By Jack Barnett

Britain is steering toward the bottom of the G7 economic growth table this year and will toy with a recession for most of 2023, the world’s economic watchdog warned today.

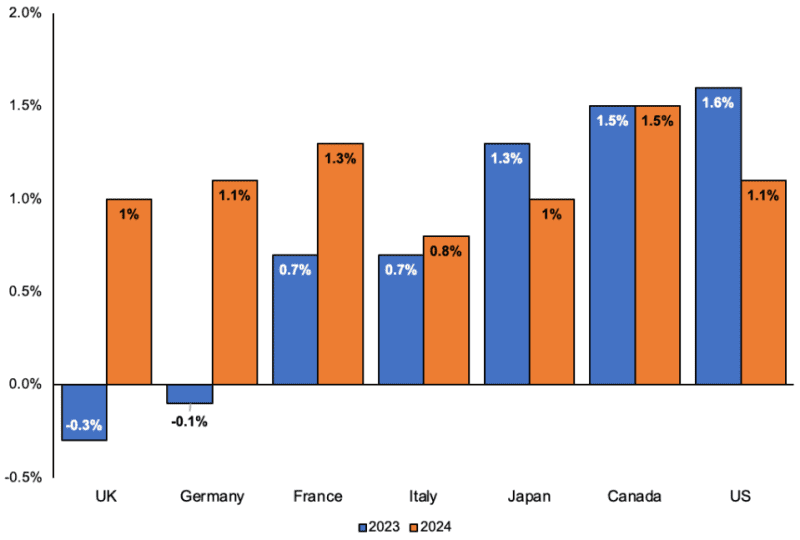

UK gross domestic product is tipped to shrink 0.3 per cent per cent in 2023, the weakest performance of any economy in the group of rich nations, which includes the US, Germany and France, among others, according to the International Monetary Fund (IMF).

While a sharp upward revision from the Washington based organisation’s previous forecasts at the beginning of the year of a 0.6 per cent contraction – a steeper drop than Russia, hobbled by Western sanctions, in 2023 – the new forecasts illustrate Britain’s economy is still trailing its competitors.

Germany is the only other country in the G7 that is forecast to suffer a contraction this year at minus 0.1 per cent. The IMF reckons the US will grow 1.6 per cent, Canada 1.5 per cent, France and Italy 0.7 per cent and Japan 1.3 per cent.

“The slowdown is concentrated in advanced economies, especially the euro area and the United Kingdom,” the organisation’s economic counsellor Pierre-Olivier Gourinchas said in its latest World Economic Outlook.

UK growth is poised to rebound next year, reaching one per cent, however that rate of acceleration is slower than the country’s pre-pandemic average and still among the lowest in the G7 for 2024.

Chancellor Jeremy Hunt said: “The IMF now say we are on the right track for economic growth.” The UK did receive the biggest GDP upgrade of any rich nation.

UK economic activity has held up much stronger than first feared at the turn of the year, partly due to households using their Covid-19 savings to cushion the blow of the cost of living crisis and fund spending.

IMF G7 GDP growth projections

But family and business finances are being crushed by roaring inflation and the Bank of England’s attempts to tame it with the most aggressive interest rate hike campaign since the 1980s.

Prices have risen 10.4 per cent over the last year and inflation has stayed in the double digits since September, forcing Bank governor Andrew Bailey and co to hike interest rates from 0.1 per cent in December 2021 to a post financial crisis high of 4.25 per cent last month.

And the UK economy is on course to suffer a repeat of the lost decade of growth after the 2008 financial crisis when output slumped far below its long-run trend, according to the IMF’s projections.

Recent turmoil in the banking system that has laid waste to Credit Suisse and US tech lender Silicon Valley Bank illustrate the global economy is in a wobbly state.

“Below the surface, however, turbulence is building, and the situation is quite fragile, as the recent bout of banking instability reminded us,” Gourinchas said.

The organisation, headed by Kristalina Georgieva, cut its global growth projection this year to 2.8 per cent and repeated their alert that world wide output is on track to slump to its weakest rate of expansion in three decades.

A combination of ageing populations, poor productivity growth and weak business investment due to slim returns will force central banks to reverse the aggressive rate hike campaigns they have embarked on over the last year to tame inflation.

“When inflation is brought back under control, advanced economies’ central banks are likely to ease monetary policy and bring real interest rates back toward pre-pandemic level,” the IMF said.

The lender of last resort did not specify where it thinks respective monetary authorities will drop rates to.

The rate of price increases has climbed rapidly in the rich world, pumped up by production limping after the pandemic reopening and higher energy costs caused by Russia’s invasion of Ukraine and strong Chinese demand.

That has lured the Bank of England and US Federal Reserve into the steepest rate increases since the 1980s. The European Central Bank has also jolted borrowing costs out of negative territory, where they had been for several years, via several outsized rises of at least 50 basis points.

UK inflation is projected by the IMF to average 6.8 per cent this year, also the highest in the G7, and still be above the Bank of England’s two per cent target for most of 2024.

In the eurozone, inflation will average 5.3 per cent and 2.9 per cent this year and next, while in the US, it is tipped to average 4.5 per cent and 2.3 per cent respectively, the IMF reckons.

The post IMF: UK economy to toy with recession this year – and fall to the bottom of global growth leaderboard appeared first on CityAM.