Today's Nvidia-fueled rally aside, it's not just artificial intelligence (AI) stocks that have piqued the market's interest over the past year. Fintech companies have also surged in popularity as the world shifts toward digital payments.

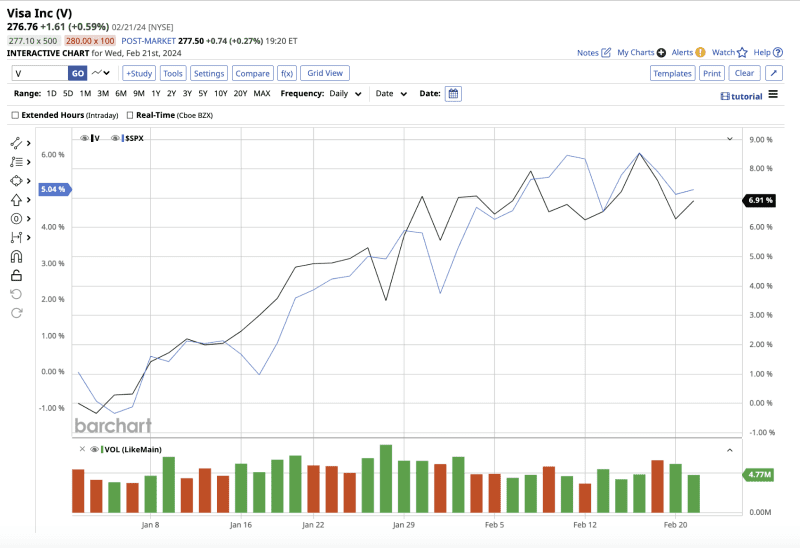

The growth in global digital payment processing company Visa (V) hasn’t been as rapid as that of tech companies, but it has been steady. Despite macroeconomic headwinds, rising post-pandemic travel demand boosted Visa’s performance last year. The stock returned 25.3% in 2023, on pace with the S&P 500 Index’s ($SPX) gain of 25%.

Visa’s strategies to innovate and expand its business signal that there will be more growth in the long run. If you have about $300 or so left over after paying all of your bills, Visa stock could be a good addition to your portfolio right now.

So far this year, the stock is up 8.8%, compared to the S&P 500's gain of 7.2%.

2024 Off to a Strong Start

Following a strong finish to fiscal 2023, Visa's start to this year has been equally impressive.

In the first quarter of fiscal 2024, adjusted earnings per share (EPS) grew 11% year-over-year to $2.41, exceeding the consensus estimate. Plus, Visa’s net revenue increased 9% to $8.61 billion, beating analysts’ estimates by $76.1 million. Management stated that strong payment volume, processed transactions, and cross-border volume were the primary drivers of growth in the quarter.

Interestingly, despite global macroeconomic challenges and geopolitical risks, “revenge travel” following the pandemic continues to trend. This resulted in an increase of 16% in Visa's cross-border volume.

The increase in post-pandemic travel demand is what has driven Visa's explosive growth in recent years. Between fiscal 2020 and fiscal 2023, Visa's revenue increased from $21.8 billion to $32.6 billion, and earnings increased from $4.78 to $7.38 per share.

According to a study conducted by Visa last year, travel demand is expected to remain strong despite rising costs, indicating further growth for the company.

Visa Is a Long-Term Play

With the world going digital, Visa remains committed to expanding its business through strategic acquisitions to capitalize on AI opportunities while providing secure payment solutions.

Visa believes that global cybercrime costs could reach $10.5 billion by 2025. As a result, last year it signed a strategic agreement with security operations provider Expel to incorporate cybersecurity measures into its value-added services.

Furthermore, Visa announced a $100 million initiative to support the “next generation of companies focused on developing generative AI technologies and applications that will impact the future of commerce and payments.”

Towards the end of 2023, Visa entered into a definitive agreement to acquire a majority stake in Mexico-based payment processor,Prosa. The agreement will allow Visa to expand "secure and innovative digital payments" in Mexico.

