Investors with a lot of money to spend have taken a bullish stance on Unity Software (NYSE:U).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with U, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 13 uncommon options trades for Unity Software.

This isn't normal.

The overall sentiment of these big-money traders is split between 61% bullish and 38%, bearish.

Out of all of the special options we uncovered, 4 are puts, for a total amount of $250,479, and 9 are calls, for a total amount of $320,046.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $29.0 to $43.0 for Unity Software over the last 3 months.

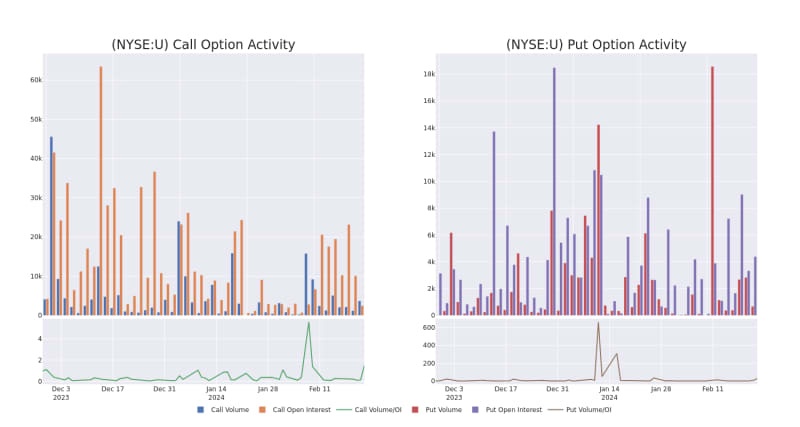

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for Unity Software options trades today is 863.0 with a total volume of 4,398.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Unity Software's big money trades within a strike price range of $29.0 to $43.0 over the last 30 days.

Unity Software Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

About Unity Software

Unity Software Inc provides a software platform for creating and operating interactive, real-time 3D content. The platform can be used to create, run and monetize interactive, real-time 2D and 3D content for mobile phones, tablets, PCs, consoles, and augmented and virtual reality devices. The business is spread across the United States, Greater China, EMEA, APAC and Other Americas, of which key revenue is derived from the EMEA region. The products are used in the gaming industry, architecture and construction sector, animation industry, and designing sector.

Following our analysis of the options activities associated with Unity Software, we pivot to a closer look at the company's own performance.

Current Position of Unity Software

- With a volume of 4,816,482, the price of U is down -0.26% at $30.94.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 3 days.

What Analysts Are Saying About Unity Software

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $27.5.

- An analyst from Stifel has decided to maintain their Buy rating on Unity Software, which currently sits at a price target of $35.

- In a cautious move, an analyst from Macquarie downgraded its rating to Underperform, setting a price target of $20.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Unity Software with Benzinga Pro for real-time alerts.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.