Benzinga's options scanner has just identified more than 14 option transactions on Pfizer (NYSE:PFE), with a cumulative value of $1,147,738. Concurrently, our algorithms picked up 2 puts, worth a total of 374,690.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $22.5 to $30.0 for Pfizer over the recent three months.

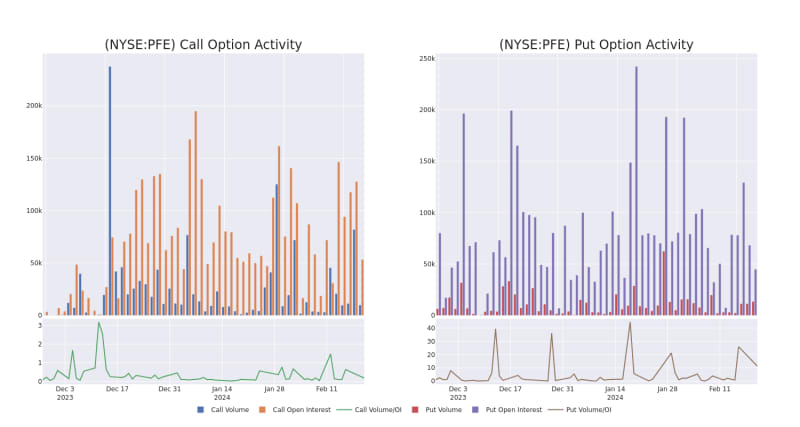

Insights into Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Pfizer options trades today is 14039.29 with a total volume of 23,475.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Pfizer's big money trades within a strike price range of $22.5 to $30.0 over the last 30 days.

Pfizer Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

About Pfizer

Pfizer is one of the world's largest pharmaceutical firms, with annual sales close to $50 billion (excluding COVID-19 product sales). While it historically sold many types of healthcare products and chemicals, now prescription drugs and vaccines account for the majority of sales. Top sellers include pneumococcal vaccine Prevnar 13, cancer drug Ibrance, and cardiovascular treatment Eliquis. Pfizer sells these products globally, with international sales representing close to 50% of total sales. Within international sales, emerging markets are a major contributor.

In light of the recent options history for Pfizer, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Pfizer

- Trading volume stands at 13,536,348, with PFE's price up by 0.14%, positioned at $27.63.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 69 days.

Professional Analyst Ratings for Pfizer

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $45.0.

- An analyst from Cantor Fitzgerald downgraded its action to Overweight with a price target of $45.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Pfizer options trades with real-time alerts from Benzinga Pro.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.