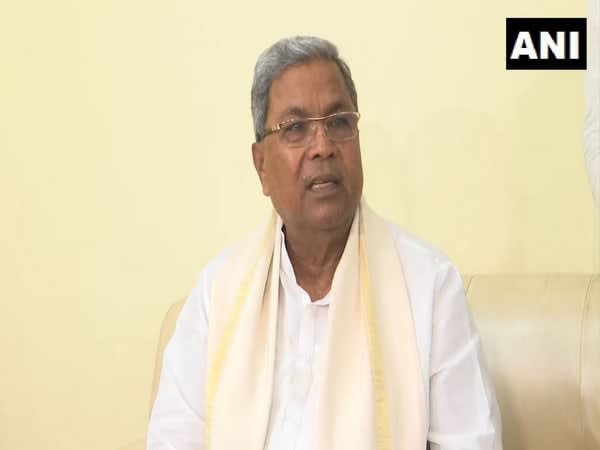

Bengaluru (Karnataka) [India], March 21 (ANI): Urging the Election Commission of India to direct the Income Tax Department to allow Congress to use its bank accounts, Karnataka Chief Minister Siddaramaiah on Thursday said that the freezing of bank accounts has severely crippled his party's ability to contest effectively in the upcoming elections.

In a post on X, the Karnataka Chief Minister said, "In an unprecedented move that undermines the very pillars of our democracy, the Income Tax Department has frozen the bank accounts of the Congress. This unjustified action has been strategically timed just two months before crucial election campaigns, severely crippling the party's ability to contest effectively. The Election Commission should direct the concerned to allow Congress to use the bank accounts."

Calling it a "calculated assault on democracy", Karnataka Chief Minister said that the action taken by the Income Tax authorities has resulted in significant operational handicaps for the party.

"This is not merely an administrative measure; it is a calculated assault on democracy itself. This deliberate act has resulted in significant operational handicaps for the party, from restricting mobility to curtailing essential campaign activities such as advertising and constituency outreach," he said.

Siddaramaiah further mentioned that the actions of Income Tax authorities are setting a dangerous precedent for the future of Indian democracy.

"It is crucial to recognize that this maneuver does more than just target a single political entity; it undermines the democratic right of every Indian citizen to a free and fair electoral process. The timing and nature of these actions suggest a distressing pattern of using state apparatus for political gains, thereby setting a dangerous precedent for the future of Indian democracy," he said.

Lashing out at the Bharatiya Janata Party, the Chief Minister said that "BJP has assumed the role of modern-day Asuras".

"In the great saga of India, the BJP has assumed the role of modern-day Asuras, harnessing the Shakti of agencies like IT, ED, and CBI as weapons against democracy," he said.

"Their power, strengthened by alliances with entities like Adani, starkly contrasts with the authentic Shakti of India's people. This BJP's slide towards autocracy is a direct assault on our democratic spirit. The time has come for the true Shakti of India, residing in its citizens, to confront this menace," he added.

Earlier today, senior Congress leader Ajay Maken alleged that the BJP government has "looted the donations given to the Congress" party by the common public "by freezing our accounts and forcibly withdrawing" Rs 115.32 crore from them.

"No political party, including the BJP, pays Income Tax, yet the Congress party's 11 Bank accounts were frozen. Why?" he asked.

He said the party last week received fresh notice from the IT Department for FY 1993-94 when Sitaram Kesri was the treasurer.

"We are being asked to calculate penal charges for FY 1993-94 after 31 years of the assessment," he said.

Earlier, the Delhi High Court last week upheld the Income Tax Appellate Tribunal (ITAT) order refusing to stay on the Income Tax notice for recovery of more than Rs 105 crore as an outstanding tax against the Congress.

The Congress had moved the Delhi High Court to challenge the dismissal of its plea by the Income Tax Appellate Tribunal (ITAT) against the imposition of penalties for discrepancies in certain tax returns and sought a stay on the Income Tax notice for recovery of more than Rs 105 crore as outstanding tax.

Meanwhile, Bharatiya Janata Party leader Ravi Shankar Prasad slammed Congress leadership on Thursday over its allegations concerning the freezing of its accounts and said "the party had sought to make an alibi at the highest level" for its "imminent defeat" in the Lok Sabha polls.

"Section 13(a) of the Income Tax Act states that income tax is not levied on parties. But the party has to file its return every year in which it has to be told how many donors are above Rs 20,000 and how many are below. If you do not file this in every assessment, you will lose your exemption," Ravi Shankar Prasad said. (ANI)