By Jack Barnett

London’s FTSE 100 kicked off the week in upbeat style, yanked higher by UK banking giants Barclays and Lloyds racking up gains.

The capital’s premier index jumped 0.9 per cent to 7,471.78 points, while the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, climbed 0.19 per cent to 18,529.62 points.

The morning’s upward moves should help ease fears about the fragility of the global banking sector that resurfaced at the end of last week and saw German giant Deutsche Bank slump as much as 14 per cent.

Traders over the weekend had been mulling how to reposition at the opening of a new week.

However, lenders that led London’s FTSE 100 and other top European indexes retraced higher today.

Barclays advanced over two per cent while HSBC, Britain’s biggest lender, climbed more than one per cent.

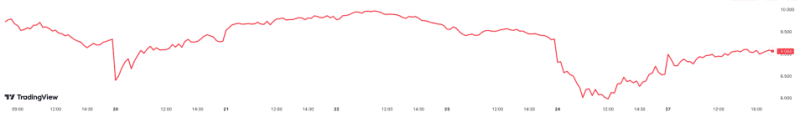

Deutsche Bank share price over last week

In Germany, Deutsche Bank surged a shade under six per cent, while France’s Societe Generale nudged higher, as did BNP Paribas and Santander in Madrid.

Failed US lender Silicon Valley Bank has found a partial buyer in First Citizens, it was announced today, lifting sentiment toward banks.

“First Citizens will buy most of SVB’s assets, helping to lift sentiment across the banking sector after a rocky end to last week, though the pall of banking stress still hangs over the market. There is a not yet the sense that the market has stopped looking for its next victim,” Neil Wilson, chief market analyst at Finalto, said.

The pound strengthened about 0.3 per cent against the US dollar.

Oil prices ratcheted up around 1.5 per cent.

The post FTSE 100 close: Deutsche Bank surges while Barclays and HSBC yank London index higher appeared first on CityAM.