By Jack Barnett

The US Federal Reserve today hiked interest rates for the ninth time in a row in what may be the world’s most influential central bank’s final increase.

Chair Jerome Powell and the rest of the federal open market committee (FOMC), the group tasked with setting interest rates in the globe’s biggest economy, sent borrowing up 25 basis points to a range of five and 5.25 per cent.

The move was widely expected by markets, but speculation has grown recently over the Fed pausing its aggressive rate hike cycle at this meeting or the next to avoid igniting more banking failures by piling more pressure on the US financial system.

Over the past two months or so, two of the biggest banking collapses in US history have taken place, with First Republic Bank snapped up by Wall Street titan JP Morgan earlier this week and Silicon Valley Bank failing in March.

US lenders have been rattled by Powell and co jacking up borrowing costs, prompting customers to yank cash out of potentially fragile firms.

First Republic had $100bn pulled from its vaults in the first three of this year, it revealed in results last week.

“The US banking system is sound and resilient,” the Fed said.

US banks have reined in lending, which will in essence produce a similar effect to the Fed tightening policy, easing pressure on Powell to keep pumping up rates.

“Tighter credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation,” the Fed added.

European lender Credit Suisse was also pawned off to its biggest rival UBS to prevent further deposit flights.

But the Fed looked through banking anxieties today to proritise taming inflation over shoring up financial stability.

The Fed also opened the door to pausing interest rate rises at its next meeting by dropping the “anticipates” further tightening wording in its FOMC statement.

“In determining the extent to which additional policy firming may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation,” today’s statement read, a more dovish tone to its previous meeting statement.

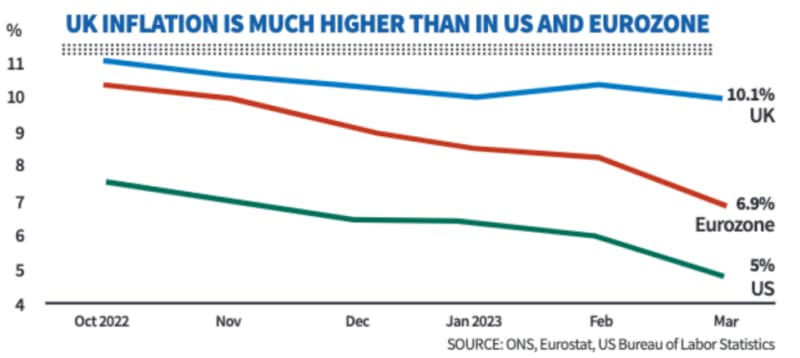

Inflation has been on downward trend since the summer, falling from a peak of just over nine per cent to five per cent.

However, FOMC officials are concerned core inflation – a more accurate measure of price pressures as it strips out volatile food and energy price movements – is still too stubbornly high.

Numbers out earlier this week revealed the Fed’s preferred inflation measure slipped to 4.6 per cent, a figure that is probably too high for US rate setters, luring them into today’s 25 point rise.

Markets, analysts and economists have all rounded behind the idea that today’s rate rise could be Fed’s last.

The other big monetary authorities are also nearing the end of their hiking cycles.

A growing number of analysts have also trimmed their European Central Bank rate rise call to 25 basis points from 50 basis points tomorrow, though most think ECB President Christine Lagarde and co have a couple more increases in them.

The post Federal Reserve bumps interest rates 25 basis points higher in what may be its final hike appeared first on CityAM.