By Darren Parkin

BRICS is a term you may have heard thrown around in the news or in conversations about the global economy. But what exactly is BRICS?

In short, BRICS is an acronym for Brazil, Russia, India, China, and South Africa. These five countries, representing some of the world’s largest economies, came together in 2009 (and South Africa in 2010), with Saudi Arabia looking to join.

The population of this group is estimated at 3.2 billion people.

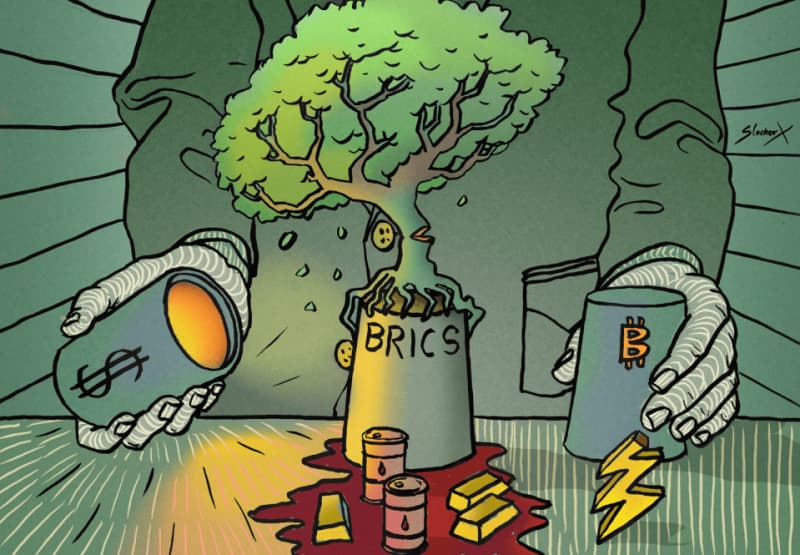

One of the most interesting aspects of BRICS is their plans to back a new currency with commodities. China first proposed this idea, and since then, the group has been working towards making it a reality. The goal of the new currency is to reduce reliance on the US dollar.

The formation of this new currency aims to re-establish the connection between hard assets and currency. A currency backed by gold, oil and other commodities would re-forge a link between money and reality. As this relationship is absent in the dollar system today, reducing the weaponization of the dollar and the risk of economic instability is the main driver behind the initiative.

To back the new currency, BRICS countries have been working on increasing their gold reserves, which will serve as a potential backing for the currency. They have also been exploring the possibility of creating a BRICS development bank to fund infrastructure projects in member countries and reduce dependence on institutions like the World Bank and the International Monetary Fund.

But how practical is backing a currency with physical commodities?

While the idea of a new currency backed by gold or other physical commodities will solve the current issue of fiat currencies being backed by thin air, there are also valid concerns about the practicality of such a system in the digital age.

An alternative to a physical commodity-backed currency is a Bitcoin standard. One of the main issues with backing a currency with physical commodities is trust. There needs to be trust that the commodities are actually there and that they are of the stated quality and quantity. This can be difficult to ensure, particularly when dealing with multiple countries with different regulatory systems and levels of transparency.

There are concerns about the environmental impact of using physical commodities as a backing for a currency. These commodities are not digital and cannot be carbon neutral, which could pose a challenge for meeting the needs of the ESG initiative.

Another question is who will audit the commodities? This is a crucial issue that must be addressed to maintain the integrity of the new currency system.

Will they send in an auditor to verify China’s gold reserves and likewise, will China be sending in investigators to validate Russia’s oil reserves? What we do know is this type of arrangement will require trust, and although these countries have a mutually beneficial relationship now, that may not last forever. They will need a commodity-backed currency that is not based on trust.

While the idea of backing a new currency with physical commodities may have its appeal, it faces significant challenges that make it impractical in today’s world. Compare this to a Bitcoin standard, that can offer a viable alternative that is transparent, secure, and decentralised.

Is it possible these countries have already thought this far ahead? Will the USA witness an epic own goal? Will they rise to the challenge and launch a revolutionary digi-dollar backed by Bitcoin? Or will the BRICS nations step up and embrace Bitcoin into their financial systems? Or, in a stunning twist of fate, will Bitcoin itself emerge as the ultimate champion and reign supreme over them all? The suspense is palpable!

The post Can BRICS build something with Bitcoin? appeared first on CityAM.