By Jack Barnett

A near £10bn debt interest bill helped to push UK borrowing to the second highest monthly total for April since records began in 1993, official figures out today reveal.

The government took on an additional £25.6bn of debt last month, above market expectations and up from £13.7bn in the same month last year, according to the Office for National Statistics (ONS).

Last month’s borrowing total was £3.1bn higher than forecast by the Office for Budget Responsibility (OBR) at March’s budget.

Swelling payments to investors in exchange for them lending to the government widened the deficit. Britain has to borrow cash when the amount of money it raises through taxes falls short of spending.

A large chunk of Britain’s debt pile – which is running just below 100 per cent of the size of the economy – is tied to an old measure of inflation, the retail price index (RPI).

RPI inflation has been surging for more than a year, raising the amount of money the government has to dish out to holders of UK debt.

April’s deficit was also fashioned by the Treasury spending nearly £4bn on subsidies, mainly to cushion the cost of living crisis partly caused by sky high energy bills.

Since last autumn, the government has capped typical annual household energy bills at £2,500, preventing them from topping £4,000. Ofgem, the energy regulator, is tipped to lower the price cap to around £2,000 on Thursday, reducing government spending under current plans.

The shortfall in the amount of money energy suppliers have to pay source gas and electricity and can charge consumers is bridged by the government.

Britain’s finances are typically measured over the year to March. Today’s figures were the first under the new fiscal year and put the UK on course to top of the OBR’s borrowing calculations by about £3.2bn.

Regardless, Ruth Gregory, deputy chief UK economist at Capital Economics, said she ” wouldn’t be surprised to see a pre-election giveaway in the Autumn Statement on top of the £21.9bn (0.8 per cent of GDP) giveaway for 2023/24 already announced in the Budget in March”.

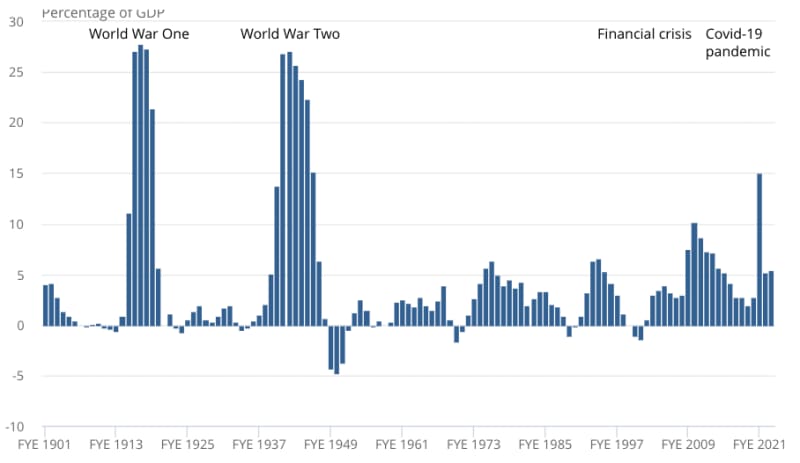

UK debt-to-GDP ratio is back at 1960s levels

Chancellor Jeremy Hunt said: “It is right we borrowed billions to protect families and businesses against the impacts of the pandemic and Putin’s energy crisis.”

“But debt and borrowing remain too high now – which is why it’s one of our priorities to get debt falling.”

He and Prime Minister Rishi Sunak have promised to get the debt stock falling and economic growth rising by the end of the year as part of a package of pledges to taxpayers.

In March, the OBR projected that Hunt has the thinnest margin of any Chancellor since the organisation was created in 2010 to hit their fiscal targets.

Presently, the government must get the debt-to-GDP ratio falling and cap yearly borrowing at three per cent of GDP in five years.

The post Swelling debt interest bill fashions second highest April government borrowing on record at £25.6bn appeared first on CityAM.