By Crypto AM: Market View in association with Ziglu

Data from CryptoCompare shows that the price of Bitcoin moved sideways throughout most of the past week, starting it at around $37,000 and seeing an initial sharp drop to $35,500, before recovering to now trade at $37,000 again.

Ethereum’s Ether, the second-largest cryptocurrency by market capitalization, moved in a similar way, starting the week at $2,000 and seeing a sharp drop to near $1,900 before recovering. After hitting a $2,100 high throughout the week, ETH has since dropped to $2,025.

Headlines in the cryptocurrency space over the past week were dominated by Binance agreeing to pay $4.3 billion to settle with a coalition of US regulators, in one of the largest corporate penalties in the history of the country after it was accused of breaking sanctions and money-transmitting laws.

As part of the settlement, its founder Changpeng Zhao, also known as CZ, will resign from his role as CEO and admit to felony criminal charges of money laundering. Binance will be under the supervision of an independent third-party compliance monitor for a five-year period, during which it will be obligated to report any suspicious transactions it processes.

The firm’s CEO, Zhao, will be succeeded by Richard Teng, the current Global Head of Regional Markets.

Prosecutors in the US have argued that CZ poses an “unacceptable risk of flight” and shouldn’t be allowed to leave the country ahead of his sentencing in February after he was released on a $175 million bond.

Over the week, the US Securities and Exchange Commission (SEC) filed a lawsuit accusing Kraken, a major cryptocurrency exchange based in San Francisco, of breaking federal securities laws by operating without proper registration as a broker, clearing agency and dealer.

The SEC has alleged that Kraken has posed a “significant risk” by blending its corporate assets with customer crypto worth up to $33 billion, citing Kraken’s independent auditor. According to the lawsuit, Kraken has occasionally held “over $5 billion of its customers’ cash, and it also mixes some of its customers’ cash with some of its own.”

The lawsuit further states that Kraken has “sometimes covered operational costs directly from bank accounts containing customer cash”. Kraken responded to these allegations saying it spent fees it has already earned, and said it disagrees with the SEC’s complaint.

The SEC has identified several tokens, such as Algorand’s ALGO, Polygon’s MATIC, and NEAR, which it deems to be unregistered securities, and has stated that Kraken has actively promoted these tokens to investors. The filing seeks to permanently prohibit Kraken from functioning as an unregistered exchange. Kraken said it does not securities and plans to “vigorously defend” its position.

On top of this, Liechtenstein-based cryptocurrency trading platform Bittrex Global has announced that it will cease its operations and terminate all trading on its platform by December 4 due to numerous regulatory obstacles that have complicated its business operations.

These regulatory challenges encompassed the closure of its U.S. branch earlier this year following a $29 million settlement with the SEC over allegations of securities law violations. As the company begins to wind down, customers will be limited to withdrawing their funds from the platform.

Fidelity files for spot Ether ETF in the US

Meanwhile, asset management giant Fidelity has filed a 19b-4 to launch a US-regulated spot Ether exchange-traded fund (ETF), the Fidelity Ethereum Fund, which would be listed by an exchange owned by Cboe Global Markets.

Some crypto enthusiasts hold that crypto ETFs could exert a substantial influence on the crypto market by boosting accessibility, as these funds would allow investors to gain exposure to their underlying digital assets without having to manage their own private keys.

This past week also saw Deribit’s Bitcoin options open interest hit a record high above the $15 billion mark, overtaking BTC futures for the first time in a sign of the market’s “maturation and growing sophistication,” according to Deribit’s Chief Commercial Officer Luuk Strijers.

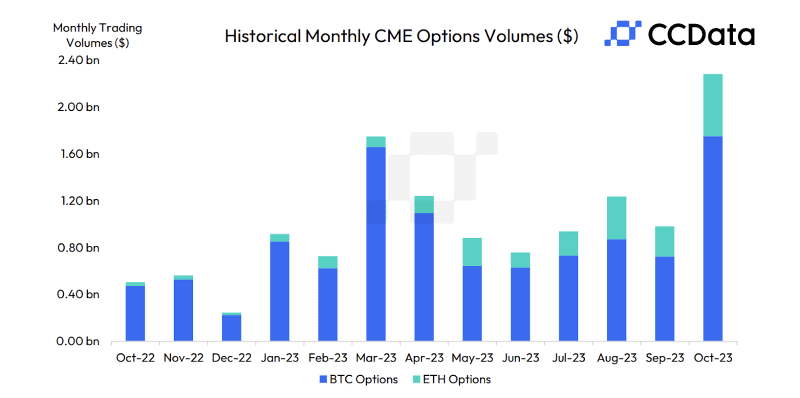

According to CCData’s latest Exchange Review, the trading volume of options on the CME experienced a significant uptick, with BTC and ETH options setting new all-time highs. BTC options saw a 142% increase, reaching a trading volume of $1.75 billion, while ETH options rose by 107%, hitting a trading volume of $532 million.

Notably, JPMorgan analysts led by Nikolaos Panigirtzoglou, have identified a potential outflow of $2.7 billion from the Grayscale Bitcoin Trust (GBTC) in the event of its conversion to a spot Bitcoin ETF, based on investors having so far this year been acquiring GBTC shares at a discount to the trust’s underlying BTC holdings.

Francisco Memoria is a content creator at CryptoCompare who’s in love with technology and focuses on helping people see the value digital currencies have. His work has been published in numerous reputable industry publications. Francisco holds various cryptocurrencies. Featured image via Unsplash.