By Nicholas Earl

Gas prices in Europe skyrocketed today over fears of future supply disruptions after Australian oil and gas workers threatened strike action.

The risk of widespread walkouts has spooked market traders after months of declining prices and easing supply concerns.

Workers at Chevron and Woodside Energy Group facilities in Australia have voted to strike today, which has the potential to threaten liquefied natural gas (LNG) exports from the country – a vital energy source for the West’s energy storage plans this winter.

While the exact date for industrial action — if it goes ahead — has not yet been disclosed, it raises the risk of tightening markets amid rebounding demand in Asian economies, making competition for supplies even more fierce.

UK and Dutch benchmarks rose over 40 per cent hikes this afternoon, and were still up 27.3 per cent and 25.6 per cent respectively heading into close of play.

At their peak today, British gas prices climbed to £1.09 per therm, while European gas prices rose to €43.49 per megawatt hour on the Dutch TTF Futures benchmark at 1332 BST.

The upturn in prices exposes growing nervousness over supplies – even with storage topped up at nearly 88 per cent across the European Union ahead of winter.

This comes after EON warned of potential volatility in prices and supply shortages today.

Callum Macpherson, head of commodities at Investec, said the key factor in deciding where prices will head is what the weather looks like once the heating season starts in October.

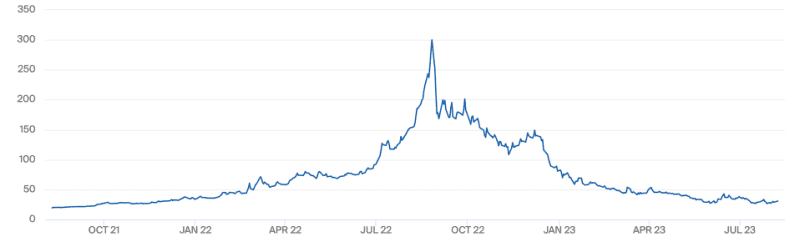

He said: “A cold October would mean we eat into inventories early in the heating season and the market may worry about storage being insufficient, pushing prices higher, possibly with price spikes similar to last year.

“However, if we have a mild October, we could see very soft pricing and an unwinding of the supply risk premium baked into the current forward curve. That could pull down forward prices all the way out to winter 24.”