By Heather Rydings

Hedge fund Shadowfall has shorted shares in FTSE 250-listed cybersecurity firm Darktrace, according todata from the UK Financial Conduct Authority.

Short selling is when an investor buys shares and then sells them on the market with the intention of buying them back later for less money. Short sellers bet on, and profit from, a drop in the share price.

The fund, led by ‘dark destroyer’ Matthew Earl, has shorted 0.52 per cent of Darktrace’s stock, according to the FCA’s latest short positions data, released on Friday.

This position is worth around £12.8mn, based on Darktrace’s current market capitalisation of £2.47bn.

Shadowfall has previously attracted attention for attacking the fraudulent payment processor Wirecard which imploded in 2020. It has also made bets against fast-fashion firm Asos and Apple supplier IQE in the past.

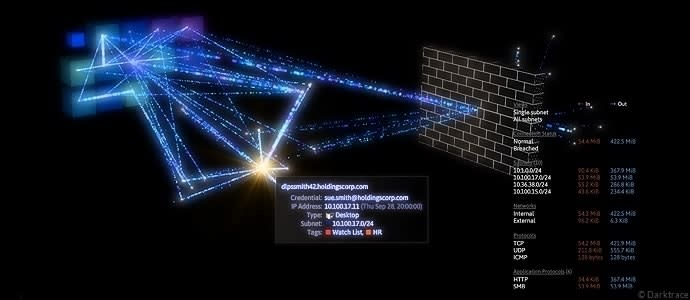

Darktrace has had a rough time since joining the London Stock Exchange in 2021. At the start of this year, its shares plummeted after being hit by a wave of criticism for its sales, marketing and accounting practices. However, in September, the firm boasted a sharp rise in annual profit, which surged to $41m from $5.3m in the year ended June 30.