By Nicholas Earl

Energy bosses are split over the role of the price cap in the UK’s retail market – with a seeming rift emerging between challenger suppliers and Big Six companies over its role in protecting households from high bills.

Ofgem’s chief executive Jonathan Brearley has urged ministers to reconsider whether the “very broad and crude” price cap is still fit for purpose following the domestic energy crisis – which saw the collapse of 30 suppliers, including the year-long de-facto nationalisation of Bulb.

The price cap prevented suppliers from passing on soaring wholesale costs to customers, contributing to the industry volatility which saw dozens of small energy firms exit the market, costing households an estimated £2.7bn in the winter of 2021 before the price of the cap was updated the following April.

It was designed to prevent long-standing customers being exposed to higher bills to compensate suppliers targeting switching customers with cheaper rates.

However, the watchdog boss is uncertain the mechanism is functioning as intended, amid concerns the price cap is doing more harm than good for households amid a painful cost-of-living crisis.

“The price cap was designed for a market that was much more stable – so, pre-2020 – and it worked quite well. But in this volatile market, the price cap has costs as well as benefits, so we would welcome a debate on the future of pricing regulation,” he told The Guardian.

Nigel Pocklington, chief executive of challenger supplier Good Energy, welcomed Brearley’s “support for a wider debate on the future of energy price regulation.”

He toldCity A.M.: “The price cap is not a successful piece of public policy, in my view. I think it’s beginning to actually harm consumers rather than do what people might claim it is doing. I think it has failed in its actual objective because it helped drive competition out of the marketplace and impose extra costs on consumers because they went bust.”

The energy boss instead wanted to see “greater consideration” for the idea of a social tariff – targeted support for vulnerable customers – with the government not expected to provide new packages of support for households in the coldest months of the year with energy bills still historically elevated.

This position is shared by Bill Bullen, chief executive of Utilita Energy, who told City A.M. last month that the price cap was the “biggest single risk to supplier profitability.”

He has also pushed for more targeted support for households, calculating that a £6bn support package could provide emergency relief to 10m low-income energy users this winter.

However, Octopus Energy boss Greg Jackson, which is home to nearly five million customers, told City A.M. in an interview in June that a social tariff – which Octopus does not support – would fail to be a viable substitute to the price cap.

“The energy price cap was the single biggest driver of energy companies putting effort into efficiency rather than just passing bloated costs on to consumers. Because energy prices are so opaque, some form of price protection is critically important for everyone,” he said.

He argued that the sector otherwise risked a market where “careful bill payers” are “absolutely ripped off” by privatised incumbents – which the government has sought to avoid through reforms to the energy market.

“We really cannot afford to see the world return to when bloated companies passed on massively swollen costs to bamboozled customers, it’s just not right,” he said.

Big Six put pressure on challenger entrants

Challenger suppliers have faced more difficulties facing higher wholesale costs during the energy crisis, while also being more weighed down by the capital requirements for long-term hedging than incumbent suppliers with larger revenue streams and bigger customer bases.

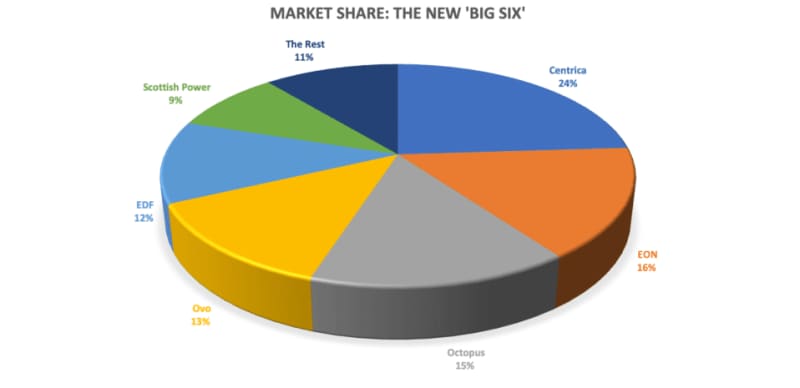

With over 90 per cent of the market once again dominated by six suppliers, it raises questions over stifling innovation – with Ofgem seeking a balance between financial discipline and ensuring new contenders can emerge into the market.

The energy price cap was legislated by the government in 2019, designed to put an end to rip-off tariffs by fixing how much suppliers can charge based on an estimate of their costs, and would require legislative changes to be revoked.

Former Conservative frontbencher and long-standing MP John Redwood called on the government to scrap the cap, which he considered to be a price control causing bills to remain elevated longer than needed.

He told City A.M.: “The price controls which can keep bills higher for longer when prices fall should be removed. Government should ensure through the benefits system that low income families can afford the energy they need. Restore competition amongst energy suppliers.”

When approached for comment this morning, the department for energy security and net zero confirmed its own analysis into the energy system was underway.

A spokesperson said: “The government will always ensure the energy market is working for consumers to protect them from sky high bills and that households are getting the best deal. Our consultation on how best to ensure people can access the full benefits of moving to a smarter, more flexible energy system is ongoing.”