Cryptocurrency’s growth trajectory in emerging markets is nothing short of remarkable. Despite inherent challenges, these regions are a fertile ground for savvy investors and traders to capitalize on lucrative opportunities. In our discussions below, we'll explore the growing state of crypto in emerging markets, unveil the driving forces behind its ascent, and uncover how platforms can be instrumental in leveraging the 24/5 market hours when crypto trading through CFDs.

Global Crypto Revolution

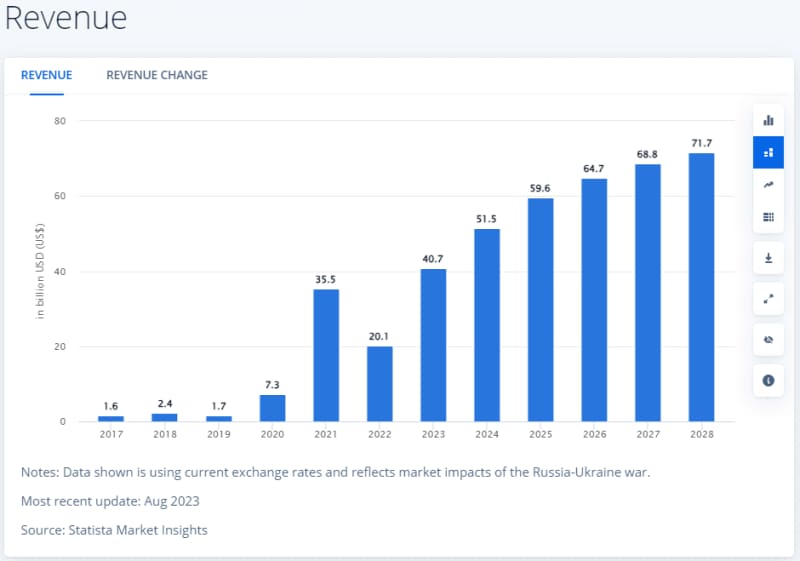

The trajectory of revenue and growth in the Cryptocurrencies market is undeniably promising. Projections indicate a surge, with anticipated revenue hitting a noteworthy US$51.5 billion shortly (2024), a figure expected to soar to approximately US$71.7 billion by 2028. That's an impressive annual growth rate of 8.62% over this period. A catalyst to this surge in revenue is an anticipated average revenue per user of US$61.8 in 2024, with the United States leading the charge with a staggering revenue of US$23,220 million.

Coupled with this financial momentum, the user base of the Cryptocurrencies market is set to expand significantly. 2028 will likely see approximately 992.50 million users. This growth mirrors user penetration rates, showcasing a steady climb from 10.76% in 2024 to a projected 12.39% by 2028. These statistics underscore the escalating global importance of cryptocurrencies, sustained by a confluence of factors including heightened adoption rates, growing interest in decentralized finance (DeFi), and the perceived role of cryptocurrencies as a hedge against inflation and political uncertainty.

The Rise of Crypto in Emerging Markets

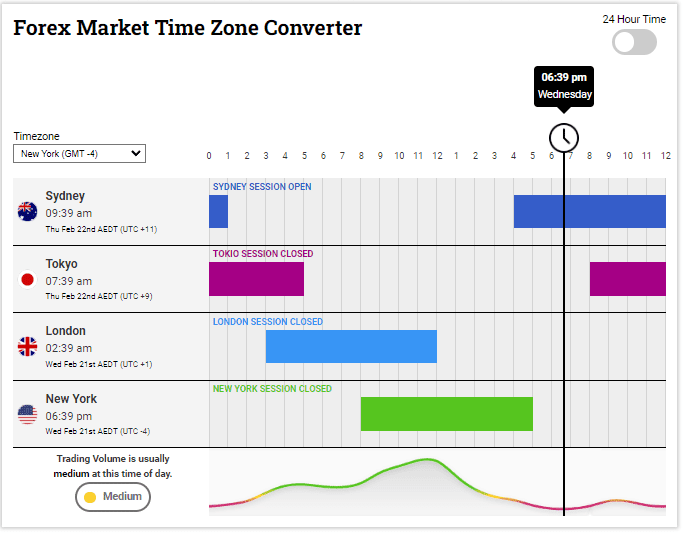

Thanks to the ubiquity of trading technologies, like Forex trading, crypto trading too is now a 24×5 opportunity across the globe – especially in emerging markets. Emerging markets, characterized by rapid economic growth and technological advancements, are embracing cryptocurrencies at an unprecedented pace too. Projections indicate that blockchain wallet market worldwide will surpass 300 million by 2024, with a significant portion of this growth anticipated from emerging markets.

