By Darren Parkin

Every man, woman and child now knows who Gary Gensler is much in the same way that Bitcoin is teaching commoners what a central bank is and what monetary debasement does to society.

It’s actually quite amazing. Imagine a population that knows how its system of money actually works. Now they are learning a lesson about how securities laws work.

The public has never been offered a more detailed look into how money and securities markets work thanks to a confluence of events triggered initially by the rising popularity of Bitcoin, high inflation and an all-time low in public trust for central banking; events whose coming was foretold by the Bitcoin OG community.

The SEC’s actions against Ripple Labs and most recently, Coinbase and Binance, have jolted the public’s fascination with these new “things” that flicker on a ticker.

80% of securities law compliance for “issuers” is initial and ongoing financial and operational disclosure. Read that again.

In SEC v. Coinbase and SEC v. Binance et al, the SEC is alleging that Coinbase and Binance are operating a securities exchange without having registered under the Securities Exchange Act of 1934.

The SEC is using a “gaslighting” tactic to justify its jurisdiction and assert its claims. The SEC claims that the “things” that flicker on those tickers are securities without suing each issuer and proving that the “things” in question are, in fact, securities. Governments and their agencies don’t think you are stupid. They know it. Read that again.

All of crypto legally belongs to gatekeepers

What nobody wants to hear, is that just because a “thing” is made using cryptography and is called something else DOES NOT mean that it is not a security or investment contract.

By that definition, every digital asset except Bitcoin is a security or investment contract. Unfortunately, it’s not the definition of the SEC. It’s the definition of the Supreme Court of the United States of America. See SEC v. WJ Howey.

To complicate matters, the SEC delegates the enforcement of securities laws to banks, broker-dealers, custodians, exchanges, transfer agents, law firms and PCAOB registered accounting firms. These are called “Gatekeepers”. They all want crypto under their control and its seems they are using the SEC and its public budget to get it. When blockchain technology represents a $100 Billion per year operational, risk and compliance cost savings, it becomes a fight to the death using existing laws, legal precedent and publicly funded regulatory agencies to wrestle it away from innovators.

Is sensible regulation possible?

There are voices that believe the SEC is not capable of regulating crypto assets; that they don’t understand it. This may or may not be true. However, there is one aspect to how the SEC specifies financial and operational disclosure that might justify these voices, but not for the same reasons.

Regulatory specifications for financial and operational disclosure leave a lot to be desired. Financial statements are not reliable. Just ask any CFA who extracts financial statement data for their employers who manage YOUR money. The software vendors and agencies who create and file financial disclosure data are only required to meet regulatory specifications. This means that a large amount of accounting and reporting logic and data is either missing, inconsistent or outright wrong.

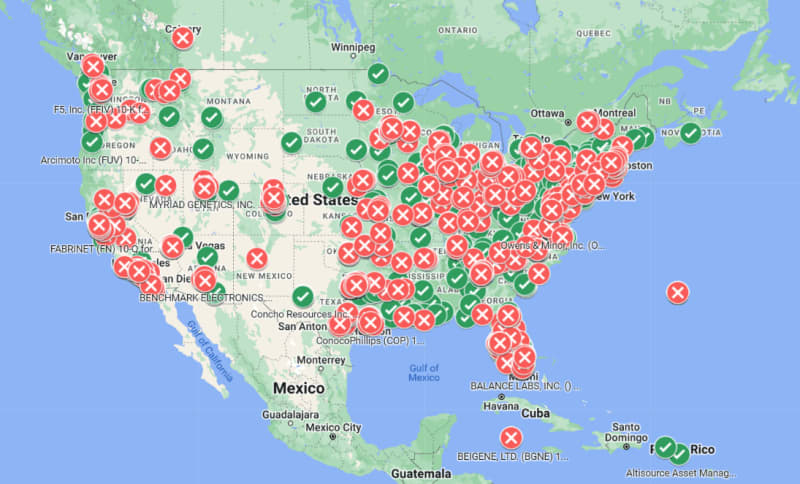

The Auditchain Protocol is a Web3 protocol that also uses AI to read, understand and analyse financial statements. It detects deficiencies in internal controls over financial reporting. Almost half of a sample of 3,000 companies failed to comply with basic fundamental accounting concepts in Q3 2022. 83 balance sheets DID NOT BALANCE!

The results were published on a map. The red dots indicate a failure of one or more fundamental accounting concepts. The green dots indicate no failures.

You can access this map and the underlying detail by clicking here. There are eight other categories of controls that can be applied to analyse financial data. This map used only one.

The Auditchain Protocol was able to detect disclosure deficiencies of Silvergate Bank before they failed.

You may be asking, “how did the controller, external reporting manager, CFO, audit committee chair, CEO and the auditor miss this?” The answer most commonly given… nobody cares.

It begs the question, if 80% of securities law compliance is financial and operational disclosure and financial disclosure is not reliable or usable, how can the SEC regulate a new “thing” when they can’t properly regulate the old thing? The answer most commonly given… they don’t care.

About Jason Meyers and Auditchain…

The Auditchain Protocol was conceived by its lead architect Jason Meyers – a former investment banker. He believes that crypto in the USA is in the process of a transfer of control from innovators to the incumbent gatekeepers. Connect with Jason on LinkedIn. Follow Jason on Twitter