By Darren Parkin

The Bank of England (BoE) is quietly pushing for approval of a Central Bank Digital Currency (CBDC), while our national broadcaster stands idly by and provides little in the way of coverage.

The public consultation document for a retail CBDC was initially set to conclude on June 7 2023. It has now been extended until June 30 2023 due to an omission in the questionnaire.

Unfortunately, there remains an unnecessary amount of complexity in the document that still excludes a significant portion of the UK population. Ideally, an extension should have been granted to foster honest public discourse. This report sheds light on the BoE’s hidden agenda surrounding CBDCs.

Many would be forgiven for not knowing that a monumental public BoE consultation – supposedly drawing to a close yesterday – could affect the money we transact with. You’d also be forgiven for not knowing what CBDC stood for! We heard about Brexit ad nauseam and understood it would have far-reaching implications for our economy, regardless of which side of the debate you stood for.

The public consultation is a symbolic act with no real meaning. The public is unlikely to be able to vote on whether a CBDC is desirable for the UK. There is no debate or discourse, and this silence is replicated across most media outlets and print journalism. If you search for the word CBDC on the BBC’s website, you will see only one article that exists, and this was written in November 2021. City AM seems to be the only publication brave enough to report accurately on the subject.

There are concerns over the accessibility of the consultation document. Questions arise about the document’s clarity and the intentions behind this intervention in people’s lives. To gain insights, we sought the expertise of a health researcher specialising in health literacy, mainly working with individuals facing mental health challenges and dementia.

Their evaluation of the consultation process conducted by the Bank of England and HM Treasury revealed significant concerns regarding the accessibility of the documentation provided to the general public. Emphasising the importance of inclusivity, co-production of information, and the need for meaningful participation for all.

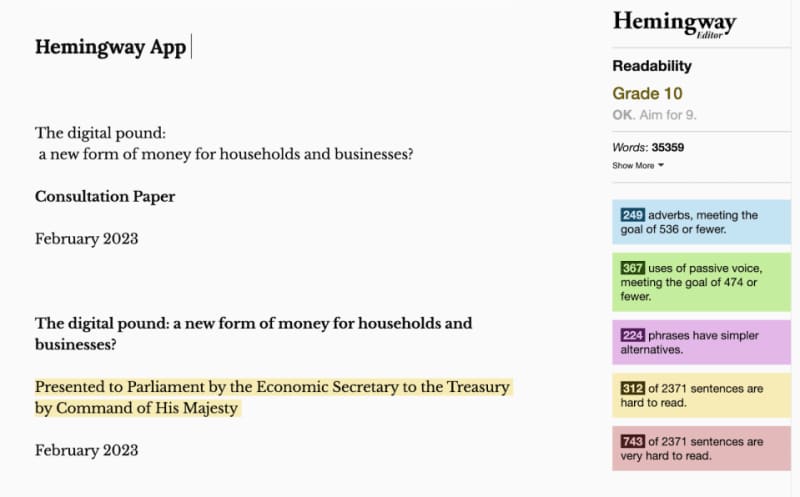

To demonstrate the issue, the popular Hemingway app was employed to assess text accessibility. By copying the text from the entire survey and pasting it into the app, the researcher was able to identify instances of inaccessibility in the language used. The findings were alarming, pointing to a significant gap between the complexity of the document and the average reading abilities of the UK population.

According to the Hemmingway App, the readability of the document was rated at Grade 10. This suggests that comprehending the document would require a reading ability of an average 15 to 16-year-old, while the average reading age in the UK is only 9. The average Guardian reader is age 14. This also raises significant questions about our education system and Rishi Sunak’s emphasis on advanced mathematics.

This stark discrepancy highlights the document’s inaccessibility and raises serious questions about its intention to exclude the general public from understanding its contents.

The CBDC consultation paper consists of a total of 2,371 sentences. A thorough analysis revealed that out of these sentences, 312 were categorised as hard to read, while a staggering 743 were labelled as very hard to read. These challenging sentences account for a significant 45% of the entire document.

The researcher strongly believes that this deliberate use of complex language in a public-facing document is unacceptable. Drawing on their collaboration with NHS communication experts, they are prepared to go on record, publicly denouncing the document as unsuitable for the general public.

The concept of programmable money, which the documents refer to repeatedly, is itself challenging to grasp, let alone decode the intricacies of the consultation. The use of exclusionary language contradicts the notion of inclusion that the documents claim to support.

It is clear that the average person, let alone marginalised groups, will struggle to understand the contents of these documents. This level of manipulation is an extreme form of negligence and constitutes a national scandal.

The call for change is resounding, and it is imperative that the concerns raised are addressed promptly to uphold the principles of democracy and inclusivity in public decision-making processes.

The post Why I believe the Bank of England’s CBDC consultation amounts to a national scandal appeared first on CityAM.