By Darren Parkin

Data from CryptoCompare shows that the price of the flagship cryptocurrency Bitcoin (BTC) moved steadily down over the past week, starting at around $28,000 per coin and moving to around $26,800 today.

Ethereum’s Ether – the second-largest digital currency by market capitalisation – moved slightly down over the past week, dropping from $1,900 to around $1,870 as the cryptocurrency sees demand from stakers.

Headlines in the cryptocurrency space this past week kept following the growth of Ordinals on the Bitcoin blockchain, which has now exceeded the 10 million mark. The Ordinals protocol was launched in January, and quickly emerged as a preferred method for creating assets on Bitcoin.

The number of Ordinals on the network grew after the introduction of the BRC-20 token standard in March, as it makes it possible for users to create entirely new tokens on top of Bitcoin. The market capitalization of all BRC-20 tokens is now above $470 million.

The number of BRC-20 tokens launched on Bitcoin has now surpassed the 25,000 mark, even though many Bitcoin advocates have critiqued the method of “inscribing” assets on the network as inefficient and wasteful, particularly concerning block space and transaction fees.

Another development throughout the week came after a partnership between the Bitcoin Milady’s NFT collection and the Ordinals protocol marketplace, Ordinals market, started allowing users to migrate their Ethereum ERC-721 NFTs onto the Bitcoin blockchain through the BRC-721E token standard.

The NFT front also saw Nike announce its NFT platform .Swoosh is set to be incorporated within EA Sports games in an integration that opens up the possibility for Nike’s virtual apparel and footwear to make appearances in game scenarios.

EA Sports has a game portfolio with several big names like FIFA, which won the “most popular game” award of 2022, the Madden NFL series, and the NBA Live series. These games have a huge fan base with loyal users, but Nike hasn’t revealed which games would feature its NFTs.

European Union signs historic crypto regulation law

This past week also saw the groundbreaking Markets in Crypto Assets (MiCA) regulation get formally enacted into law by the European Union, marking a significant event for the global cryptocurrency industry. This move positions the EU on the brink of becoming the world’s inaugural major jurisdiction to have specific rules tailored for this sector.

The EU Parliament President, Roberta Metsola, along with the Swedish Rural Affairs Minister Peter Kullgren, jointly signed the innovative legislation. Simultaneously, an anti-money laundering law, compelling crypto service providers to ascertain their customers’ identity during transactions, was also endorsed.

Meanwhile, Singapore’s sovereign wealth fund Temasek Holdings has expressed regret for its $275 million investment in the now-defunct cryptocurrency exchange FTX, and clarified there was no evidence of any misconduct on the part of their investment team.

Nevertheless, Temasek’s team behind the investment has accepted collective responsibility and witnessed a reduction in their compensation. The team had conducted an eight-month due diligence process into the exchange before making its investment, including an examination of its audited financial statements, a thorough analysis of regulatory risks, and potential cyber-security threats.

In light of the FTX debacle, the sovereign wealth fund affirmed its plans to fine-tune its investment appraisal process, particularly with a focus on rapidly expanding enterprises. Temasek emphasized its plans to refrain from cryptocurrency investments and vowed to exercise caution in future dealings within the blockchain sector.

Over in Russia, lawmakers abandoned their plans to establish a state-run cryptocurrency exchange, and are instead focusing on setting up regulations for existing cryptocurrency trading platforms.

Tether’s USDT market cap hits new high above $83 billion

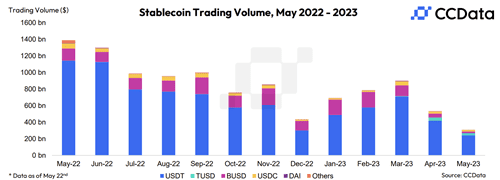

The total market capitalisation of Tether’s USDT stablecoin has hit a new all-time high of $83.2 billion, an achievement that comes amid an ongoing 14-month contraction in the stablecoin market.

According to CCData, trading volume for stablecoin has also dropped, experiencing a significant 40.6% decrease last month to $460 billion. This marked the lowest monthly trading volume for stablecoins on centralized exchanges since December 2022.

Nevertheless, Tether’s USDT has been benefitting from the woes of its rival, as Circle’s USDC was hit by the implosion of its banking partner Silicon Valley Bank in March, and Binance USD (BUSD) saw New York state regulators compel its issuer Paxos to stop minting new tokens.

Tether reported net profit of $1.48 billion in the first three months of the year, with most of its investments in cash, cash-like assets, and other short-term deposits. The company makes money from its large portfolio of U.S. Treasury bills, gold, and other investments and has recently decided to buy Bitcoin with 15% of its net realized profits.

Francisco Memoria is a content creator at CryptoCompare who’s in love with technology and focuses on helping people see the value digital currencies have. His work has been published in numerous reputable industry publications. Francisco holds various cryptocurrencies. Featured image via Pixabay.

The post Bitcoin Ordinals surpass 10 million as EU regulates crypto, while Tether keeps growing appeared first on CityAM.