By Ruby Gee

ISSB – the new ESG standards: addressing the reporting pain for companies or feeding the fire?

At the end of June, the widely anticipated first standards from the International Sustainability Standards Board (ISSB) were released. We have provided a summary of what they are, where to find them and what it means to your ESG reporting strategy.

What are the ISSB Standards?

The ISSB was established at COP 26 in 2021 with the objective to simplify the ESG disclosure landscape into a global common language of sustainability related financial disclosures.

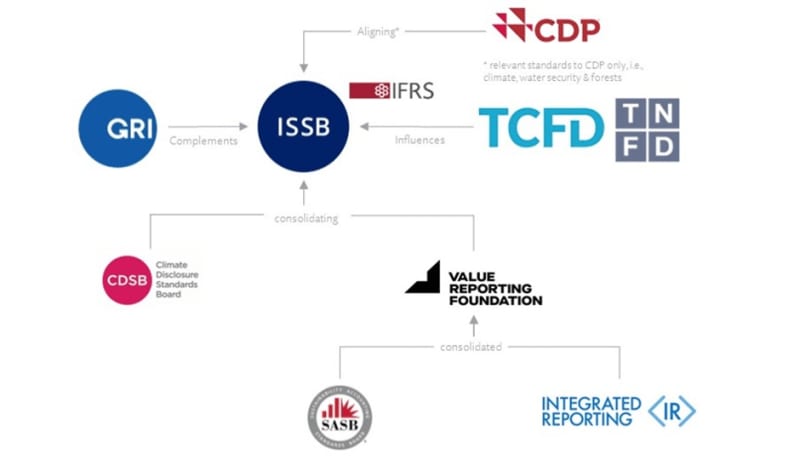

ISSB has received a lot of international support in its efforts to consolidate and extract value from existing standards, including SASB and CDSB and will eventually replace these. CDP has committed to integrate the relevant requirements into its disclosure process. The published standards fully integrate the TCFD framework and reflect the same structure covering Governance, Strategy, Risk Management, and Metrics and Targets. On 6 July it was announced that ISSB will take over the monitoring of TCFD reporting.

As the ISSB has created the consolidated standards there has been an effort to focus on proportionality to improve inclusivity, for example for smaller companies, which is good news for AIM listed and other small cap companies.

Where can I find the standards?

The first standards, downloadable from the IFRS (parent body) website, are effective on annual reporting periods beginning on or after 1 January 2024.

Users are to report at the same time as the Annual Report using the same assumptions and timing of data to allow comparability between the financial disclosures and the sustainability disclosures. And there are some first-year reliefs including timing of reporting and Scope 3 green-house gas reporting.

The ISSB will continue to develop additional standards to eventually cover all sustainability topics. Focus is now shifting to biodiversity and ecology, human capital, and human rights.

Do I have to report?

No, or at least not yet.

Although no jurisdiction has declared that the ISSB standards will be made mandatory, the G20, G7, Financial Stability Board and IOSCO have all publicly stated support and there have been several reported intentions to support mandating compliance, including in the UK.

So, is ISSB the only ESG reporting initiative I need to think about now?

Sadly, the answer is no.

Firstly, the scope of the standards only covers climate today. The advice from ISSB is to (continue to) use SASB, which covers a full scope of material ESG metrics for a firm based on its sector, and CDSB for any biodiversity reporting, in parallel with the ISSB standards until these legacy standards can be fully replaced. However, if you report against S1 and S2, this will also cover any TCFD reporting requirement and we assume that future ISSB biodiversity and natural capital standards will fully integrate the TNFD reporting which is currently in consultation.

Secondly, differences remain with other reporting standards. For example for those who need to report against the new EU standards under CSRD, there is a key difference in the definition of materiality which will impact the scope of what companies are required to report. There are also some differences expected in the US and Canadian reporting requirements that are due. ISSB recognises this and continues collaboration efforts to resolve differences and states incremental data required to meet the EU standards; but there will continue to be different global standards for firms that cross jurisdictions, at least in the medium term.

Thirdly, even if the differences are resolved and once the full standards are finalised, there is no expectation that the standards will replace all the global frameworks, e.g., GRI which are designed for wider stakeholder groups and not just investors.

In addition to any voluntary standards reporting today, firms also receive multiple different ESG questionnaires from clients, investors, NOMADs, brokers, all looking for different data and updates on ESG strategy and positioning. It is hopeful that the ISSB standards will help reduce the overall reporting burden on firms, although perhaps not immediately.

What does this all mean?

Based on the complexities of the current transition, the difficulties in unwinding reporting once being consumed by stakeholders, as well as the time and effort required to understand reporting, companies need to take a proactive review of their ESG reporting strategy.

Companies need to weigh up the benefits of reporting, which can bring resilience through improved governance of risks and opportunities, as well as build support from key stakeholders, against the following factors:

- What reporting do they already do?

- What are their mandatory reporting requirements – current and future?

- What is the evolution of the reporting frameworks, and how do they compare?

- What are peers doing?

- What are key investor and client requirements?

In summary

It was never going to be an easy task to replace the plethora of ESG reporting initiatives that exist globally and it will feel bumpy for organisations as they juggle different standards in the interim, but the end game for ESG reporting at last seems to be gaining clarity although it may be some time before companies feel the full benefit.