By Nicholas Earl

Drax’s share price has endured a wild journey on the London Stock Exchange today, with backers seemingly spooked over investors betting against the power company.

The power company’s shares dropped as much as 4.7 per cent this morning – it’s lowest price for more than two years – before recovering to a 0.96 per cent loss later in the day.

It is currently priced at 444.2p per share on the FTSE 250.

Matt Earl, managing partner of Shadowfall Capital and Research today disclosed a short position in Drax now worth about £9.4m ($11.5m) – which was made this month.

He said the company is significantly more leveraged than most investors calculated, and is expecting increasing scrutiny of Drax’s green credentials -which will make it harder for the company to justify its significant government subsidies, high dividend payments and share buyback program.

Hedge funds Marshall Wace and GLG Partners have also disclosed short bets – according to Bloomberg.

Analysts at Citigroup have slashed their target price for the company 25 per cent, after uncovering £653m of liabilities on the balance sheet – which were not linked to net debt.

“We take a disciplined approach to managing our balance sheet, which includes debt and working capital facilities which are all long-standing facilities and clearly disclosed,” a Drax spokesperson said, when approached for comment by City A.M.

The company’s share price showed signs of recovery after Drax revealed its biomass carbon capture and storage project – known as BECCS – has been made eligible for government approval in an extended ‘Track 1’ process.

The company is looking for a bridging mechanism for its legacy generators as it invests £2bn upgrading the facilities – to ensure sustained returns.

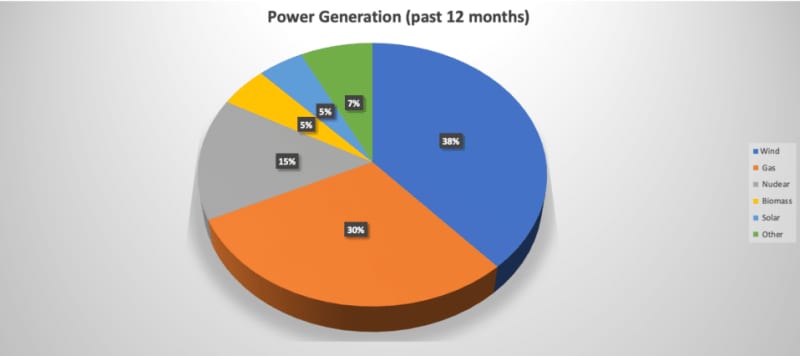

Drax is the UK’s chief producer of biomass energy, which is produced through burning imported wood pellets at the country’s largest power station in Selby, North Yorkshire – and makes up 12 per cent of the country’s renewable mix.

The power company recently received a fresh boost from government, which backed continued support for biomass, provided it was accompanied with carbon capture projects- with the current subsidy regime set to expire in 2027.

Its terminals have been essential to keeping Britain’s lights on over the winter, alongside its remaining coal unit which is now set to be scrapped.

The company has also benefitted from £2.4bn in subsidies over the past three years from the taxpayer – and there are doubts it four biomass terminals would be viable without state support.

Biomass is controversial due to its classification as a low carbon energy source, a matter of dispute within the energy industry.

It is considered a renewable energy source by the government, because new trees are planted to replace old ones used in sourcing wood – which are expected to recapture the carbon emitted by burning the pellets.

When used in high-efficiency wood pellet stoves and boilers, biomass pellets can offer combustion efficiency as high as 85 per cent – making it highly prolific as an energy source.

There is also a carbon saving in clearing out residue such as forestry leavings and sawmill shavings which could otherwise release more emissions intensive methane gas.

However, regulator Ofgem is investigating the company over its sustainability reporting, while the UK’s National Audit Office announced this month that it is reviewing the government’s policy on biomass.

There have also been controversies over allegations it has burned old carbon rich trees and that it has gamed the system to prevent paying back the public for renewable subsidies, both claims it denies.

Will Gardiner, Drax chief executive, said: “The Government’s statements are a helpful step forward not just for BECCS in the UK, but for the wider fight against climate change. We can only reach net zero by investing in critical, new green technologies such as BECCS. I welcome the Government’s draft position and urge them to progress with both Track-1 expansion and Track-2 processes in parallel this winter”.

City A.M. has approached Marshall Wace and GLG Partners for comment.