By Darren Parkin

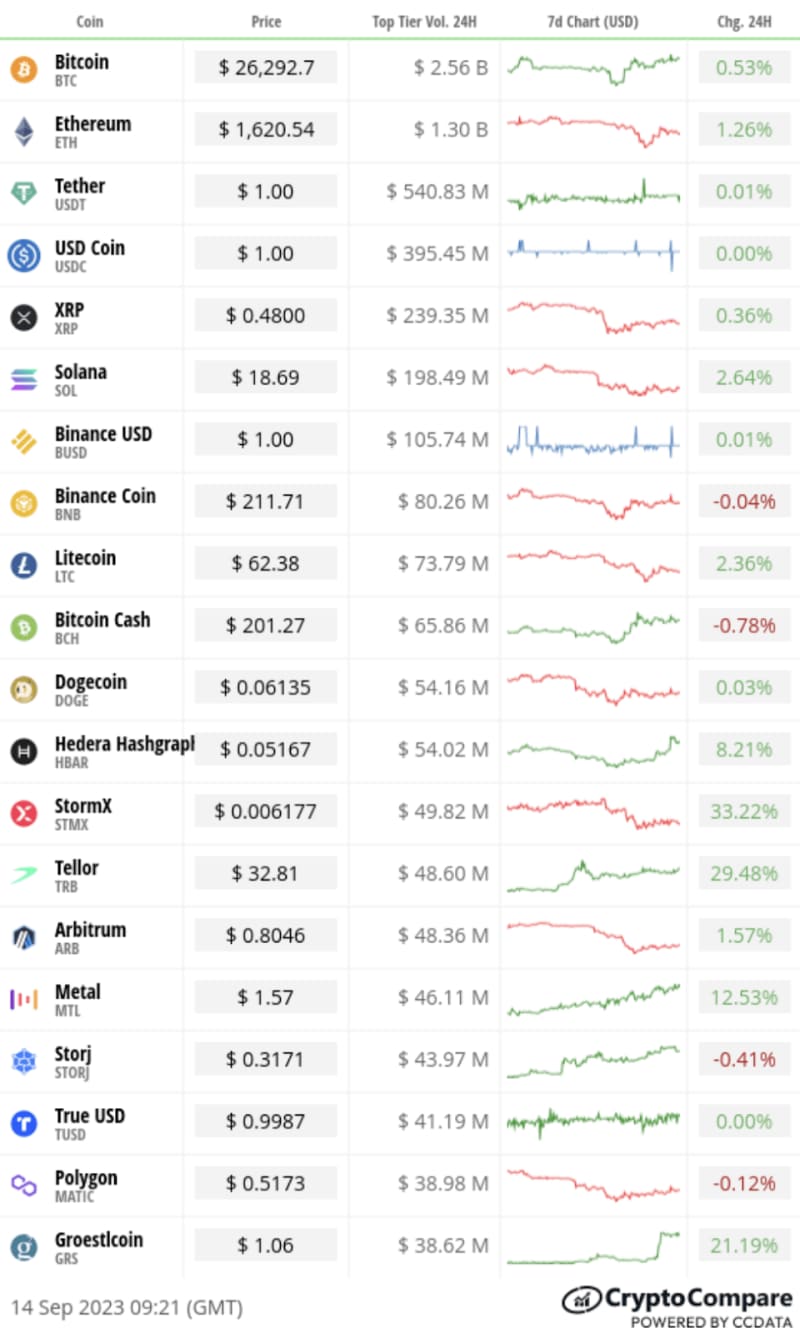

Bitcoin continues to improve on its position in increments. The market leader is up 1.5% in the last day, trading above the key $26k level this morning.

Ethereum (ETH) is up 2.3%, while Solana (SOL) is showing a bit more pep and is up by more than 4%. Other cryptos like Polygon (MATIC) and Avalanche (AVAX) are also up by more than 1% over the last 24 hours.

Earlier this week, Franklin Templeton, a global investment company, filed an application with the Securities and Exchange Commission (SEC) to launch a Bitcoin exchange-traded fund (ETF). In doing so, the company joins other global institutional investors such as BlackRock waiting on SEC approval.

