By Nicholas Earl

Gas prices remain stubbornly high this summer – dashing hopes of plummeting energy bills over the winter, when demand will be at is at its peak.

The UK’s benchmark is up 0.37 per cent in this morning’s trading, priced at 86.7p per therm – having started the month at 60.9p per therm.

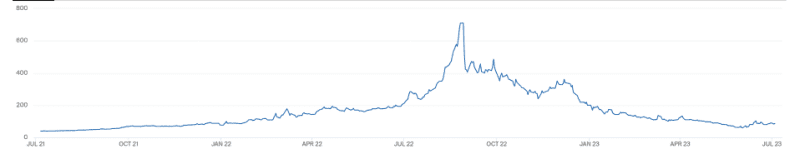

While this is well below last year’s record levels of nearly £8 per therm – it is still more than double conventional trading levels when prices sat at 40-45p per therm.

Prices are also high on the continent, with the Dutch TTF Futures benchmark persistently elevated at €34.99 per therm – having traded at €17.25 per therm just two years ago as a market norm.

The latest cause for gas prices rising is diminished output at key producers such as Norway and the US alongside sustained tight supplies from Russia.

Callum Macpherson, head of commodities at Investec told City A.M.: “Norwegian gas output remains significantly disrupted by maintenance – this has been one of the key drivers of gas and electricity strength in recent weeks combined with strong air conditioning demand. Plus on the international market, maintenance in the US has reduced its LNG output.”

He argued that prices had also been weighed down by rival factors such as milder temperatures which has both seen air conditioning demand decline and bolster strong wind and solar generation, along with rising French nuclear output.

“These factors have helped to temper strength in energy markets which remain generally tight on the lack of Russian gas. The summer maintenance in the North Sea is expected to wind down over the next few weeks though, enabling gas production to increase again. This will help to top up gas in storage ahead of the winter,” Macpherson said.

Long term prospects

This comes as government support for households and businesses ends, with some customers set to burden higher upfront costs for energy than last year when oil and gas prices skyrocketed.

Cornwall Insight expects the energy price cap, which establishes the maximum cost suppliers can charge for average energy usage, to remain just under £2,000 per year over winter and into next spring.

The cap was set at £1,000-£1,200 per year prior to the collapse of over 30 suppliers post-pandemic in the domestic energy crisis, and Russia’s invasion of Ukraine last year.

When the cap first rose to £1,971 per year in April 2022, this was both a record and near 60 per cent hike and on the previous price.

Dr Craig Lowrey, principal consultant at Cornwall Insight said: “Any reductions in the price cap should not diminish the sense of urgency in implementing necessary changes. The protection of vulnerable households from high energy bills remains a pressing issue that requires immediate attention.”