drop to around £2,000 per year from the summer, which is well below January’s price cap peak of £4,279 per year but still nearly double pre-crisis expectations.

The post Gas prices slide ahead of spring as banking chaos sparks recession fears appeared first on CityAM.