S&P 500 and especially bonds closed on a cautious basis yesterday, clearly positioned for a hawkish surprise in the run up to the CPI release. While headline delivered solidly on disinflation expectations, core didn‘t do so really.

The key move that‘s set to overpower the bears as a bare minimum for today, is the reversal in tightening odds, even if for Jun only. The jubilation is set to prevail today. Right or wrong, the Fed is being forced by markets to back off, and as a side effect that takes some heat off the continued deposits flight when T-Bill rates go down.

The behavior of the short end of the curve, is key for today (and will be reflected in USD) – and I‘ll be foremost commenting on the intraday moves live on Twitter, including the opening dip – this is one of such days when I also open today‘s analysis for free.

So, make sure you‘re signed up for the free newsletter and make use of both Twitter and Telegram – benefit and find out why I’m the most blocked market analyst and trader on Twitter.

Let‘s move right into the charts (all courtesy of www.stockcharts.com) – today‘s full scale article contains 6 of them.

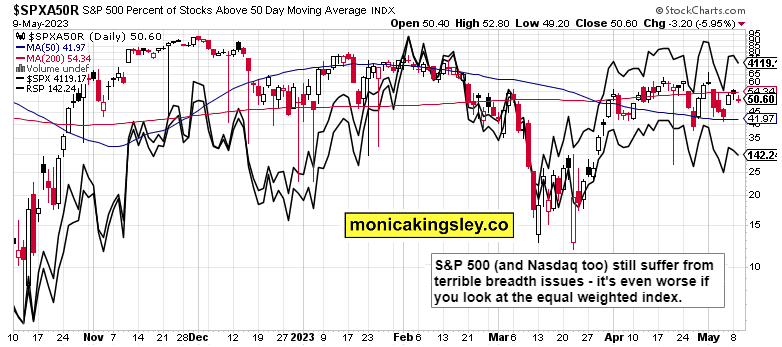

S&P 500 and Nasdaq Outlook

With odds of a day in the black this high, it would be key to see how KRE, XLF, XLB and XLI with IWM kick in again, plus the total volume. Bears can‘t think about 4,136, and low 4,150s close would be a huge and unexpected success.

Rather, have your eyes on 4,177 followed by the key 4,188 level – and of course presence or absence of market breadth relative improvements. Again, the short end of the curve – with focus on 3m foremost – holds the key.

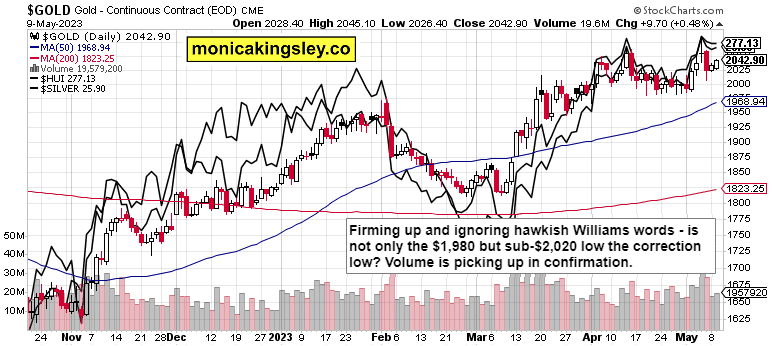

Gold, Silver and Miners

Precious metals would be the first canary (together with USD) pointing to any significant reversal of Fed tightening bets. Are they done, are they not – this is where it would show up first. Not in copper that still has to keep above $3.78 first, and odds are it would following today – and the same goes for crude oil reclaiming $73.

Thank you for having read today‘s free analysis, which is a small part of my site‘s daily premium Monica’s Trading Signals covering all the markets you’re used to (stocks, bonds, gold, silver, miners, oil, copper, cryptos), and of the daily premium Monica’s Stock Signals presenting stocks and bonds only. Both publications feature real-time trade calls and intraday updates.

While at my site, you can subscribe to the free Monica‘s Insider Club for instant publishing notifications and other content useful for making your own trade moves.

Turn notifications on, and have my Twitter profile (tweets only) opened in a fresh tab so as not to miss a thing – such as extra intraday opportunities. Thanks for all your support that makes this great ride possible!

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice.

Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind.

Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make.

Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.