So, let's put that growth into perspective, McKinsey Consulting's research estimates that global non-cash digital transactions (a subset of which includes Cryptos) experienced a compound annual growth rate (CAGR) of 13% between 2018 and 2021. For emerging markets, the CAGR was closer to 25%. And between 2021 and 2026, emerging markets will experience digital transaction growth at 15% – a pace faster than the rest of the world

What drives the rise of crypto in emerging markets? Cryptocurrencies offer a haven in countries plagued by economic instability. For instance, during Argentina’s 2019 economic crisis, Bitcoin trading volumes surged as citizens sought refuge from the plummeting value of the peso. More recently, over 60% of crypto transactions, on Mexican-founded crypto exchange Bitso, represented dollar-based stablecoins, including USDC and USDT. Similarly, in Nigeria, where inflation rates remain high, cryptocurrencies serve as a store of value and medium of exchange.

Opportunities for Investors and Traders

And there lies the opportunity for savvy crypto traders and investors. With the right crypto and forex trading platform, investors and traders can harness the growing crypto market in emerging economies through various strategic approaches. Let's explore some hypothetical scenarios to understand the impact of those strategies on various portfolios:

- Arbitrage Trading: Accessing a reliable forex market time zone converter can help traders exploit asset price discrepancies between currency pairs, and on exchanges in emerging markets and global platforms. They may then leverage that insight to their advantage when using forex trades in tandem with specific crypto trades.

By purchasing forex pairs or cryptocurrencies at lower prices on one exchange and selling them at higher prices on another, traders can profit from market inefficiencies.

Example: Your trading platform shows that Bitcoin is priced at $40,000 on a global exchange and $42,000 on a local exchange in an emerging market. A trader purchases 1 Bitcoin for $40,000 on the global exchange and sells it for $42,000 on the local exchange, resulting in a profit of $2,000 per Bitcoin. If the trader executes this trade with 10 Bitcoins, the potential profit would be $20,000. The trader may use a profitable Forex (arbitrage-based) trade to fund a favorable crypto trade.

- Portfolio Diversification: Diversify investment portfolios by exploring 24×5 trading in emerging market cryptocurrencies. While established coins dominate global markets, emerging market coins offer unique growth opportunities and exposure to specific regional industries.

Example: A trader allocates 20% of their investment portfolio, valued at $100,000, to emerging market cryptocurrencies. They invest $20,000 in various emerging market coins, including M-Pesa in Kenya and Petro in Venezuela. Over time, as the value of these coins appreciates, the trader’s portfolio diversification strategy helps mitigate risk and potentially yields significant returns.

- Long-Term Investment: Adopt a long-term investment strategy to capitalize on the growth potential of emerging market cryptocurrencies. Identifying promising projects addressing regional challenges can yield significant returns over time.

Example: A trader invests $5,000 in an emerging market cryptocurrency project that aims to revolutionize remittance payments in Southeast Asia. Over the next five years, as the project gains traction and adoption, the value of the cryptocurrency appreciates by 500%, resulting in a total investment value of $25,000. The trader’s long-term investment strategy enables them to capitalize on the growth potential of emerging market cryptocurrencies and generate substantial returns.

- Swing Trading: Take advantage of the 24×5 trading cycle to capitalize on short to medium-term price fluctuations in emerging market cryptocurrencies. By identifying trends and utilizing technical analysis tools, traders can enter and exit positions strategically to maximize profits.

Example: Using technical analysis tools provided by their trading platform, a trader identifies a short-term uptrend in an emerging market cryptocurrency. They enter a long position at $50 per coin and set a target price of $60. The cryptocurrency’s price reaches the target within a week, allowing the trader to exit the position and realize a profit of $10 per coin. If the trader executes this trade with 1,000 coins, the potential profit would be $10,000.

- Peer-to-Peer Trading: Engage in direct, decentralized trading with peers in emerging markets. Platforms facilitating peer-to-peer transactions allow traders to access local markets and currencies directly, bypassing centralized exchanges and potentially benefiting from lower fees and faster transactions.

Example: A trader in an emerging market wishes to purchase Bitcoin directly from a peer using a peer-to-peer trading platform integrated with CompareForexBrokers.com. They buy 1 Bitcoin from a peer at a negotiated price of $45,000, bypassing centralized exchanges and potentially benefiting from lower fees. If the market price of Bitcoin rises to $50,000, the trader can sell the Bitcoin on an exchange, realizing a profit of $5,000.

These examples illustrate how traders can leverage different strategies to profit from emerging market cryptocurrencies, whether through arbitrage, portfolio diversification, long-term investment, swing trading, or peer-to-peer trading

In summary, the dynamic nature of emerging markets coupled with the versatility of cryptocurrencies presents a myriad of opportunities for investors and traders. By embracing diverse strategies tailored to the unique characteristics of these markets, individuals can unlock significant potential for growth and profitability.

