Whales with a lot of money to spend have taken a noticeably bullish stance on Visa.

Looking at options history for Visa (NYSE:V) we detected 10 trades.

If we consider the specifics of each trade, it is accurate to state that 70% of the investors opened trades with bullish expectations and 30% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $271,654 and 8, calls, for a total amount of $322,566.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $155.0 to $280.0 for Visa over the last 3 months.

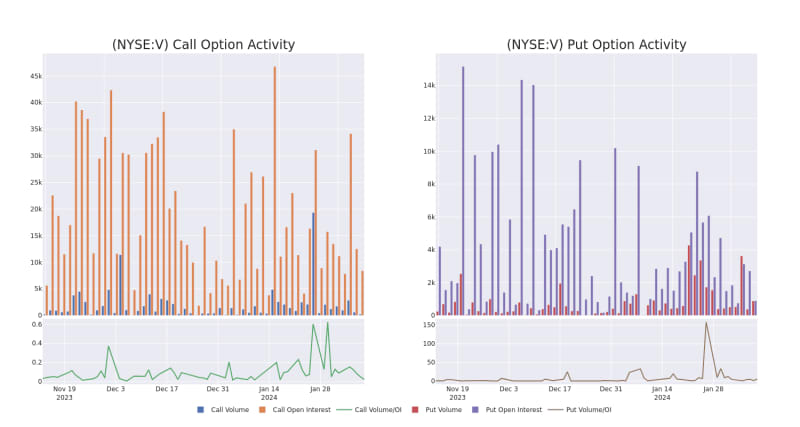

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Visa's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Visa's whale trades within a strike price range from $155.0 to $280.0 in the last 30 days.

Visa Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

About Visa

Visa is the largest payment processor in the world. In fiscal 2022, it processed over $14 trillion in total volume. Visa operates in over 200 countries and processes transactions in over 160 currencies. Its systems are capable of processing over 65,000 transactions per second.

In light of the recent options history for Visa, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Visa

- Trading volume stands at 1,598,313, with V's price down by -0.28%, positioned at $275.0.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 74 days.

Professional Analyst Ratings for Visa

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $299.8.

- Maintaining their stance, an analyst from Wedbush continues to hold a Outperform rating for Visa, targeting a price of $280.

- An analyst from Susquehanna persists with their Positive rating on Visa, maintaining a target price of $326.

- An analyst from Mizuho has decided to maintain their Neutral rating on Visa, which currently sits at a price target of $265.

- Consistent in their evaluation, an analyst from RBC Capital keeps a Outperform rating on Visa with a target price of $309.

- Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for Visa, targeting a price of $319.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Visa options trades with real-time alerts from Benzinga Pro.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.