By Mohammed Kudrati

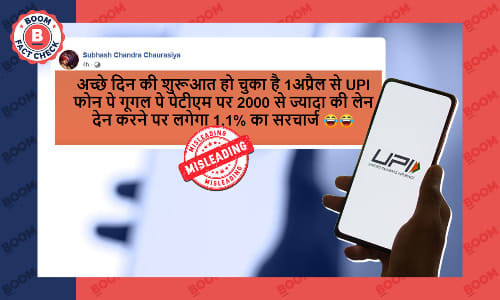

Several posts on social media, stating that all transactions done through the Unified Payments Interface (UPI) platform would attract a 1.1% fee, are misleading.

Recent changes as outlined by the National Payments Corporation of India - the operator of the platform - have outlined an interchange of up to 1.1% from April 1 on transactions done above ₹2000 through Prepaid Payment Instrument (PPI) done through UPI. PPIs include mobile wallets, digital wallets or prepaid cards like Pockets by ICICI Bank, Paytm Wallet and Amazon Pay.

The interchange will be charged to the merchant and not to the customer a press release by the NPCI clarified.

Transactions that occur between bank accounts will not be affected. This includes transactions that take place between two peers, or from a buyer to a seller in a general everyday transaction.

These claims can be shared below.

Also Read: Deadline To Link PAN With Aadhaar Extended By 3 Months To June 30

FactCheck

A clarification by the NPCI has refuted claims of all transanction through UPI above ₹2000 inviting a fee.

The Ministry of Finance also made this same clarification through a tweet.

"...and it is further clarified that there are no charges for the bank account to bank account based UPI payments (i.e. normal UPI payments)", the clarification says.

This means that the fee will not be applicable on:

- Peer to peer transactions between two individuals

- Peer to merchant transactions to settle everyday transactions

- UPI transactions made to recharge a wallet

Confusion on the interchange fee first arose based on a circular issued by the NPCI that was seen by various news outlets.

The circular stated that UPI transactions done through PPI will carry an interchange of up to 1.1% from April 1 this year. This will be levied on the merchants. The issuer of the PPI would also need to pay a 15 basis point of this fee to the remitter bank for loading a value above ₹2,000.

Different industry transactions (like those done for insurance, utilities, mutual funds etc.) carry different interchange fees.

BloomberQuint reports that, for example, the 1.1% fee would be at convenience stores. Insurance would attract a 1% fee subject to a maximum of ₹10. Telecom and utilities would attract a 0.7% fee each while supermarkets would attract a 0.9% fee. The fee for mutual funds would attract 1% fee subject to a maximum of ₹15 and agriculture a 0.7% fee subject to a maximum of ₹10.

The clarification can be seen below.

In August last year, the Ministry of Finance called UPI a "digital public good" and said that the government has no plans to levy any charges for UPI services.