Yesterday’s Crypto AM Daily

In the Markets

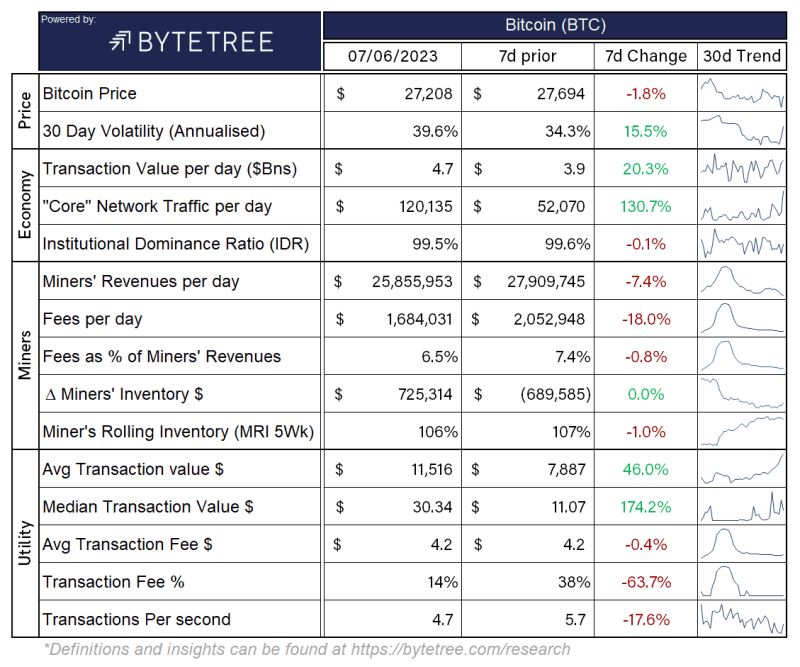

The Bitcoin Economy

*Data can be found at https://terminal.bytetree.com/

🌅Total crypto market cap

🔵 $1.05 trillion

🔺1.66%

What Bitcoin did yesterday

🔺 Daily high $26,382

🔻 Daily low $25,766

Bitcoin market capitalisation

🟠 BTC $512,416 billion

🟡 Gold $12.724 trillion

💳 Visa $515.43 billion

Bitcoin volume

🪣 Total spot trading volume $13.62 billion

🔻14.26%

SP500

🔺0.12%

FTSE/JSE Top 40

🔺 0.24%

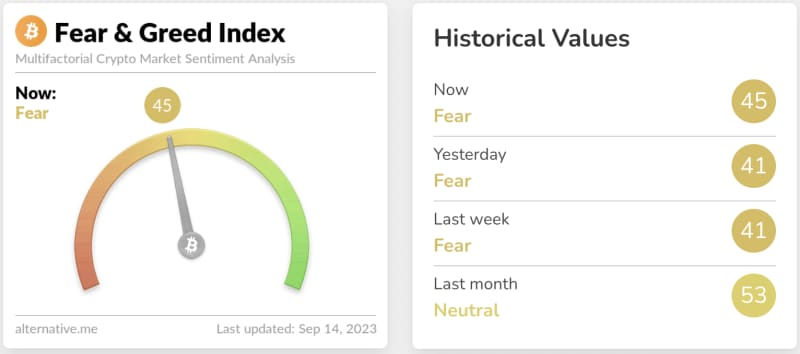

Fear and Greed Index

Bitcoin’s market dominance

📊 50

Relative Strength Index (RSI)

💪 51

Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price, while 30 or below indicates an oversold or undervalued condition.

📣 What they said yesterday

What Visa has said to the global banking community is “get your crypto act together or we might well go elsewhere to settle our merchants”.

Steven Boykey Sidley, Professor and Head of the Blockchain and the Cryptoverse Research Group at the Institute for Future Knowledge

Crypto AM: Editor’s picks

FCA’s new crypto advertising rules met with mixed industry response

ChatGPT urges crypto conference panel not to become over-reliant on AI

Mt. Gox customers will have to wait until November to recover lost Bitcoin funds

Sam Bankman-Fried: A tissue of lies soaked with fake tears?

Three-in-four wealth managers are gearing up for more cryptocurrency exposure

Crypto.com granted FCA licence to operate in UK

Q&A with Duncan Coutts, Principal Technical Architect at IO Global

Jamie Bartlett – on the trail of the missing ‘Cryptoqueen’

MPs are falling silent over potential of cryptocurrency

Erica’s ‘Crypto Wars’ handed honours in Business Book Awards

Crypto AM: Features

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM: Contributors

Crypto AM: In Conversation with James Bowater

Crypto AM: Tomorrow’s Money with Gavin S Brown

Crypto AM: Mixing in the Metaverse with Dr Chris Kacher

Crypto AM: Visions of the Future, Past & Present with Alex Lightman

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Taking a Byte out of Digital Assets with Jonny Fry

Crypto on the catwalk

Crypto AM: Events

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.