Q4 2022 hedge fund letters, conferences and more

The Reasons Behind The Surge In Rent Delinquency Rates

Rising interest rates and rents, still-high inflation, and slumping revenues are fueling this surge:

- 74% say increasing interest rates are already hurting their business or will soon (up five percentage points over 69% in Feb.)

- 48% say inflation will further erode their businesses if it doesn't drop significantly

- 52% say their rent is higher than it was six months ago

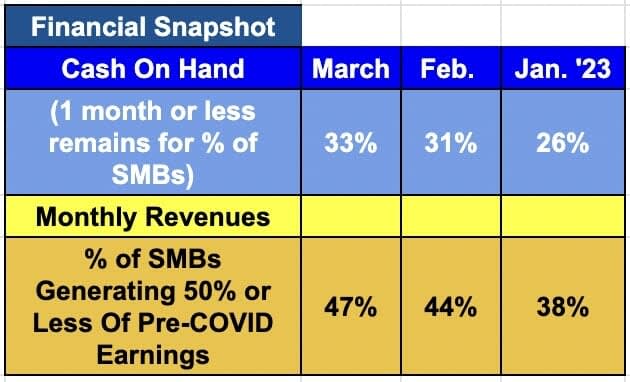

- 47% are earning 50% or less of the monthly revenues they generated prior to COVID. This trend is getting worse each month, as it was only 44% in Feb., and 38% in Jan.

- Small businesses that began after COVID are also struggling: 50% of those owners are making half or less of the monthly revenue they earned in Feb. 2022

- Across all SMBs, 33% have only one month or less of cash reserves available (up 2% from Feb., and 7% from Jan.)

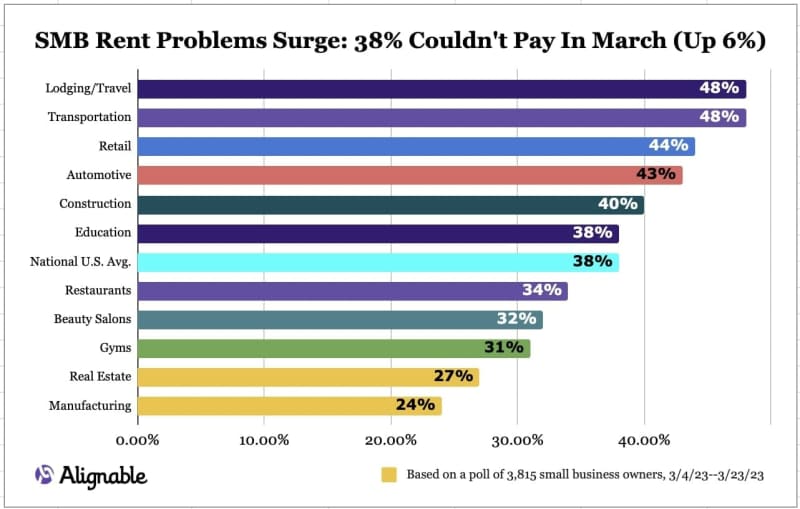

- Rent delinquency is highest among SMBs in transportation (48%), travel/lodging (48%), retail (44%), automotive (43%), and construction (40%)

- States with the biggest issues are NJ and GA, each with 45% rent delinquency rates. Next in line are AZ (40%), TX (39%), NY (37%), IL (35%), and MI (35%).

Beyond these findings, many SMBs aren't sure the situation will improve any time soon. In fact, 60% say they're afraid a recession is imminent (up five percentage points from Feb.), and 33% say it's already here. That statistic increased six percentage points from last month, with many poll respondents noting that recent bank failures are making them increasingly nervous.

These findings are based on responses from 3,815 randomly selected small business owners polled from 3/4/23 to 3/23/23, along with past research surveying 70,000+ other small business owners over the past 15 months.