High-rolling investors have positioned themselves bullish on Groupon (NASDAQ:GRPN), and it's important for retail traders to take note.

\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in GRPN often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 10 options trades for Groupon. This is not a typical pattern.

The sentiment among these major traders is split, with 60% bullish and 40% bearish. Among all the options we identified, there was one put, amounting to $37,430, and 9 calls, totaling $388,429.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $10.0 to $22.0 for Groupon over the recent three months.

Analyzing Volume & Open Interest

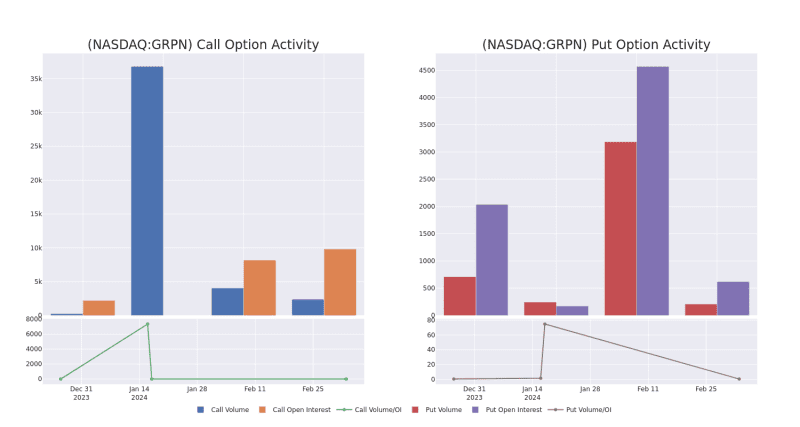

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Groupon's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Groupon's substantial trades, within a strike price spectrum from $10.0 to $22.0 over the preceding 30 days.

Groupon Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

About Groupon

Groupon acts as the middleman between consumers and merchants, offering a variety of products and services at discounts via its online store. It offers consumers daily deals from local merchants. It generates revenue from the take rate on the vouchers' purchase and/or usage. More than 60% of Groupon's revenue comes from North America.

Having examined the options trading patterns of Groupon, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Groupon

- Trading volume stands at 301,970, with GRPN's price down by -0.11%, positioned at $18.9.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 11 days.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Groupon options trades with real-time alerts from Benzinga Pro.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.