By Darren Parkin

Data from CryptoCompare shows that the price of the flagship cryptocurrency Bitcoin (BTC) started last week with a hefty drop from around $26,600 to a low under the $25,500 mark, but quickly recovered to touch the $27,000 mark. The cryptocurrency has since corrected and is now trading at $26,000.

Ethereum’s Ether, the second-largest digital currency by market capitalisation, started the week with a dip to $1,800, before moving back to the $1,900 mark. Since then the cryptocurrency has been slowly dropping and is now trading at $1,750.

Headlines in the cryptocurrency space this week focused heavily on the U.S. Securities and Exchange Commission (SEC) filing 13 charges against Binance Holdings Ltd., its U.S.-based affiliate BAM Trading Services Inc., and its founder, Changpeng Zhao, alleging violations of securities law on Monday.

The charges include operating unregistered exchanges, broker-dealers, and clearing agencies, misrepresenting trading controls and oversight on the Binance.US platform, and the unregistered offer and sale of securities. The SEC argued Binance and Zhao made public statements that Us customers were barred from Binance.com, while in reality bypassed their own regulations by allowing those significant transaction volumes to keep using their platform.

The SEC’s accusations extend to the claim that Binance has been mixing “billions of dollars” in customer funds and secretly sending them to an entity owned by its founder Changpeng Zhao

Binance responded by lamenting the regulator’s unilateral action, which it views as part of the SEC’s misguided refusal to provide clarity and guidance to the digital asset industry. It emphasized its commitment to maintaining user assets’ safety on its platforms, including Binance.US.

Binance’s Chief Communications Officer, Patrick Hillmann, said there is “zero evidence that users’ funds were ever at risk” and said there has “never been any sort of misuse of spending of user funds for corporate purposes.”

As the crypto community digested the SEC’s lawsuit against Binance, on Tuesday the regulator doubled down and filed a lawsuit against Nasdaq-listed cryptocurrency exchange Coinbase in a New York Court.

Charges levied against Coinbase include operating as an unregistered broker and exchange, with the SEC demanding the company cease these actions permanently. The SEC’s indictment maintains the exchange has continually resisted regulatory structures and bypassed the disclosure requirements mandated by U.S. securities law.

The SEC’s lawsuit was followed by a joint action from regulators in 10 U.S. states, including Alabama, California, Illinois, Kentucky, Maryland, New Jersey, South Carolina, Vermont, Washington and Wisconsin. They ordered Coinbase to stop its staking service.

Later in the week, the U.S. arm of Binance, Binance.US, announced it will transition to an all-crypto exchange as of June 13, as a result of the mounting pressure from the SEC, which has also filed a motion for a temporary restraining order in a bid to freeze assets tied to Binance.US.

SEC considers more than 60 digital assets as securities

Over a series of lawsuits filed against cryptocurrency firms, the SEC has been adding a number of digital assets to the list it deems to be a security, to the point that lists now exceeded the 60 mark.

Its most recent lawsuits against Binance and Coinbase saw the SEC classify various large digital assets as securities, including Binance’s BNB, Binance USD, and the native tokens of Solana, Cardano, Polygon, Cosmos, The Sandbox, Decentraland, Axie Infinity, and COTI.

Other prominent cryptocurrencies labeled as securities by the SEC include Ripple’s XRP, LBRY’s LBRY Credits (LBC), and Algorand. The largest single haul came with the charging of Terraform Labs for fraud in February, resulting in 16 crypto assets being dubbed securities.

On live television this week, SEC Chair Gary Gensler said he believes there is no need for additional digital currencies other than the digital forms of the U.S. dollar, the euro, and the yen.

Gensler explained that the lawsuits against Coinbase and Binance took a long time to prepare, because of the research work required. The SEC Chair also said the regulator had tried to communicate with the platform to make them comply.

In the UK, the Financial Conduct Authority (FCA) announced new restrictions for crypto advertisers on June 7. Set to come into effect from October 8, the new rules will impose stricter regulations on the promotion of crypto services.

ETF volumes fall to four-year lows

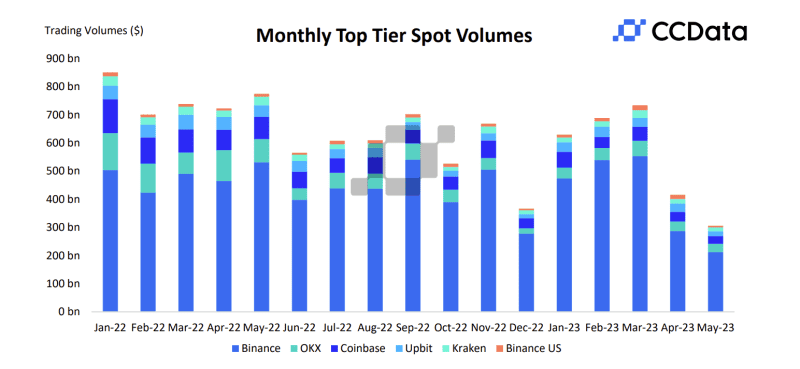

A new CCData report has highlighted 15.7% fall in spot and derivatives trading volumes in May from April. Binance took the biggest hit, with its market share falling to 43%, from 57% in February.

The drop is tied to Binance ending zero-fee trading for USDT pairs and the growing scrutiny from U.S. regulators. Other exchanges like Bullish, Bybit, and BitMEX gained more than 1% in market share.

After the SEC’s lawsuit against Binance was announced, the exchange had more than $500 million in net outflows, but told users their assets were safe. It also led to a 444% spike in the median trading volume across the top three decentralized exchanges.

Despite overall declines, the market share of derivatives trading across centralized exchanges rose to 79.5% of the total crypto market, up from 78.3% in April.

Francisco Memoria is a content creator at CryptoCompare who’s in love with technology and focuses on helping people see the value digital currencies have. His work has been published in numerous reputable industry publications. Francisco holds various cryptocurrencies.

Featured image via Pixabay.

The post Crypto market scrutiny amps in US as Binance and Coinbase face SEC lawsuits appeared first on CityAM.