By Jack Mendel

House price growth may face “significant drag” from high interest rates as fresh figures show they remained relatively stable in June despite yearly growth being negative.

The latest Nationwide House Price Index show house prices remained broadly flat in June, but down 2.5 per cent compared to last year, owing in part to 13 successive interest rate hikes from the Bank of England.

Higher interest rates mean it’s more expensive to borrow money from lenders, including for mortgages, meaning cash-strapped Brits are struggling to buy new properties, and are hoping to wait out until the market cools slightly.

The Nationwide figures show all regions of the UK apart from Northern Ireland had annual price falls, with prices going up 0.1 per cent on last month, following a drop of 0.1 per cent before that.

London remains ‘buoyant’

Overall the annual cost of a house across the UK was £262,239, with London experiencing a 4.3 per cent year-on-year decline, while the surrounding Outer Metropolitan region saw a 2.9 per cent fall.

Matt Thompson, head of sales at Chestertons, commented said “despite interest rates going up, London’s property market remains buoyant.

“We are seeing more cash buyers but also meet house hunters who rather buy now before facing another potential rate hike. We have seen a clear uplift in buyer demand over the past months and, in June alone, conducted 20% more viewings than in June of last year.

“The capital’s high rents are another contributing factor to London’s continuous buyer interest. As more and more tenants are facing rent increases, many are reviewing their situation and conclude that, despite higher interest rates, buying still presents a financially attractive option.”

This comes after Nationwide’s housing figures showed a 0.1 per cent fall in house prices last month,

The annual rate of house price growth slipped back to -3.4 per cent in May on the Nationwide House Price Index, from -2.7 per cent in April.

Prospective buyers have been burned with red hot interest rates following the Bank of England’s decision to raise interest by 0.5 per cent to cool inflation.

In early spring, the housing market was showing signs of improvement, with figures from the Bank of England showing the number of mortgage approvals was on a steady rise.

However, over the last four weeks since the rise, Zoopla recorded a 14 per cent fall in buyers in the market over the last four weeks compared to a year ago.

More rate pain for prospective buyers

Sky high rates have led some 42 per cent of sellers to accept discounts over five per cent on the asking price to secure a sale – the biggest discount recorded by the estate agent since 2018.

According to Moneyfacts, the average rate for a five-year fixed term mortgage now sits at 5.83 per cent, up from 5.17 per cent since the start of June.

Commenting on the figures, Robert Gardner, Nationwide’s chief economist, said: “Longer term interest rates, which underpin mortgage pricing, have increased sharply in recent months, in response to data indicating that underlying inflation in the UK economy is not moderating as fast as expected.

“This has prompted investors to expect the Bank of England to increase its policy rate further and for it to remain higher for longer.

“Longer term borrowing costs have risen to levels similar to those prevailing in the wake of the mini-Budget last year, but this has yet to have the same negative impact on sentiment.

He said “the sharp increase in borrowing costs is likely to exert a significant drag on housing market activity in the near term.

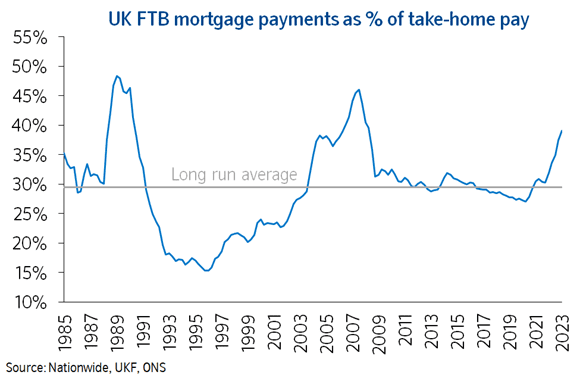

“For example, for a representative first-time buyer earning the average wage and buying the typical property with a 20 per cent deposit, mortgage payments as a share of take-home pay are now well above the long-run average, as illustrated in the chart below.

He added that house prices still “remain high relative to earnings”, and despite the higher rates “the sharp rise in rents, together with continued high rates of inflation more generally is continuing to make it difficult for many prospective buyers to save for a deposit.”