The crypto market is off to a strong start this week with Bitcoin and Ethereum breaking through key resistance levels on Monday. Bitcoin rose above $53k while Ethereum crossed $3.1k, pushing the total crypto market capitalization above $2.05 trillion.

While the major cryptos led the charge, Polygon (MATIC) emerged as one of the top gainers, jumping 8% to trade around $1.05. This price level represents a crucial resistance zone for MATIC that could determine its next major move. Meanwhile, the InQubeta presale event crossed $10 million last week, building momentum as the project nears its official launch.

MATIC is drawing attention after rallying to $1.05, which is right at the upper bound of its current sideways trading channel spanning $0.75 to $1.05. According to analysis by altFINS, a breakout above resistance at $1.00 – $1.05 could pave the way for MATIC to retest the $1.25 level in the near-term.

The sideways channel provides an opportunity for swing traders to enter long positions near $0.75 support and take profits around $1.00 resistance for potential gains of 35%. A stop loss just under the 200-day moving average at $0.67 would help manage downside risk on such trades.

The 200-day moving average acts as an important support and resistance level. When the price trades above the 200-day MA, it signals an overall long-term uptrend. On the other hand, if the price falls below the 200-day MA, it indicates a downtrend.

For MATIC, the current 200-day moving average is around $0.72. MATIC trading above this level shows the long-term trend remains bullish. The 200-day MA serves as an important floor of support buoying the price.

As long as MATIC holds above the 200-day MA, it gives traders confidence that the uptrend is intact. Closing below this long-term average could negate the bullish trend, making it an important threshold to monitor.

The current uptrend across short, medium, and long timeframes adds a bullish backdrop for MATIC. However, momentum indicators suggest bullish strength may be peaking with MACD showing declining histogram bars. This indicates momentum is weakening despite the coin still trading above its 55 RSI level. Overall, MATIC appears primed for a breakout but may need stronger momentum to push through the $1.05 resistance convincingly.

In terms of support and resistance, MATIC has price floors at $0.75 and $0.60 while facing upside barriers at $1.00 – $1.05 and $1.25. Notably, the 200-day moving average sits around $0.72 which is bullish for MATIC holding firmly above this long-term trend indicator.

Recent updates from the Polygon team could also be contributing to positive traction for MATIC currently. Polygon announced its next zkEVM upgrade called Elderberry is now on testnet and will go live on mainnet soon. The upgrade aims to reduce errors and improve efficiency for developers building on Polygon.

If MATIC can consistently trade above $1.00, it could create momentum to push toward $2. After reclaiming this psychological threshold, MATIC may target the $2.92 level last seen in 2021. However, MATIC will need to demonstrate growing strength to propel through the immediate resistance zone.

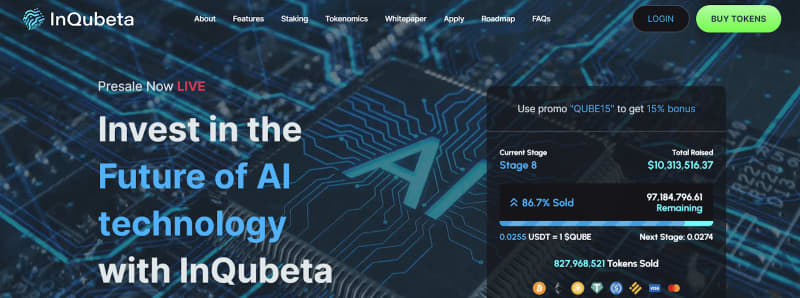

InQubeta Presale Surpasses $10 Million as Launch Nears

InQubeta has grabbed attention for its novel approach to crypto-based investing in artificial intelligence startups. The project recently surpassed $10.3 million raised in its ongoing presale as hype builds ahead of its official launch.

The native QUBE token is currently valued at 0.0255 USDT in stage 8 of the 10 stage presale. The next stage is expected to increase the token price to 0.0274 USDT.

InQubeta aims to improve access to funding for AI startups through crypto crowdfunding. The platform will allow startups to mint NFTs representing equity investment opportunities. Investors can then own fractionalized portions of the NFTs to gain exposure to promising AI ventures early on.

This connects startups with a wider pool of potential investors in a streamlined, efficient manner powered by crypto and NFTs. Startups can raise capital while building community support, while investors get in early on innovative AI companies.

QUBE token holders can seamlessly invest in vetted projects, fostering an ecosystem rewarding both startups and investors. QUBE has deflationary tokenomics including a 2% buy/sell tax contributing to a burning wallet and a 5% tax going to a rewards pool. This encourages long-term holding and engagement.

Conclusion

MATIC appears positioned for a potential breakout above the $1.05 resistance, which could open the door to a rally back toward its 2021 high around $2.92. However, MATIC needs to demonstrate growing momentum to overcome immediate upside barriers.

InQubeta, meanwhile, offers an intriguing new model for crypto investing into AI startups. With presale success already surpassing $10.3 million, InQubeta has garnered significant early interest as it aims to launch soon and put its novel crowdfunding concept into action. Both MATIC and InQubeta present interesting opportunities at their respective stages of market development.

This post was authored by an external contributor and does not represent Benzinga’s opinions and has not been edited for content. This contains sponsored content and is for informational purposes only and not intended to be investing advice. Cryptocurrency is a volatile market; do your independent research and only invest what you can afford to lose. New token launches and small market capitalization coins are inherently more risky than large cap cryptocurrencies. These tokens are subject to larger liquidity and market risks.