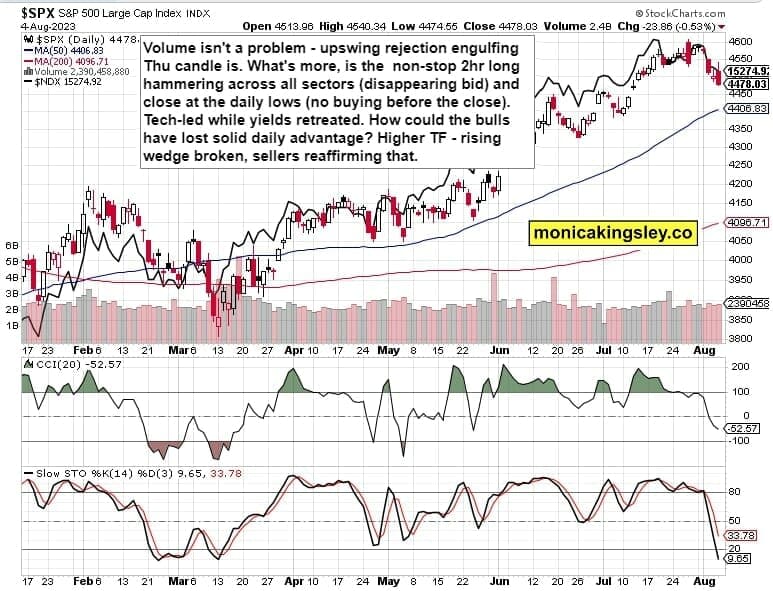

S&P 500 couldn‘t keep the fine rebound as all eyes were on “good that the job market is still OK, but maybe the Fed would stop hiking now” interpretation of weaker than expected non-farm payrolls. Bonds certainly played ball, but it was more than the dollar that pulled stocks down – all sectors declined from whichever high they had reached intraday, in spite of yields not moving adversely.

It‘s that oil prices, gasoline and diesel (heating oil) have appreciated double digits in July, and wage pressures aren‘t weakening much either – take the base effect of Jul 2022 CPI data being removed (it was 0% month on month), and the July 2023 CPI simply has to rise, which the market doesn‘t seem ready for.

Depends upon the Fed, but Sep rate hike odds would go considerably up, which together with prior week‘s telegraphed tweak to Bank of Japan‘s yield curve control (resulting of course in yields there creeping higher, triggering two interventions already) is slated to move 10-year yield again higher from Friday‘s 4.05% close. Monday‘s target of 4.20% had been reached fast, and it‘s not the top – 4.30%+ can be.

What would make rates keep rising? Apart from plenty of fresh Treasuries offered for sale and the discussed effect of Japanese yields working to lift yields worldwide (via the yields differential maintenance so as to keep the yen carry trade as appealing as before, which is now objectively harder to do and leaves the Fed a little in a position of catching a horse that‘s running away with further hikes), it‘s the still ruling soft landing, recession avoided narrative.

Economic data aren‘t simply deteriorating fast enough (forget six consecutive months of downside revisions of non-farm payrolls or similar, pointing to upcoming recession), so the yield curve continues steepening. It‘s always like this before the onset of recession – it appears that one has been avoided. Yet the many signs latest updated here, point to certainty of its arrival, with timing being the only question – how long after Sep?

Seriously deteriorating economic data, not just the measly Friday miss, and coupled with notion that the Fed must return to tightening as disinflation is over (the latter is to happen first), is what would force larger downturn in stocks. The coming – as it seems just a couple of percentage points – correction – is still within the context of a rising stock market… until the dream that the economy (with earnings) is accelerating from here, gets broken.

Keep enjoying the lively Twitter feed via keeping my tab open at all times (notifications on aren’t enough) – combine with subscribing to my Youtube channel, and of course Telegram that always delivers my extra intraday calls (head off to Twitter to talk to me there), but getting the key daily analytics right into your mailbox is the bedrock.

So, make sure you‘re signed up for the free newsletter and make use of both Twitter and Telegram – benefit and find out why I’m the most blocked market analyst and trader on Twitter.

Let‘s move right into the charts (all courtesy of www.stockcharts.com) – today‘s full scale article contains 5 of them.

S&P 500 and Nasdaq Outlook

4,515 support was broken, and good odds of running into 4,585 – 4,592 area were crushed in 4,560 already. The retreat in breadth, and below shown resilient VIX, speak against a sharp upturn right next – the odds of a correction went up sharply.

Neither the market breadth is appealing – Top 7 are no longer the best ones standing in a rising rates environment. Whatever seemed fine in advance-decline line, is overshadowed by advance-decline volume.

Copper is correctly appreciating the economic conditions as not being entirely rosy, and is still due to spend more time in (high) $3.80s. Commodities though have turned the corner following the lengthy and fast rate raising campaign – subsequent dips on fear of hawkish Fed destroying demand as much the recession itself, would prove to be buying opportunities in light of the stagflationary realities to strike later in 2023 and 2024.

Thank you for having read today‘s free analysis, which is a small part of my site‘s daily premium Monica’s Trading Signals covering all the markets you’re used to (stocks, bonds, gold, silver, miners, oil, copper, cryptos), and of the daily premium Monica’s Stock Signals presenting stocks and bonds only. Both publications feature real-time trade calls and intraday updates.

While at my site, you can subscribe to the free Monica‘s Insider Club for instant publishing notifications and other content useful for making your own trade moves.

Turn notifications on, and have my Twitter profile (tweets only) opened in a fresh tab so as not to miss a thing – such as extra intraday opportunities. Thanks for all your support that makes this great ride possible!

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice.

Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind.

Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make.

Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.