By Jess Jones

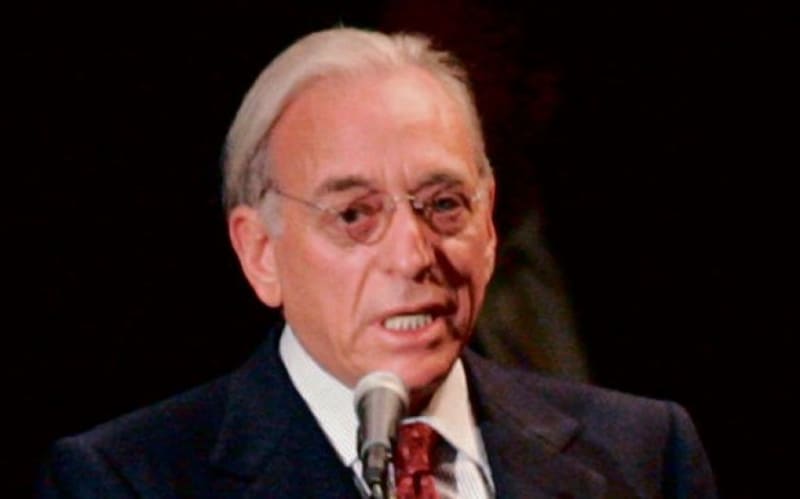

Activist investor Nelson Peltz has reignited the boardroom battle at Disney in a fresh clash between his investment firm Trian Partners and Disney chief executive Bob Iger.

Trian, which controls a $3bn (£2.4bn) stake in Disney, said it will take the “case for change directly to shareholders” after Disney rebuffed Peltz’s bid to secure board seats.

According to Reuters, Peltz wants at least three seats on the soon to be 12-strong board.

The renewed confrontation comes on the heels of a $70bn (£55bn) decline in shareholder value since Trian’s previous rumblings with Disney at the start of this year.

Despite Iger’s earlier plan to revitalise Disney through cost-cutting and measures aimed at boosting its struggling streaming business, Trian said shareholder losses have escalated.

Peltz’s concerns extend beyond a wobbly share price to the board’s decision to extend Iger’s tenure as chief executive until the end of 2026.

While Disney’s shares have seen a 4 per cent increase this year, they have under-performed against the broader stock market’s nearly 19 per cent rally.

Trian’s statement pointed to challenges within Disney, citing low investor confidence and strategic uncertainties. Even Iger has acknowledged the difficulty the company faces.

In response, Disney said it has restructured the company ovet the last year to “restore creativity” to its businesses and “significantly reduce costs and drive efficiencies”.

It claimed it is on target to reach about $7.5bn (£5.9bn) in cost savings, $2bn (£1.6bn) more than initially anticipated.

“Disney is moving from a period of fixing to a new era of building, as the entire media sector navigates the crosscurrents of the competitive landscape for streaming,” the company said in a statement.

It also announced it has nominated two new directors to its board: James Gorman, the outgoing chief executive of Morgan Stanley, and Jeremy Darroch, former Sky boss.

Investment director at AJ Bell, Russ Mould, said Disney’s current chief Bob Iger is having none of Peltz’s jibes.

“Iger is in no mood to give in, having returned to his former charge when his appointed successor Bob Chapek failed to make the grade in 2022.

“Initially Iger cast a spell over the share price but the stardust has rapidly faded as he confronts problems with streaming and traditional cable TV while seeking to justify a $60 billion bill for revamping its parks,” Mould added.

While Peltz gave in after Iger pledged to cut costs, Mould said it feels like both sides are up for a fight this time.

“Given the track record Peltz’s Trian Partners has for achieving change at other targets, Iger and his fellow executives will not be sitting comfortably.

“Disney is a company with an enviable cache of content and an almost unrivalled brand in entertainment – clearly Peltz sees value in that or he wouldn’t be pursuing his case so vigorously,” he explained.