By Coinrule

Each day, Coinrule will run through the state of the digital assets market for Blockbeat, your home for news, analysis, opinion and commentary on blockchain and digital assets.

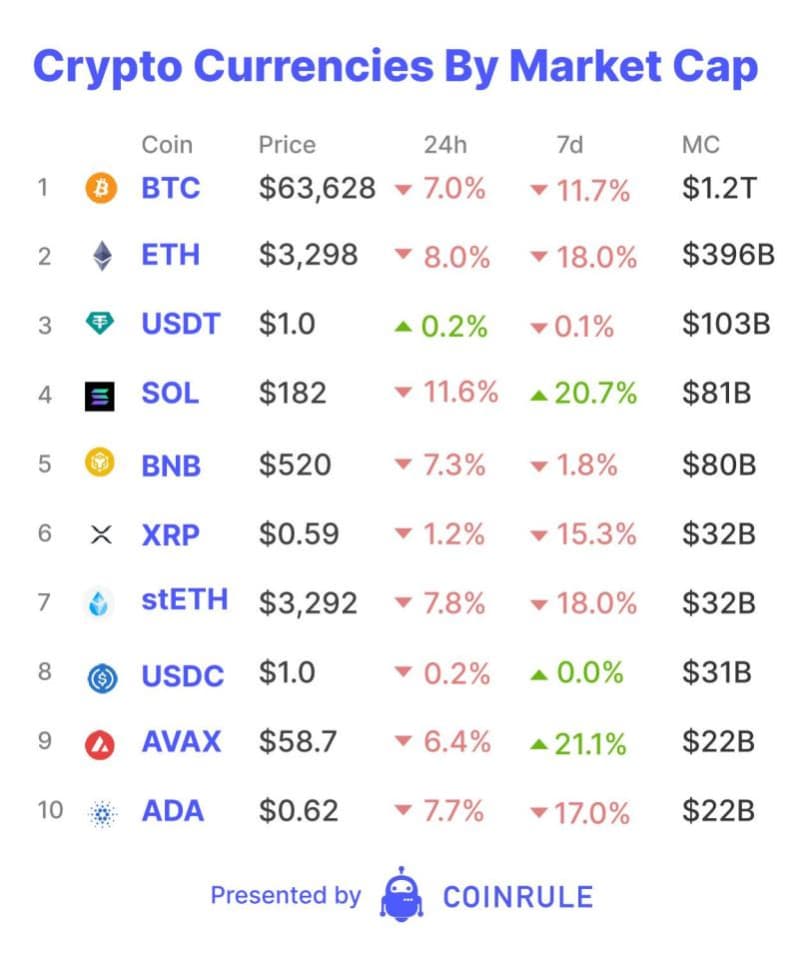

As Bitcoin makes a lower low and tries to find an area of demand, it seems the investment phrase “sell in May and go away” is being front run. Is this the beginning of a period of consolidation for crypto after several months of “up only?” Or, are markets simply de-risking ahead of today’s Federal Reserve meeting to determine interest rates?

On Monday, we saw the first day of Bitcoin ETF outflows since 1 March, amounting to $154 million. One of the major contributors to the outflows was Grayscale’s GBTC with a new record of $643 million in outflows. However, BlackRock’s IBIT still maintained positive inflows of over $450 million. Fidelity’s FBTC disappointed and made a new inflow record low of only $5.9 million. However, Bitcoin isn’t the only ETF Fidelity has on its mind. On Monday, they amended their Ethereum ETF application to include the ability to stake some of the fund’s assets.

If staking was accepted by the SEC, funds that staked would likely not charge any fees on their Ethereum ETFs. In return, they would simply deduct the staking yield from the returns of the fund. This model would be an issue for Grayscale’s ETHE if converted into an ETF and if Grayscale maintained their high 2.5% fees. To attract as much AUM as possible through no fees and higher returns, if one ETF includes staking it is likely all of them will have to. This is due to investors missing out on the potential to make an additional 1-4% per year, depending on the amount staked, on staking alone. If Grayscale’s ETHE maintained their high fees and didn’t include staking, then this would most likely cause an even faster exodus than we have been seeing with Grayscale’s GBTC.

Grayscale currently possesses approximately 2.9 million Ether worth around $10 billion. At current prices and with their 2.5% fee, this generates $250 million per year. All other ETF issuers will be reciting Jeff Bezos’s quote – “Your margin is my opportunity.”

Meanwhile, the SEC faced another defeat in court. A Utah judge detailed on Monday that the regulator had committed a “gross abuse of power” when it froze assets and ordered a restraining order against Debtbox, a crypto mining-related company. The judge ordered the SEC to pay for all of Debtbox’s legal fees due to misleading the court. It seems judges are waking up to the SEC’s heavy handed approach to crypto regulation. Here’s hoping the regulator learns their lesson.