Meta Platforms (META) produced excellent results last year and decided to pay its first dividend. However, its put option premiums are high and it makes sense to short out-of-the-money (OTM) puts as an income play.

I discussed Meta's huge free cash flow (FCF) in my Feb. 9 Barchart article, “META Stock Could Still Be Worth Up Over 18% to $556 Per Share, Based on Its Massive FCF%20made%20%2440,more%20at%20%24556%20per%20share.).” I suggested that given the company's consistent FCF over the past 4 quarters META stock could be worth $556 per share.

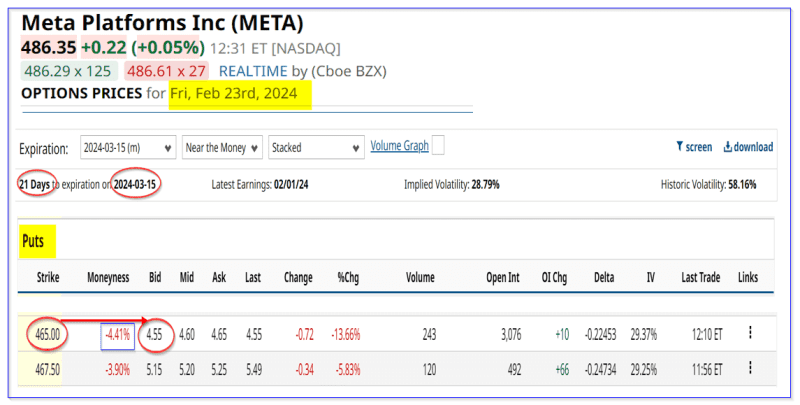

Today META is trading for about $487.23 per share in midday trading on Friday, Feb. 23. This implies that the stock could still be worth at least 14% more in the near term.

More importantly, given the high put option premiums, existing shareholders can make extra income selling short OTM puts in nearby expiry periods.

Shorting OTM Puts for Income

For example, look at the March 15 expiration period, which is three weeks away. One example is to sell short the $465 strike price put, which is over 4% below today's price. The premium on the bid side is $5.00 per contract.

That means that the short seller can make an immediate yield of about1.0% (i.e., $4.55/$465.00 = 0.978%). This means that the investor must buy the stock at $465.00 (if META falls to that level) but the short seller receives an immediate payment of $4.55 per contract for that obligation.

Here is how that works out. The investor must first secure $46,500 in cash and/or margin with their brokerage firm. This is because each contract involves 100 shares of META stock, so 100 x $465.00 equals $46,500.

Then they have to get permission from the brokerage firm to be able to sell short cash-secured puts. Once received, they can enter an order to “Sell to Open” 1 put contract at $465 for expiration on March 15.

The account will then immediately receive $455.00. That means that the investor gets to keep this premium no matter what happens. If META stock stays where it is by March 15 and does not fall to $465 from $487.23 today, the short put contract will expire worthless.

That implies the annualized expected return (ER), assuming this type of play can be repeated every 3 weeks, is 16.63%. This is because there are 17 periods of 3 weeks in a year, so 17 x 0.9875% equals 16.63%.

In other words, the dollar ER, if repeated each period is $7.735 (17 x $455), on an investment each period of $46,500.

Moreover, even for the next 90 days, the potential upside is $1,820. This means that if the investor can repeat this trade 4 times in 90 days they stand to make $455 x 4, or $1,820. That works out to a quarterly ER of 3.91% (i.e., $1,820/$46,500).

How To Handle Downside Risk

However, as you might suspect there is downside risk. For example, the investor who does may not make 1.0% every time the 3-week out put option play rolls over.

Another risk is that the stock could fall below $465.00. That means the investor's secured cash would automatically be used to buy META at $465.00 (if the investor did not cover the option play or get out of the play).

That could result in an unrealized loss. However, existing shareholders would be able to average this in with their existing holdings.

There are ways to help ameliorate this downside risk. For one, the investor might be willing to buy put options in a deeper OTM strike price for the same expiry period. For example, buying the $460 strike price put for $3.65, using the $4.55 premium received, allows the investor to limit the downside risk to just $5.00 (i.e., the width between the $465.00 short put play and the $460.00 long play).

But remember the investor already has a net credit of 90 cents (i.e., $4.55 received less $3.65 paid). So the net risk is just $4.10 (i.e., $5.00 - $0.90). Moreover, the investor could cover the short-put trade before it expires to limit the obligation to buy the shares.

Another way to improve the risk is to sell out-of-the-money covered calls once the short puts are exercised. This allows the investor to regain some extra income with the newly bought shares if they were obligated to buy the shares upon expiration.

Keep in mind that META stock has a significant upside. So it may just be worthwhile for the existing investor to buy META stock at $465.00 and hold the shares for the long term.

More Stock Market News from Barchart

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.