Whales with a lot of money to spend have taken a noticeably bearish stance on Caterpillar.

Looking at options history for Caterpillar (NYSE:CAT) we detected 31 trades.

If we consider the specifics of each trade, it is accurate to state that 38% of the investors opened trades with bullish expectations and 61% with bearish.

From the overall spotted trades, 16 are puts, for a total amount of $917,665 and 15, calls, for a total amount of $764,846.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $250.0 to $350.0 for Caterpillar over the last 3 months.

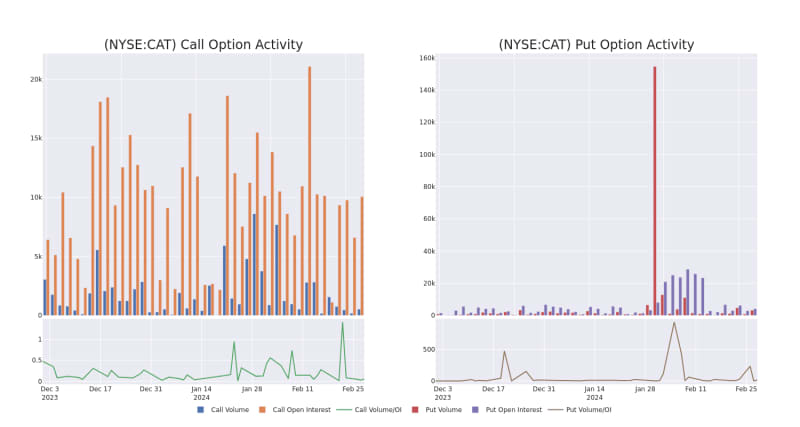

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Caterpillar's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Caterpillar's significant trades, within a strike price range of $250.0 to $350.0, over the past month.

Caterpillar Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

About Caterpillar

Caterpillar is the premier manufacturer of heavy equipment, power solutions, and locomotives. It is currently the world's largest manufacturer of heavy equipment with over 13% market share in 2021. The company is divided into four reportable segments: construction industries, resource industries, energy and transportation, and Caterpillar Financial Services. Its products are available through a dealer network that covers the globe with about 2,700 branches maintained by 160 dealers. Caterpillar Financial Services provides retail financing for machinery and engines to its customers, in addition to wholesale financing for dealers, which increases the likelihood of Caterpillar product sales.

Present Market Standing of Caterpillar

- With a volume of 982,004, the price of CAT is down -0.34% at $326.5.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 57 days.

Professional Analyst Ratings for Caterpillar

In the last month, 5 experts released ratings on this stock with an average target price of $332.8.

- Maintaining their stance, an analyst from Citigroup continues to hold a Neutral rating for Caterpillar, targeting a price of $340.

- Consistent in their evaluation, an analyst from JP Morgan keeps a Overweight rating on Caterpillar with a target price of $385.

- Consistent in their evaluation, an analyst from Baird keeps a Underperform rating on Caterpillar with a target price of $257.

- Maintaining their stance, an analyst from Goldman Sachs continues to hold a Buy rating for Caterpillar, targeting a price of $357.

- Maintaining their stance, an analyst from Wells Fargo continues to hold a Equal-Weight rating for Caterpillar, targeting a price of $325.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Caterpillar options trades with real-time alerts from Benzinga Pro.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.