Financial giants have made a conspicuous bearish move on Caesars Entertainment. Our analysis of options history for Caesars Entertainment (NASDAQ:CZR) revealed 15 unusual trades.

Delving into the details, we found 13% of traders were bullish, while 86% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $249,300, and 13 were calls, valued at $563,036.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $20.0 and $70.0 for Caesars Entertainment, spanning the last three months.

Volume & Open Interest Trends

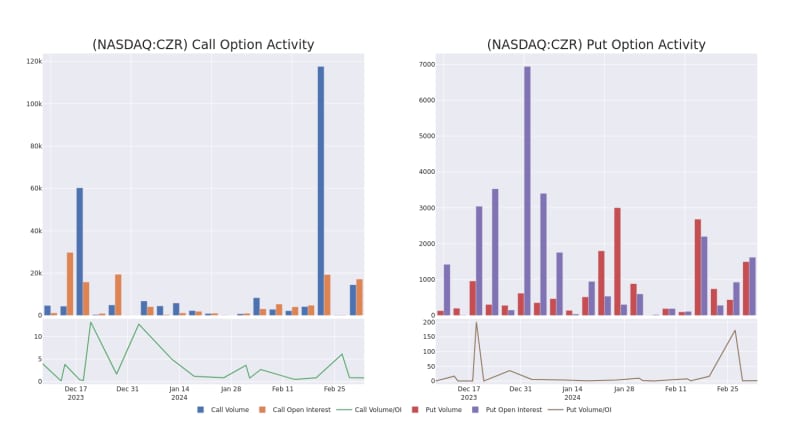

In today's trading context, the average open interest for options of Caesars Entertainment stands at 3750.8, with a total volume reaching 16,000.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Caesars Entertainment, situated within the strike price corridor from $20.0 to $70.0, throughout the last 30 days.

Caesars Entertainment Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

About Caesars Entertainment

Caesars Entertainment includes about 50 domestic gaming properties across Las Vegas (58% of 2022 EBITDAR before corporate and digital expenses) and regional (59%) markets. Additionally, the company hosts managed properties and digital assets, the later of which produced material EBITDA losses in 2022. Caesars' U.S. presence roughly doubled with the 2020 acquisition by Eldorado, which built its first casino in Reno, Nevada, in 1973 and expanded its presence through prior acquisitions to over 20 properties before merging with legacy Caesars. Caesars' brands include Caesars, Harrah's, Tropicana, Bally's, Isle, and Flamingo. Also, the company owns the U.S. portion of William Hill (it sold the international operation in 2022), a digital sports betting platform.

Having examined the options trading patterns of Caesars Entertainment, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Caesars Entertainment

- Trading volume stands at 1,554,677, with CZR's price up by 0.42%, positioned at $43.14.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 57 days.

What Analysts Are Saying About Caesars Entertainment

In the last month, 5 experts released ratings on this stock with an average target price of $57.2.

- An analyst from JMP Securities downgraded its action to Market Outperform with a price target of $65.

- Consistent in their evaluation, an analyst from Morgan Stanley keeps a Equal-Weight rating on Caesars Entertainment with a target price of $44.

- Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on Caesars Entertainment with a target price of $65.

- Maintaining their stance, an analyst from Wells Fargo continues to hold a Overweight rating for Caesars Entertainment, targeting a price of $68.

- An analyst from Susquehanna persists with their Neutral rating on Caesars Entertainment, maintaining a target price of $44.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Caesars Entertainment with Benzinga Pro for real-time alerts.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.