By Darren Parkin

Data from CryptoCompare shows that Bitcoin’s price moved significantly at the start of last week, from around $28,000 to a $31,000 high. The cryptocurrency’s price has since corrected to $29,560.

Ethereum’s Ether, the second-largest cryptocurrency by market cap, moved steadily up throughout the week, from around $1,850 to reach a $2,1000 high. The cryptocurrency is currently still trading close to that high, at $2,090.

This week, headlines in the cryptocurrency space were dominated by Ethereum’s highly-anticipated Shapella upgrade, which successfully went live on the cryptocurrency’s mainnet. The upgrade allows for the withdrawal of locked staked ETH, and completes the network’s transition to a Proof-of-Stake system.

The upgrade has positively impacted the network’s native token Ether. Its major feature was Ethereum Improvement Proposal (EIP) 4895, which brought in staked Ether withdrawals. Along with the withdrawal mechanism, Shapella improved the network’s gas fees for some transactions, as the core team had explained on GitHub before.

Staked ETH can now be withdrawn in two ways: partial and full. Partial withdrawals keep the validators running by automatically distributing the ETH to them, so they have the required 32 ETH balance. Full withdrawals stop the validator and take out the whole staked amount.

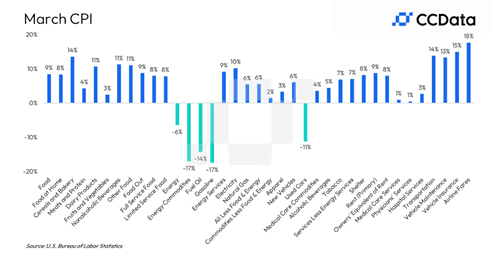

Ethereum’s upgrade dominated headlines in a week in which it was revealed that last month, the United States experienced its lowest inflation rate in almost two years, as the Consumer Price Index (CPI) declined to 5%, down from 9.1% in June.

During the week, Twitter partnered with social trading platform eToro to allow its users to access stocks, cryptocurrencies, and other financial assets. The new feature lets users access these assets through Twitter’s “cashtags” feature, which already gives them real-time trading data access.

The collaboration adds an option to click a button labeled “view on eToro” that directs them to eToro’s site for buying and selling assets.

Crypto made another significant step on social media over the week, after the price of Bitcoin started appearing in search results on Douyin, China’s equivalent of TikTok. This could indicate that Beijing is becoming more friendly to crypto and easing its grip on the digital asset space.

Douyin is the most popular short video-sharing app in China, with 700 million people using it every day. The app shows the cryptocurrency price at a time in which Hong Kong started opening its door to crypto and China’s state-owned banks.

Bitfinex secures El Salvador’s first digital asset service provider license

While cryptocurrencies have been gaining more traction on social media, El Salvador inaugural digital asset service provider license has been granted to popular cryptocurrency trading platform Bitfinex.

The move follows the January legislation passed by the country’s Legislative Assembly creating a framework for El Salvador to launch Bitcoin-backed “Volcano Bonds.” In September 2021, under President Nayib Bukele’s leadership, El Salvador became the first country to recognize Bitcoin as legal tender.

El Salvador’s acceptance comes when Binance.US is having trouble finding a new banking partner to enable fiat transactions for its customers in the country. The exchange lost its banking services with the recent collapse Silvergate and Signature Bank, and now relies on intermediary banks to hold funds for it.

Meanwhile, the Bank of England is reportedly looking to establish a team of up to 30 experts to develop a central bank digital currency (CBDC). In February, the UK’s central bank and finance ministry declared their intention to undertake further research and development on a digital version of the pound sterling and called on the public to offer input on the initiative.

It’s also worth noting that Montenegro’s Central Bank announced a collaboration with fintech company Ripple to explore the feasibility of creating a digital currency for the nation. Montenegro has used the euro as its currency since its introduction in 2022, even though it’s not a part of the Eurozone.

FTX’s legal bills show progress

Over the week, legal bills have revealed that collapsed cryptocurrency exchange FTX, under the leadership of newly appointed CEO John J Ray III, is contemplating reviving the trading platform to recover for its customers and creditors. Legal bills show progress on that task.

With the assistance of legal counsel from the prestigious law firm Sullivan & Cromwell LLP, FTX is examining the tax implications, cybersecurity concerns, and user experience aspects associated with a potential relaunch. The firm’s February invoice for these exploratory efforts totaled $13.5 million.

Francisco Memoria is a content creator at CryptoCompare who’s in love with technology and focuses on helping people see the value digital currencies have. His work has been published in numerous reputable industry publications. Francisco holds various cryptocurrencies.

Featured image via Unsplash.

The post Major Ethereum upgrade goes live, and Twitter starts letting users trade stocks with eToro partnership appeared first on CityAM.