Financial giants have made a conspicuous bearish move on Cadence Design Sys. Our analysis of options history for Cadence Design Sys (NASDAQ:CDNS) revealed 15 unusual trades.

Delving into the details, we found 20% of traders were bullish, while 80% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $70,420, and 13 were calls, valued at $573,301.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $280.0 and $410.0 for Cadence Design Sys, spanning the last three months.

Analyzing Volume & Open Interest

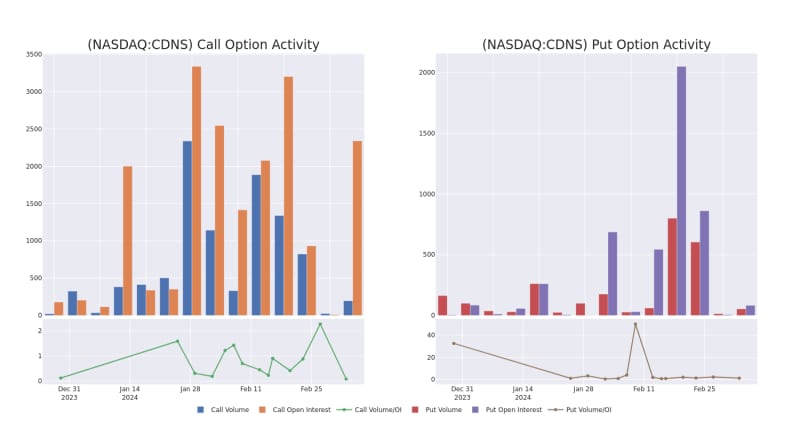

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Cadence Design Sys's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Cadence Design Sys's whale activity within a strike price range from $280.0 to $410.0 in the last 30 days.

Cadence Design Sys 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

About Cadence Design Sys

Cadence Design Systems is a provider of electronic design automation software, intellectual property, and system design and analysis products. EDA software automates the chip design process, enhancing design accuracy, productivity, and complexity in a full-flow end-to-end solution. Cadence offers a portfolio of design IP, as well as system design and analysis products, which enable system-level analysis and verification solutions. Cadence's comprehensive portfolio is benefiting from a mutual convergence of semiconductor companies moving up-stack toward systems-like companies, and systems companies moving down-stack toward in-house semiconductor design. The resulting expansion in EDA customers, alongside secular digitalization of various end markets, benefits EDA vendors like Cadence.

After a thorough review of the options trading surrounding Cadence Design Sys, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Cadence Design Sys's Current Market Status

- With a trading volume of 1,078,708, the price of CDNS is up by 0.25%, reaching $316.03.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 49 days from now.

Expert Opinions on Cadence Design Sys

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $315.4.

- In a positive move, an analyst from Morgan Stanley has upgraded their rating to Overweight and adjusted the price target to $350.

- Consistent in their evaluation, an analyst from Keybanc keeps a Overweight rating on Cadence Design Sys with a target price of $325.

- An analyst from Rosenblatt downgraded its action to Neutral with a price target of $280.

- Maintaining their stance, an analyst from Needham continues to hold a Buy rating for Cadence Design Sys, targeting a price of $320.

- An analyst from Baird persists with their Outperform rating on Cadence Design Sys, maintaining a target price of $302.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Cadence Design Sys options trades with real-time alerts from Benzinga Pro.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.