By Charlie Conchie

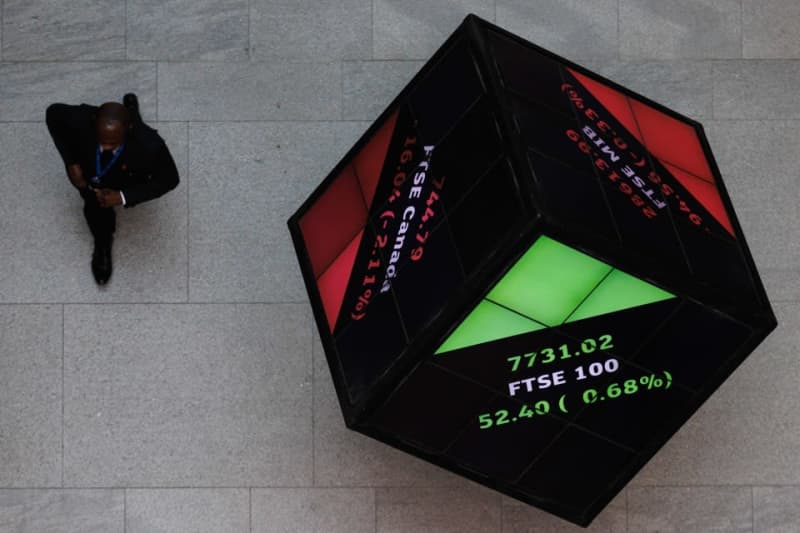

Boku is a San-Francisco founded fintech that bucked the trend to float in London in 2017. Charlie Conchie asks its new chief how life has been on the beleaguered London Stock Exchange.

It’s an all too familiar tale. High growth fintech bags funding from some of Silicon Valley’s biggest investors, eyes up the public markets and decides to sail across the Atlantic in pursuit of deep pockets and a bumper price tag.

Regulators and policy makers in the UK have been puzzling over how to put an end to the narrative for years. But back in 2017, one firm gave the story a twist.

Boku, a San Francisco-founded payments start-up with backing from some of California’s biggest names, shrugged off received wisdom and opted to list on the London Stock Exchange’s junior AIM market.

Since then it has become something of a quiet success story. Shares in Boku are trading up around 100 per cent above their IPO price, profits have ticked upwards, and analysts across the board have been telling their clients to buy.

Earlier this month, Boku called in new chief Stuart Neal to lead its global operations from London. His assessment of all the doom and gloom in the City this year? Well, London’s not all bad.

“AIM is regulation light, it’s half yearly reporting rather than quarterly reporting. It’s just a little less onerous [than the US],” he tellsCity A.M. in his first interview in the job. “When you’re a smaller company and you really need to focus your energy on how [to] grow the business, that kind of suited us, and so we listed in London in 2017.”

Boku does not have the name recognition of its more flashy consumer facing payment peers in the UK. The now West End headquartered outfit essentially provides infrastructure for non-card based payments, allowing shoppers to pay for products on sites like Amazon and Tencent without the need for a bank card or Apple pay.

Much of its revenue comes from its sprawling global operations in markets like Brazil, India and East Asia, where its ability to slot into super apps has helped fuel its growth.

But Boku’s decision to list in London runs in the face of a bruising belief that has hurt the City. Namely, that the spiritual home of tech is in New York and floating there will inevitably pocket founders a much bigger pay day.

Boku’s own performance and the record of London-based firms listing in the US raises some questions over the sturdiness of that logic in the long run. Of the 21 UK companies raising over 100m that have gone to the US over the last 10 years, five have already delisted, only three are trading above their IPO price, and the rest are on average trading down by 76 per cent.

Boku conversely has swelled to a valuation of £482.35m after floating in London at a valuation of just £125m in 2017.

Among the tech behemoths of Nasdaq, smaller firms have a tendency to get lost, which Stuart says was the key driver of the London Stock Exchange move back in 2017.

“We could have gone to Nasdaq, [but] we would have been a very, very small fish in an enormous pond. And we just didn’t feel that would have been the right move for the company,” he says, adding that despite the growth of giants like Meta and Tesla, “there’s a lot of companies struggling”.

“Actually AIM is quite a good home for companies of a smaller size.”

Many of the gripes around AIM do stem from a similar tendency to get lost to investors. Historic red tape and a lack of capital mean it’s not cost effective for banks to be pumping resources into covering London’s smaller listed firms. As a result, they too tend to be shut out of sight.

Efforts are underway to address some of the structural problems in the market with Rachel Kent’s research review, which is looking to deepen the quality of investment on small companies. But Boku itself has had no trouble convincing analysts to cover it in the meantime.

A total of eight banks now follow the firm – and their read is largely positive. Just last week Jefferies doubled down on its buy guidance for the stock after Boku sailed past analyst estimates to a record year.

Analysts at Peel Hunt meanwhile argue the performance of Boku disproves the narrative that London-listed tech firms are hamstrung by domestic investors’ failure to grasp any growth-based business model. A look at its investor base also shows no lack of appetite from international backers, a key concern of companies when mulling a London base.

“Capital today is more international than ever. A good company like Boku will attract international money, including from the US, despite the listing venue being the UK,” Peel Hunt analyst Damindu Jayaweera wrote in a note last year.

Among its top shareholders are one of the largest US asset managers, Capital Research, one of the largest Nordic asset managers, Danske, and private equity behemoth Vitruvian.

Boku’s US-listed peer, DLocal, has a lower quality holder list by comparison, as its “story is lost among the land of giants like Microsofts and Nvidias”, Jayaweera argues.

Stuart agrees that you “can argue about the share price till the cows come home” but its investor base would “probably not be any different had we been on Nasdaq”.

The appeal of Boku is by no means a signal that all is well on London’s junior market. Among the reasons it is one of the best performers is that the comparators have been so poor.

“The fact that [the share price] hasn’t gone down has actually made us a standout performer,” Stuart adds. “I did say to our brokers, I don’t I really don’t have an aspiration for us to be the least worst performing stock on AIM. I want this to be about growing the business and growing returns for our shareholders in the process.”

For now, Neal’s focus is on just that – growth. He’s gearing up for another period of expansion in India and Brazil and says the firm has penned a number of deals that now just need delivering.

While Neal insists there are no plans for a Boku to follow scores of firms and ditch its listing, his warning to regulators and policymakers is a stark one.

“It’s a trend that we’ll see unless some of these AIM reforms get done.”