The fintech posted record results that impressed analysts and institutions but apparently not SOFI stock’s retail investors

SoFi Technologies, Inc. (NASDAQ:SOFI) is poised to extend yesterday’s decline, with the SOFI stock price off more than 3% in Tuesday’s pre-market trading.

SoFi generated adjusted net revenue of $460.16 million compared to a consensus expectation of $440 million. Adjusted EBITDA profits expanded significantly over the year to 75.69 million, almost double market forecasts of $41 million.

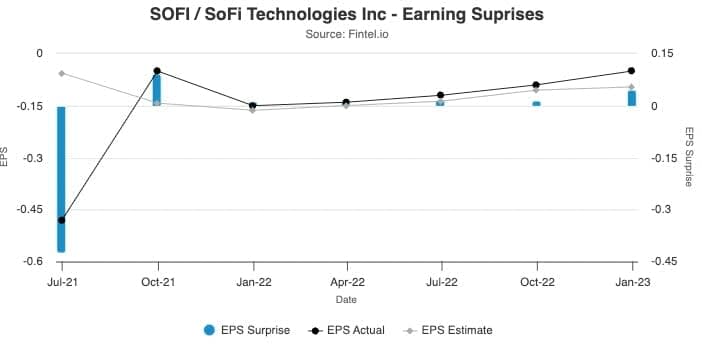

At the group’s bottom line, net losses narrowed by 69% from $110.36 million in Q1 of 2022 down to a loss of $34.42 million or 5 cents per share. The EPS figure was above the range of analyst estimates which averaged a loss of 8 cents per share.

The chart below from Fintel’s Earnings Surprise data shows the quarterly performance versus analyst expectations. The chart highlights that earnings surprises have not been common in recent quarters which correlates to a stock price that despite its ups and downs, has otherwise traded sideways.

Record Print

All three of SoFi’s business segments — Lending, Technology Platform, and Financial Services — contributed to the company’s overall record print.

CEO Anthony Noto stated “Our strong momentum in member, product and cross-buy adds, along with improving operating efficiency, reflects the benefits of our broad product suite and unique Financial Services Productivity Loop (FSPL) strategy.”

SoFi gained over 433,000 new members during the quarter, ending with nearly 5.7 million total members, representing a year-over-year increase of 46%. The company also added nearly 660,000 new products during the quarter, growing 46% over the year.

Sales and marketing expenses as a percent of revenue declined ~100 basis points sequentially and approximately 475 basis points year-over-year, showing the improving operational momentum towards break even.

SoFi’s total deposits grew by a record $2.7 billion, up 37% during the quarter to $10 billion at quarter-end, with 90% of SoFi Money deposits coming from direct deposit members, given the turmoil in the banking sector. With the launch of FDIC insurance of up to $2 million, 97% of SoFi’s deposits were insured at quarter-end.

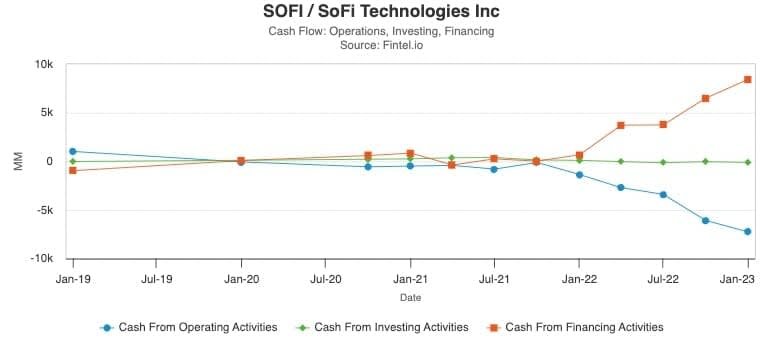

The deposit funding gives SoFi more of an ability to capture more net interest margin spread over accounts.

The chart below from Fintel’s Financial Metrics and Ratios page for SOFI stock shows how the company is generating growing income from financing activities relating to net interest margins.

Higher loan balances and net interest margin expansion drove strong growth in net interest income in the segment.

Strong contributions from Technisys helped the technology platform segment post 28% revenue growth over the year. Management said that contribution profit was lower because of higher employee-related costs including and increased investment spending in the platform.

Analyst See Upside

Oppenheimer analyst Dominick Gabriele thinks the stock sell-off was likely related to the guidance for flat Tech Platforms segment revenue for the next nine months, coming at a time when valuations are so important.

The analyst thinks that SOFI had a great quarter with solid execution being able to absorb several revenue headwinds while raising guidance. Oppenheimer sees limited downside to shares now after the decline and kept its ‘outperform’ call on the stock and $7 target price.

Meanwhile, the analyst team at Goldman Sachs told clients on Monday that they expect SOFI stock to trade higher on the beat and improved guidance.

Fintel’s consensus target price of $8.03 suggests the market thinks SOFI shares could rise 47% over the next year.

The post SoFi Dropped 12% Despite Beating Forecasts. Why Were Investors Not Impressed? appeared first on Fintel.