By Darren Parkin

Data from CryptoCompare shows that the price of the flagship cryptocurrency Bitcoin (BTC) moved mostly sideways throughout the past week, starting at around $29,300 and dipping to the $29,000 mark, before moving up to $29,500 and subsequently correcting to $29,400, where it’s currently trading.

Ethereum’s Ether, the second-largest digital currency by market capitalisation, moved mostly sideways throughout the week, with a start at $1,850 and two upward moves that tested the $1,900 resistance. Ether is now at around $1,870.

This week’s headlines in the cryptocurrency space focused partly on the launch of new cryptocurrency-related projects, with the controversial eye-scanning project Worldcoin making headlines for launching.

Sam Altman, the CEO of the firm behind ChatGPT, OpenAI, launched the project last week, which rewards participants with crypto for a scan of their eyes. On its launch day, individuals from across the globe formed lines at various locations to peer into silver orbs to get their rewards.

The project is meant to help distinguish humans from robots online, and according to Altman could “drastically increase economic opportunity” while preserving privacy. Worldcoin’s official launch means its tokens are now available on cryptocurrency trading platforms.

While innovative, the scanning process has been controversial, particularly when it comes to the strategies employed by commission-based orb operators, especially in less affluent countries. Moreover, privacy experts have raised concerns over the potential misuse of sensitive information obtained through iris scanning.

Another project launched over the week was a stablecoin pilot from the government of Palau, for its U.S. dollar-backed cryptocurrency Palau stablecoin (PSC), which will be issued on the XRP Ledger. The release comes after days of testing with volunteers making purchases with various devices.

Situated among the islands of the Oceania region in the Pacific Ocean, Palau is a small island country with a population of slightly over 18,000. It uses the U.S. dollar as its official currency and runs a digital residency program.

While newer projects keep on launching, long-term Bitcoin holders, deemed addresses that have held onto their BTC for at least 155 days, have recently seen the amount of Bitcoin under their control rise to 75% of the circulating supply.

Glassnode data indicates a surge of 62,882 BTC, approximately $1.83 billion, in the wallets of long-term holders, resulting in a record high of 14.52 million BTC this month. This new high exceeds the previous record of 14.48 million BTC established in May 2021.

SEC mulls challenging court ruling on XRP’s status

Over the week, the United States Securities and Exchange Commission (SEC) revealed it’s contemplating appealing a recent court decision – concerning Ripple Labs – that established that XRP “is not necessarily a security on its face.”

The regulator believes the ruling contradicts “fundamental securities laws principles” such as the Howey test, which assesses whether a transaction can be categorized as an investment contract.

Meanwhile, a key committee in the U.S. House of Representatives has given the green light to a bill that aims to provide clearer rules for the cryptocurrency industry. The Republican-led bill got through the House Financial Services Committee with a 35-15 vote.

The bill aims to establish a comprehensive regulatory framework for cryptocurrencies in the US and would set clear guidelines on when cryptocurrency firms need to register with the SEC or the CFTC, and the process by which they can demonstrate their tokens are not securities.

Moreover, the legislation incorporates specific terms that indicate a digital asset isn’t classified as a security solely due to its sale as part of an investment agreement, seemingly in alignment with a recent ruling by a federal judge on XRP not being a security.

In Europe, leading cryptocurrency exchange Binance has dropped its bid for a cryptocurrency license in Germany, following reports, the country’s financial regulator, BaFin, declined the exchange’s application for a crypto custody license.

Binance has faced a series of recent regulatory challenges in the continent. The crypto giant has withdrawn its licensing applications in Austria, the Netherlands, and Cyprus, while last month it cut off its association with its European banking partner, PaySafe.

Sequoia Capital trims crypto fund by 65%

Prominent venture capital firm Sequoia Capital has significantly reduced its cryptocurrency investment fund to $200 million, a stark decrease from the initial commitment of $585 million in a decision allegedly disclosed to investors in March.

Along with the shrinkage of the cryptocurrency fund, Sequoia has also cut its ecosystem fund in half, which primarily invests in other venture funds, bringing it down to $450 million from its initially planned $900 million.

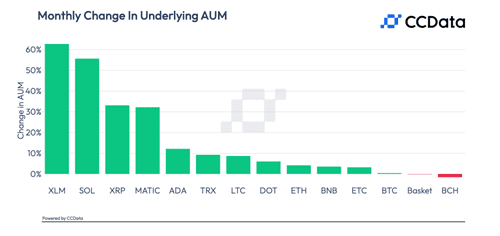

Institutional investors are nevertheless eyeing crypto, with crypto investment funds focusing on Stellar (XLM), Solana (SOL), and XRP all seeing major inflows in July according to CCData’s latest Digital Asset Management Review, along with products focusing on Bitcoin.

Investment funds offering exposure to XLM experienced a striking 62.7% upswing, amassing $17.3 million in AUM, with the leap largely being driven by a notable rise in Grayscale’s XLM product, which reported a premium surpassing 330%.

Similarly, products centered on XRP and SOL showcased solid growth, buoyed by the recent SEC lawsuit verdict where the judge ruled that XRP doesn’t necessarily qualify as a security.

Francisco Memoria is a content creator at CryptoCompare who’s in love with technology and focuses on helping people see the value digital currencies have. His work has been published in numerous reputable industry publications. Francisco holds various cryptocurrencies.

Featured image via Unsplash.