By Darren Parkin

The Week in Review

with Jason Deane

This is a very special Friday morning summary for me because, not only is this my 108 submission since June 2021, this, dear reader, will be my very last one for Crypto AM.

It is, for me at least, the end of an era.

We’ve covered a lot together haven’t we, you and I? We’ve seen nefarious parts of the crypto world collapse in on itself, we’ve seen crazy green candles (as well as diabolical red ones) and we’ve observed the traditional world of finance and regulation grapple with the changes in the monetary system that our innovation is forcing through. And yet there is still so much to talk about.

Just this week, for example, we’ve seen Bitcoin breach $28,000 and around 30,000 traders liquidated in short positions, while the amount of available bitcoin (on exchanges) continues to fall, shaving off another 303,000 over the last 180 days.

At the same time, fiat around the world continues to crumble and America’s debt increased by $275bn in just ONE day this week, leading the country even more quickly to the debt spiral that now almost certainly lays ahead.

In the UK, we’re scrapping HS2 and investing $36bn into local transport infrastructure instead, but I wonder if this money wouldn’t be better spent on paying NHS workers or teachers instead. Or maybe starting work on a Bitcoin treasury that, in my mind, most countries are going to have to have at some point in the future. Then, ultimately, we could probably do both (just putting it out there Mr Sunak).

And this is why I have so enjoyed writing these Friday summaries. There’s always so much to talk about and so much lining up to be the next week’s headline. I sincerely believe that 2024 will be a milestone year in terms of the crypto industry generally, but especially in terms of Bitcoin becoming a mainstream investment in the US and across the globe.

Frankly, I suspect it will be a full time job just trying to keep up with it, but it’s also something I’m passionate about contributing to. Indeed, I’ll be focussing on developing one or two renewable energy and Bitcoin mining energy projects over the next year or so as well as continuing to build the Bitcoin Racing team’s presence in the UK.

Speaking of which, it’s the team’s season finale this weekend at Silverstone, so if you’re around on Sunday you can grab your tickets here for the very last event of 2023. There will be speakers, pupusas, racing simulators and, of course, the races themselves. Then, in April 2024 we’ll do it all over again!

Today, I’ll be attending Zebu in London, so if anyone’s around and would like to catch up, simply DM me on Twitter and we’ll make it happen!

Of course, I’ll almost certainly be dropping into Crypto AM’s virtual offices with some muse inspired scribblings on a scrap of virtual paper for Darren – the world’s most patient editor – to review and consider publishing from time to time, but until then, thanks for indulging me over the last couple of years.

I hope you’ve enjoyed reading these as much as I’ve enjoyed writing them.

And, as ever, I hope you have a truly wonderful weekend!

All the best!

[EDITOR’S NOTE- Patience has not been required, Mr Deane. It has been an enjoyable few years receiving your wisdom-laden, insightful and often witty copy. DP]

