By Chris Dorrell

The independence of the US Federal Reserve may come under threat from ballooning government deficits, according to a leading analyst.

Liberum’s Joachim Klement argued the Federal Reserve may have to increasingly consider the impact of interest rate hikes on government debt, raising the risk that its independence could be undermined by fiscal dominance.

Fiscal dominance is when the decisions of an independent central bank are driven by how they might impact fiscal policy rather than narrowly monetary issues.

For example, big budget deficits could prevent aggressive rate hikes if a central bank is concerned about the sustainability of government debt.

Klement argued this was likely to be a necessary state of affairs in an emergency, such as during the financial crisis or the pandemic, but warned the Federal Reserve’s independence could be threatened.

“I think we are on our way to another major shift in the relationship between governments and central banks,” he said.

“For decades, we lived in an era of monetary dominance where central banks were actively trying to manage inflation while governments passively set fiscal policy, accepting interest rates and the cost of debt as a given.

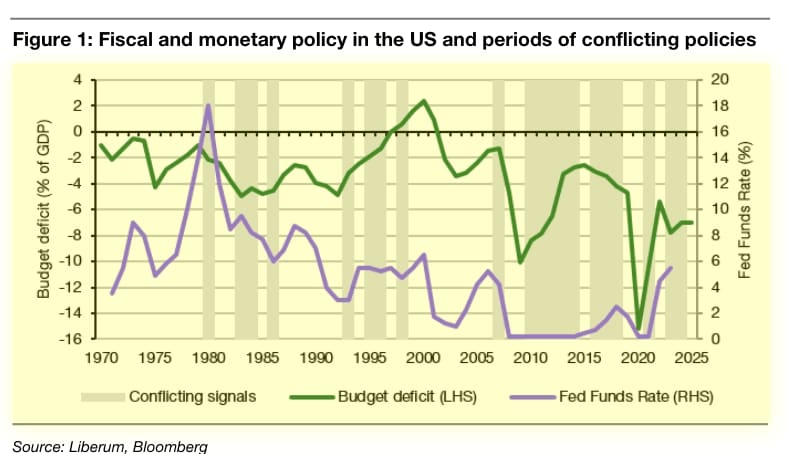

“But the chart below shows that fiscal policy and monetary policy are more and more often in conflict, with one of them being expansionary while the other is restrictive. If such conflicts appear, either the central bank or the government must give in and change course or inflation will get out of control,” he said.

Klement pointed out the government debt is extremely high in the US with little sign that it will come back down any time soon. This will mean the Federal Reserve will have to consider debt sustainability when it is setting interest rates in the years to come.

“If the Fed wants to prevent a slow-motion version of the debt crash under Liz Truss and Kwasi Kwarteng in the UK, it will increasingly have to limit interest rate hikes to levels that do not endanger bond market stability. Which in turn means that the fight against inflation will become more difficult,” he said.

“Consciously or unconsciously, fiscal policies will become more and more dominant over time, reducing the independence of monetary policy and making inflation harder to control. And where inflation becomes harder to control, you can rest assured that it will at least become more volatile,” Klement concluded.