Leveraging 24/5 Forex and Crypto Trading Opportunities

Integrating Forex (foreign exchange) and cryptocurrency trading opportunities can be a strategic move for diversifying your investment portfolio. To leverage those opportunities, choose a broker or trading platform that offers both forex and crypto trading. According to CBS News, the most popular trading platform is MetaTrader 4 followed by MetaTrader 5 which is more suited to crypto. Ensure they are regulated and have a good reputation. Importantly, use a platform that offers a comprehensive suite of tools and resources tailored to optimize forex and crypto trading in emerging markets:

- Real-Time Market Data: Access up-to-date market data and price feeds for forex pairs and cryptocurrencies in emerging markets. Real-time market data enables traders to make informed decisions and capitalize on timely trading opportunities. Being of different asset classes, Forex and Crypto often react differently to major economic or crypto-related news.

Example: Your platform provides real-time market data showing that Bitcoin is trading at $40,000 on a global exchange while simultaneously displaying a price of $42,000 on a local exchange in an emerging market. Some brokers allow you to trade both forex pairs and crypto CFDs (contracts for difference). Traders can leverage this information to identify arbitrage opportunities and execute profitable trades, potentially earning a $2,000 profit per Bitcoin.

- Risk Management Tools: Utilize risk management tools such as stop-loss orders and position sizing calculators to mitigate risk in volatile emerging market crypto trading. These tools help traders set predefined risk parameters and protect their capital from adverse market movements. Use forex and crypto positions to offset risk.

Example: A trader decides to allocate 2% of their capital, which amounts to $2,000, to a volatile emerging market cryptocurrency. By utilizing the platform’s position sizing calculator, the trader can determine that they should only purchase $200 worth of the cryptocurrency to adhere to their predefined risk parameters and protect their capital from significant losses.

- Regulatory Compliance Information: Stay informed about regulatory developments and compliance requirements in emerging markets. Data feeds on your platform should provide valuable insights into regulatory frameworks and compliance standards, enabling traders to navigate legal and regulatory challenges effectively.

Example: Assume traders monitor their platform's news feeds to provide them insights into regulatory developments in an emerging market where cryptocurrency regulations are evolving. Traders learn that a new regulatory framework imposes stricter requirements on forex and cryptocurrency exchanges, increasing compliance costs. As a result, some exchanges may raise their transaction fees, impacting traders’ profitability and prompting them to adjust their trading strategies accordingly.

- Advanced Charting Tools: Analyze price trends and patterns using advanced charting tools offered by the platform. Traders can conduct technical analysis, identify key support and resistance levels, and develop trading strategies tailored to emerging market crypto assets. Use technical analysis (charts, indicators) and fundamental analysis (news, economic data) to identify potential trading opportunities. Consider correlations between forex and crypto markets.

Example: A trader analyzes the price chart of an emerging market cryptocurrency using advanced charting tools. By identifying a bullish pattern indicating an uptrend, such as a “cup and handle” formation, the trader decides to enter a long position. The trader sets a target price based on Fibonacci retracement levels and a stop-loss order to manage risk, aiming for a potential profit of 20% on their initial investment.

- Social Trading Platforms: Engage with a community of traders and investors through social trading platforms integrated with the trading platform. These platforms allow traders to share insights, follow successful traders, and replicate their trading strategies, enhancing collaboration and knowledge sharing in the emerging market crypto trading community.

Example: A trader joins a social trading platform integrated with CompareForexBrokers.com and follows a successful trader who specializes in emerging market cryptocurrencies. By replicating the trades of the experienced trader, a strategy known as copy trading, the novice trader learns new strategies and gains insights into market dynamics. Over time, the novice trader builds confidence and profitability, thanks to the collaborative environment facilitated by the social trading platform.

By incorporating the features of these trading tools, traders can better understand how to leverage the platform to optimize their trading strategies in emerging market cryptocurrencies.

CompareForexBrokers.com equips traders with all the essential tools and resources discussed here to navigate the complexities of emerging market crypto trading. By leveraging these resources alongside strategic insights, traders can seize the 24/5 forex and crypto trading opportunity and capitalize on the immense potential of cryptocurrencies in emerging markets.

Take the Leap and Seize the Emerging Crypto Opportunity

The burgeoning crypto landscape in emerging markets presents abundant opportunities for investors and traders. By leveraging strategic trading approaches and platforms, and optimizing their suite of tools and resources, traders can capitalize on an array of crypto trading opportunities and unlock the full potential of emerging market cryptocurrencies.

This post was authored by an external contributor and does not represent Benzinga’s opinions and has not been edited for content. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice. Benzinga does not make any recommendation to buy or sell any security or any representation about the financial condition of any company.