Yesterday’s Crypto AM Daily

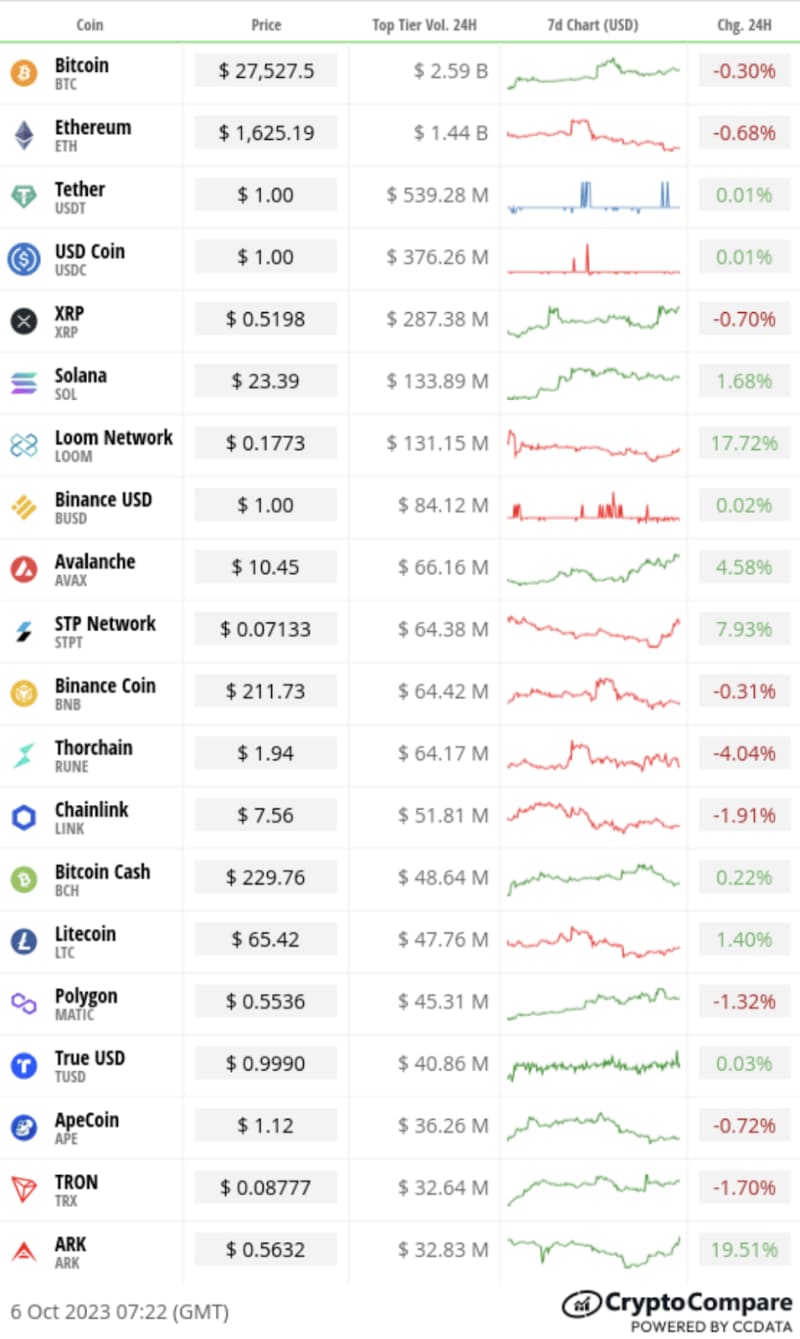

In the Markets

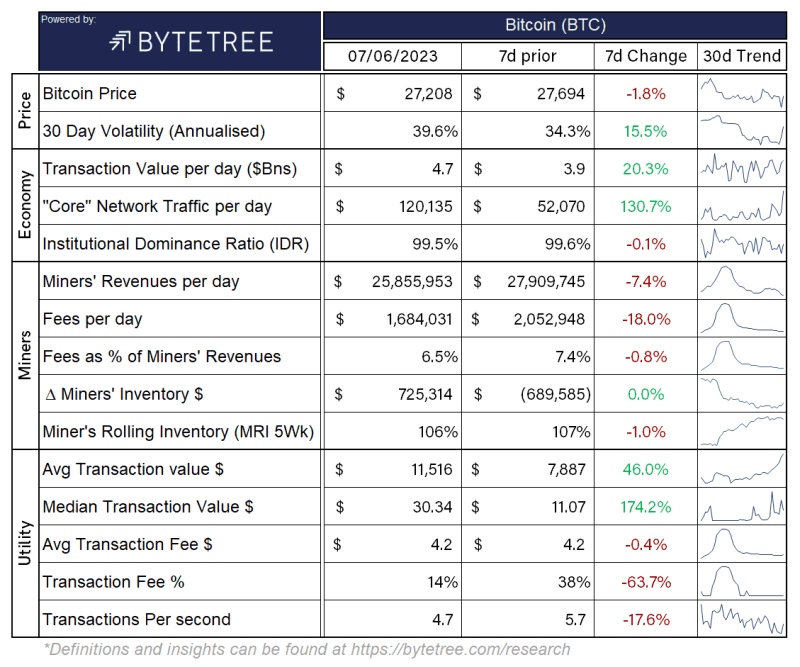

The Bitcoin Economy

*Data can be found at https://terminal.bytetree.com/

🌅Total crypto market cap

🔵 $1.08 trillion

🔻0.42%

What Bitcoin did yesterday

🔺 Daily high $27,582

🔻 Daily low $27,394

Bitcoin market capitalisation

🟠 BTC $537.17 billion

🟡 Gold $12.096 trillion

💳 Visa $485.59 billion

Bitcoin volume

🪣 Total spot trading volume $11.590 billion

🔻10.86%

Ethereum validator entry queue

The waiting list of Ethereum validators who want to participate in the network’s proof of-stake consensus mechanism but have not yet been activated.

💎 2 days 14 hours

SP500

🔻0.13%

FTSE/JSE Top 40

🔺 0.22%

Fear and Greed Index

Bitcoin’s market dominance

📊 50.60

Relative Strength Index (RSI)

💪 61

Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price, while 30 or below indicates an oversold or undervalued condition.

📣 What they said yesterday

Whether you’re a Bitcoin expert or a total newbie – or even somewhere in between – you can now join the new HODLers Telegram community to learn more …. or share your insights with others!

Our goal is simple: to provide a safe place where people can ask any question they want about Bitcoin, even if they think it’s a daft one! Learning Bitcoin takes time and we generally have the same questions when we first encounter it, so we know from our own experience having somewhere to ask a real person a specific question can be of great value!

There’s also access to great learning resources and, to cap it all off, we run monthly competitions to win great prizes such as tickets for events, VIP passes, exclusive access to talks and webinars or even just some Sats to add to your stack, all courtesy of our partners!

Even better, the whole thing is completely FREE!

So, if you’re a beginner, or know someone who is, take our fun five question multiple choice quiz and join the group today. Of course, if you’re an expert, you’re also welcome to join and help others who are looking to understand Bitcoin as an asset and the industry as a whole.

T’s and C’s: Open to UK residents only. All ages are welcome in the community, but you need to be over 18 to enter competitions. No purchase required.

All feedback on Crypto AM Daily in association with Luno is welcome via email to James.Bowater@cityam.com 🙏🏻

Crypto AM: Editor’s picks

FCA’s new crypto advertising rules met with mixed industry response

ChatGPT urges crypto conference panel not to become over-reliant on AI

Mt. Gox customers will have to wait until November to recover lost Bitcoin funds

Sam Bankman-Fried: A tissue of lies soaked with fake tears?

Three-in-four wealth managers are gearing up for more cryptocurrency exposure

Crypto.com granted FCA licence to operate in UK

Q&A with Duncan Coutts, Principal Technical Architect at IO Global

Jamie Bartlett – on the trail of the missing ‘Cryptoqueen’

MPs are falling silent over potential of cryptocurrency

Erica’s ‘Crypto Wars’ handed honours in Business Book Awards

Crypto AM: Features

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM: Contributors

Crypto AM: In Conversation with James Bowater

Crypto AM: Tomorrow’s Money with Gavin S Brown

Crypto AM: Mixing in the Metaverse with Dr Chris Kacher

Crypto AM: Visions of the Future, Past & Present with Alex Lightman

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Taking a Byte out of Digital Assets with Jonny Fry

Crypto on the catwalk

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.