GETY stock on roller coaster after board fires back, questioning credibility of bid

The news sent GETY shares soaring around 39% higher by mid-day on Monday, though they’ve pulled back through Tuesday’s after hours trading, to $6.05 a share.

Getty Images is a stock-photo company that licenses digital images to various clients, including advertising and creative agencies, publishers, and businesses. Its imagery ranges from editorial and creative images,

The offer price would value Getty at almost $4 billion, nearly double its closing share price of $5.06 per share on April 21. Getty’s share price rose as much as 62% as the market opened in New York and closed trading 32% higher.

Trillium said that the proposal is subject to immediate engagement by the Getty board, completion of satisfactory due diligence, obtaining satisfactory financing arrangements, entering a satisfactory purchase and sale contract, filing and completion of all regulatory matters related to the proposal, and approval of shareholders.

If the transaction is completed, Trillium Managing Partner Scott Murray will join the board of Getty and become its chairman, according to a statement on Monday.

Not So Fast

Late Tuesday, Getty’s board fired back, acknowledging the offer but questioning the credibility of the suitor and its offer.

“Trillium Capital LLC has not provided the Board of Getty Images or its advisors with any evidence that it, its managing partner or its non-binding, highly conditional proposal are sufficiently credible to warrant engagement by the Board of Getty Images,” read the letter from the Getty Images board.

Trillium had asked Getty Images for a board seat and urged the company to evaluate options including a sale to either private equity or strategic players, saying it could boost the company’s shares to more than $12 and add over $1 billion to its market capitalization.

Trillium had also said the company should expand and create partnerships with tech firms and publishers to grow its revenue. Trillium reportedly holds over ~500,000 shares in the company.

Trillium urged Getty’s board to enter into a non-disclosure agreement while warning it may pull its non-binding proposal at any time.

Fintel’s Big Short

GETY stock has big sitting atop Fintel’s Short Squeeze Board for several days, with a score of 99.77. There’s short interest of 509,553 shares which equates to 100.24%, according to Capital IQ and NYSE data. The short interest has 1.02 days to cover and borrow fee rates remain high, currently 97.45.

Short interest in the stock has grown by 48.15% over the last month.

As a result, Monday’s price surge would have caused significant losses to short-sellers who bet against the company.

The Fintel platform also revealed that GETY stock has experienced mostly net positive options exchange volume for April since posting fourth quarter earnings.

For the final quarter of 2022, GETY generated sales of $231.5 million falling a little short of market expectations, however adjusted EBITDA levels were within consensus forecasts.

The company provided FY2023 guidance during the results, telling investors that it expects to generate sales of $935 to $963 and adjusted EBITDA of $305 to $315 million for 2023. Market expectations were marginally above the top end of the range for sales and profit guidance.

The options data page for GETY highlights that investor sentiment is currently bullish as explained by a put/call ratio of 0.29. The platform’s options scoring model creates a sentiment indicator based on the ongoing levels of call and put option demand in a stock over time.

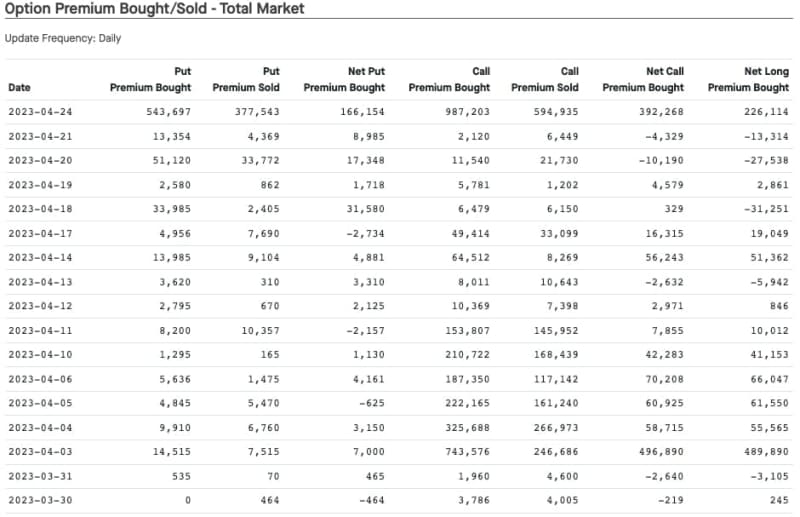

The table below shows a summary of options trades in the market for April with the net long/short premium being highlighted in the column on the right.

Goldman Maintains ‘Neutral’

Goldman Sachs analyst Brett Feldman kept his ‘neutral’ call on the stock and $6 target post result given expected rising operating costs and ongoing litigation.

The analyst wants to become more positive on the stock and its AI partnership with NVDA but is waiting on the sidelines until the new revenue opportunities are better understood.

Fintel’s consensus target price of $6.63 suggests the market thinks shares are now fully valued post rally.

The post Getty Images Shorts are Squeezed Hard as Trillium Capital Proposes $10 Takeover Offer appeared first on Fintel.