By Chris Dorrell

The dust has settled on a pre-election Spring Budget which did not deliver any major surprises.

Jeremy Hunt cut National Insurance by 2p, handing back £10m to taxpayers in a repeat of the move he made in November’s Autumn Statement.

“Conservatives know lower tax means higher growth. And higher growth means more opportunity and more prosperity,” he said.

To fund the move he announced a new tax on vaping, the abolition of non-dom tax reliefs and extended the windfall tax on oil and gas firms, all moves heavily trailed in run-up to the Budget.

But what do the measures really mean?

Tax burden highest

The Chancellor has stressed his ambition to get the tax burden falling, but that ambition will have to wait. Despite another 2p cut to National Insurance, tax take as a proportion of GDP is still on track to rise to near-record levels.

How is this happening despite tax cuts? Its almost entirely due to fiscal drag.

Fiscal drag occurs when tax thresholds remain static but pay increases in line with inflation or more – dragging people into higher tax brackets even when their relative wealth may not increase.

Personal tax thresholds have been frozen since 2021, which – excluding the impact of the NI cuts – the OBR estimates will boost tax receipts by over £40bn by 2028-29.

Hunt was dubbed the ‘fiscal drag queen’ on BBC Radio 4’s Today programme due to the policy.

“I want to make a start on bringing down taxes. I’ve never said for one moment that I can bring them right down all in one go,” the Chancellor told BBC Radio 4’s Today programme.

“I don’t think I’ve ever been called a drag queen before, by the way,” he added.

Winners and losers

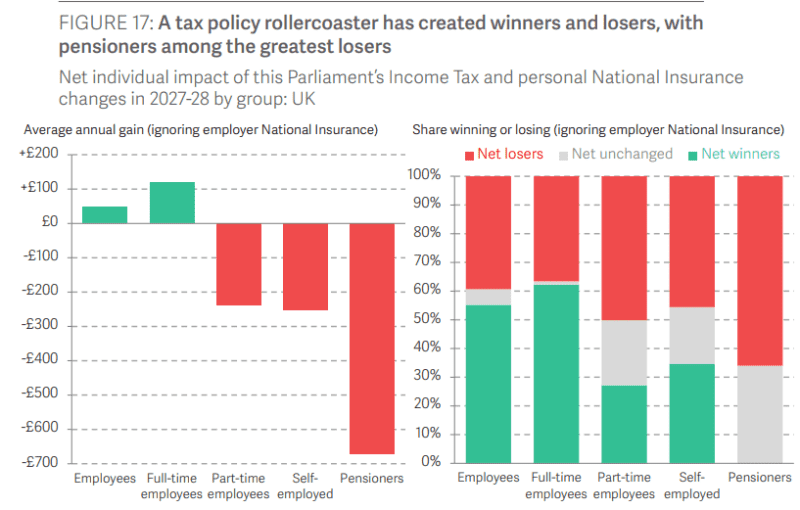

So the tax burden is rising overall, but that does not mean there are not any specific beneficiaries.

Employees on middle incomes are the big winners, when considering the combined impact of threshold freezes and personal tax cuts.

79 per cent of employees will pay less tax next year as a result of the changes, according to the Resolution Foundation, with an average gain of £450.

Those earning £50,000 will be the biggest winners, gaining £1,200 annually. Taxpayers earning £19,000 or less will actually be worse off due to the impact of threshold freezes.

All 8m taxpaying pensioners meanwhile will see their taxes increase, by an average of £1,000. Collectively, this amounts to an £8bn hit.

“The biggest choice Jeremy Hunt made was to cut taxes for younger workers, while allowing taxes to rise for eight million pensioners,” Torsten Bell said. “This is a staggering reversal of the approach taken by Conservative governments since 2010.

“It is undoubtedly good economics, even if the politics are a harder sell,” he said.

Spending and size of the state

Both major parties are not being honest about the true nature of the challenges facing the UK economy.

Hunt met his fiscal rule of getting debt falling in the five years time with ‘headroom’ of just £8.9bn. His ability to meet the rule largely depended on post-election spending plans which most commentators think are unrealistic, to be put it mildly.

The plans will see a one per cent real terms boost to departmental spending after the election, but given existing spending commitments on protected budgets – like health, education and defence – this means unprotected departments will see steep cuts.

The Resolution Foundation estimated that these departments would face per-person cuts of around 13 per cent, similar to the level of cuts faced during the austerity of the early 2010s.

This is unlikely to be popular. Unsurprisingly, the Conservatives have refused to say where the cuts would fall. After all, its unlikely to be their problem after the election.

For its part, Labour has not given any indication of where the money would come from to prevent the cuts from occurring.

“Government and opposition are joining in a conspiracy of silence in not acknowledging the scale of the choices and trade-offs that will face us after the election,” Paul Johnson, director of the Institute for Fiscal Studies said.

“They, and we, could be in for a rude awakening when those choices become unavoidable”.