More recently, Visa completed its acquisition of Pismo. The combined entity will allow clients "to launch innovative payments and banking products within a single cloud-native platform regardless of network, geography, or currency."

Visa Returns Value to Shareholders

While steadily growing, Visa also kept its balance sheet stable, while returning value to its shareholders through share repurchases and dividends.

In the fourth quarter of fiscal 2023, Visa increased its quarterly dividend by 16% to $0.52 per share. In the first quarter of 2024, the company paid $4.4 billion in dividends and share repurchases.

Visa offers a dividend yield of 0.75%, much lower than the financial sector average yield of 3.1%. However, its forward payout ratio of 18.6% implies that the company can support ongoing dividend payments, with the possibility of dividend growth as earnings continue to rise.

At the end of the quarter, Visa had cash, cash equivalents, and investment securities totaling $21.9 billion.

Looking ahead, analysts predict that Visa's earnings will grow by 13% in fiscal year 2024, along with a 9.8% increase in revenue. Revenue and earnings are expected to rise by 10.4% and 12.5%, respectively, in fiscal 2025.

Visa stock currently trades at 24 times forward 2025 earnings, compared to its five-year historical average price-to-earnings ratio of 34x.

What Does Wall Street Say About Visa Stock?

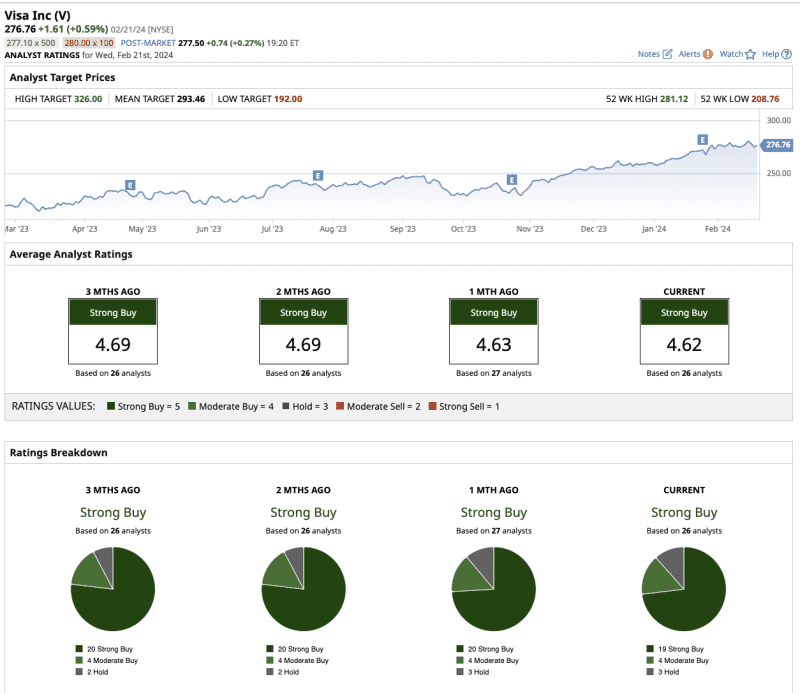

DBS analyst Manyi Lu rates Visa stock as a "buy" with a $305 price target. The analyst sees the digital payment market as a $18 trillion opportunity. According to Lu, with its dominant market position in the payments industry, Visa is well-positioned to capitalize on this rapidly growing market.

Overall, Wall Street rates Visa stock as a “strong buy.” Out of the 26 analysts covering the stock, 19 rate the stock a “strong buy,” while four rate it a “moderate buy” and three rate it a “hold.” The average target price for V stock is $293.46, which implies an upside potential of 3.6%.

The Bottom Line for Visa Stock

Visa's global reach, commitment to innovation, and strategic initiatives are propelling the company toward a bright future. As the world becomes more digital, I am confident in Visa's ability to adapt, innovate, and thrive.

If Visa continues to report stronger quarters this year, I’m convinced that the stock will be able to reach its high target price of $326, which implies a 15% upside potential over the next 12 months. Trading at below $300 per share, I believe Visa is a good buy-and-hold investment for the long haul, as well.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.